Daily technical highlights – (MALAKOF, WEGMANS)

kiasutrader

Publish date: Fri, 29 Apr 2022, 09:15 AM

Malakoff Corporation Berhad (Trading Buy)

• Following a sideways pattern since August 2021, MALAKOF shares subsequently slipped to a low of RM0.575 in March 2022 (-23%) before reversing its direction to shift higher lately.

• We believe the stock will likely strengthen further on the back of positive technical signals arising from: (i) the rising Parabolic SAR indicator, (ii) the MACD histogram gaining bullish momentum, and (ii) the 20-day SMA on the verge of crossing above the 50-day SMA.

• Thus, the stock could rise further to challenge our resistance levels of RM0.75 (R1; 13% upside potential) and RM0.84 (R2; 26% upside potential).

• We have pegged our stop loss at RM0.60, which represents a downside risk of 10%.

• Business-wise, MALAKOF is involved in the design, construction, operation & maintenance of combined cycle power plant, power generation and sale of electricity.

• For FY21, the group’s core net profit dropped by 9% from RM330.1m in FY20 to RM299.2m due to a one-off deferred expense and lower contribution from Tanjung Bin Energy Sdn Bhd (TBE) (which was impacted by lower capacity payment and impairment of assets caused by plant outage).

• Going forward, Kenanga Research is anticipating a stable earnings outlook for FY22 (as the repair work for the forced outage at TBE was completed in 4QFY21) along with higher contributions from Alam Flora (which has been posting better results since its acquisition in early 2020). Thus, we are projecting the group to post a core net profit of RM301.2m in FY22 and RM319.2m in FY23, which translates to forward PERs of 10.8x and 10.2x, respectively.

• In addition, based on our research house DPS forecasts of 4.8 sen for FY22 and 5.1 sen for FY23, the stock currently offers attractive prospective dividend yields of 7.2% and 7.7%, respectively.

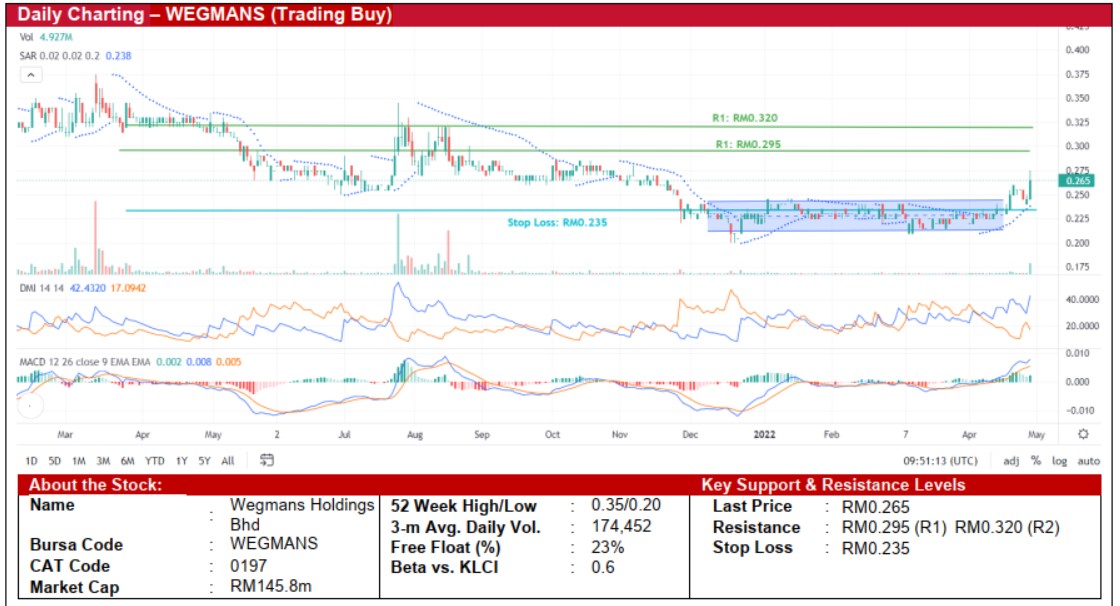

Wegmans Holdings Berhad (Trading Buy)

• Chart-wise, WEGMANS’ share price has recently broken out from a sideways range (which began in December 2021) to shift higher.

• With the Parabolic SAR indicator trending up and the MACD indicator gaining bullish momentum while the DMI Plus remains above the DMI Minus, we believe the stock will likely strengthen further to challenge our resistance levels of RM0.295 (R1; 11% upside potential) and RM0.320 (R2; 21% upside potential).

• On the downside, our stop loss price has been set at RM0.235, which translates to a downside risk of 11%.

• Business-wise, WEGMANS is a home furniture manufacturer, focusing on the design, manufacture and sale of home furniture products. The group’s customers comprise wholesalers, retailers, chain stores and traders.

• For FY21, the group’s core profit plunged by 61% YoY to RM3.4m from RM8.8m in FY20 as a result of lower revenue (-13% YoY) (which was hit by lower sales volume from North America). Nonetheless, amid an ongoing global economic recovery, WEGMANS will likely see a pick up in business activities going forward.

• Valuation-wise, based on its book value per share of RM0.19 as of end-December 2021, the stock is currently trading at a Price/Book Value multiple of 1.39x (or at 1SD below its 3-year historical mean).

• Meanwhile, to reward its shareholders, WEGMANS has recently proposed a bonus issue exercise on the basis of one free warrant (which has a 3-year exercise period and an exercise price of RM0.21) for every four ordinary shares held. The stock will be traded on an ex-bonus entitlement today (29 April 2022).

Source: Kenanga Research - 29 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024