Daily technical highlights – (UZMA, RL)

kiasutrader

Publish date: Tue, 10 May 2022, 09:09 AM

Uzma Bhd (Trading Buy)

• An uptick in UZMA’s share price last Friday that was backed by higher-than-average trading interest may pave the way for the stock to climb further ahead.

• After piercing above the 50-day SMA, the positive momentum will likely carry on in view of the prevailing uptrend in the Parabolic SAR indicator and the bullish crossing by the DMI Plus over the DMI Minus.

• Riding on the upward trajectory, the stock could strengthen towards our resistance thresholds of RM0.54 (R1; 14% upside potential) and RM0.59 (R2; 24% upside potential).

• We have pegged our stop loss price level at RM0.41 (representing a 14% downside risk).

• An oil & gas service and equipment group, UZMA’s principal activities include the provision of integrated well solutions, production solutions, subsurface solutions and other upstream services (which involves the provision of geoscience and reservoir engineering, drilling, project and operations services) as well as other specialized services.

• Earnings-wise, the group posted net profit of RM0.4m (-96% YoY) in 1HFY22 as overall performance was severely affected by slower business activities and project delays.

• Still, based on consensus numbers, UZMA is forecasted to see a recovery in net earnings to RM14.9m in FY June 2022 and RM23.0m in FY June 2023. This translates to forward PERs of 11.2x this year and 7.3x next year, respectively.

• Yesterday evening, UZMA announced the award of an Engineering, Procurement, Construction & Commissioning (EPCC) contract for the development of a 29.99MWac large scale solar photovoltaic plant in Selangor with an estimated contract value of RM101.8m.

• Over the longer run, the group is targeting to achieve a revenue of RM1.5b by 2025. Of which, c.40% is expected to be derived from non-oil & gas ventures, coming mostly from its diversification into the solar energy space.

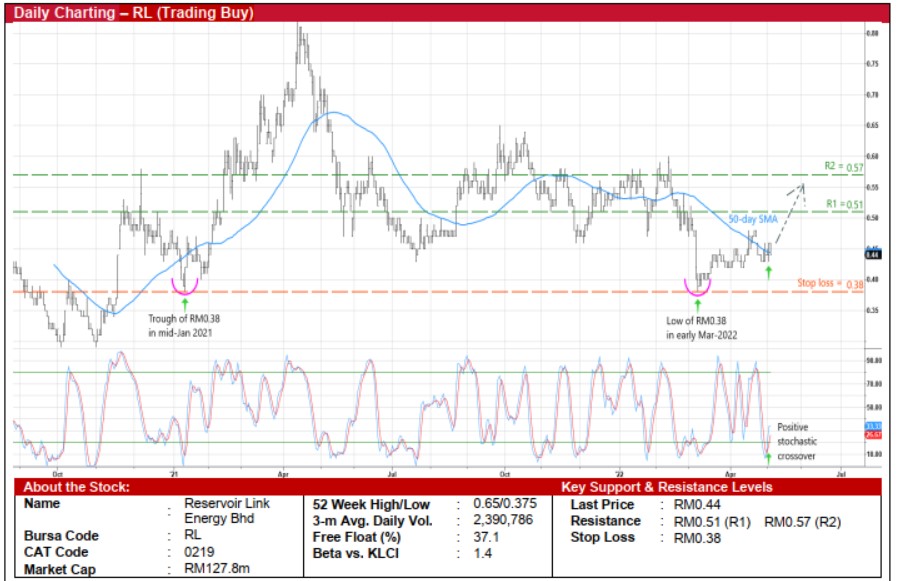

Reservoir Link Energy Bhd (Trading Buy)

• After bouncing off from a low of RM0.375 in early March – which coincided with the previous trough in mid-January last year that had preceded a sharp price rally in the ensuing three months – RL shares could trend higher ahead.

• An upward shift in the share price – backed by a positive stochastic crossover in the oversold territory – will be forthcoming when the stock pulls away from the 50-day SMA.

• With that, the shares will probably advance towards our resistance targets of RM0.51 (R1; 16% upside potential) and RM0.57 (R2; 30% upside potential).

• Our stop loss price level is set at RM0.38 (or a downside risk of 14%).

• RL is a provider of well services for oil & gas operators, supporting the upstream segments of the industry via its range of services for well leak repair, perforation, well testing, wash & cement, wireline services production enhancement and the supply of oilfield products, equipment & technical personnel.

• Earnings-wise, the group logged net profit of RM10.8m (-9% YoY) for FY December 2021. As at end-December last year, RL’s net cash holdings & short-term investments stood at RM15.1m (or 5.2 sen per share).

• In terms of corporate development, the company is in the midst of transferring its listing status from the ACE Market to the Main Market, which would then boost its investment appeal to a wider pool of investors going forward.

Source: Kenanga Research - 10 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024