Daily technical highlights – (BONIA, PWROOT)

kiasutrader

Publish date: Fri, 20 May 2022, 10:28 AM

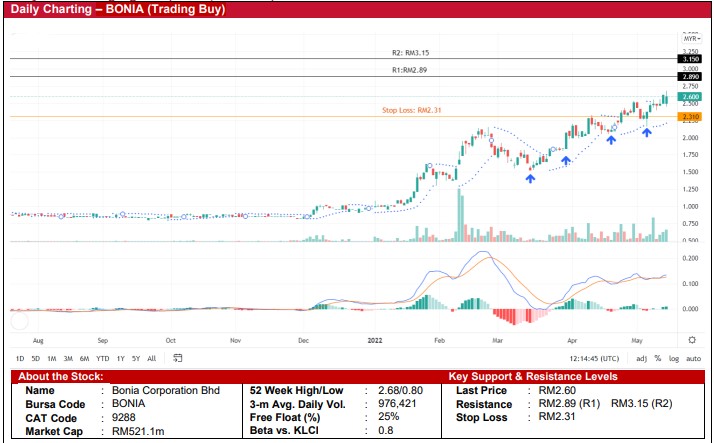

Bonia Corporation Bhd (Trading Buy)

• After breaking out from a sideways pattern in Dec 2021, BONIA’s share price has been trending upwards to form a sequence of higher highs and higher lows.

• With the Parabolic SAR indicator still rising and coupled with the bullish MACD signal, we anticipate that the stock will continue its upward trajectory.

• Thus, we believe that BONIA’s share price could climb towards our resistance thresholds of RM2.89 (R1) and RM3.15 (R2), which represent upside potentials of 11% and 21%, respectively.

• Our stop loss price level is set at RM2.31 (or a downside risk of 11%).

• Business-wise, BONIA is involved in the designing, manufacturing, retailing and wholesale of leatherwear, footwear, men’s apparel and accessories.

• BONIA reported a net profit of RM14.8m in 3QFY22 (-36% QoQ), which brought 9MFY22 net profit to RM32.9m (+128% YoY), lifted by the reopening of economic activities and strong consumer spending during festive seasons.

• Based on consensus forecasts, the group is expected to record a net profit of RM36.7m in FY June 2022 and RM48.9m in FY June 2023, translating to forward PERs of 14.2x and 10.7x, respectively.

• BONIA’s balance sheet is backed by net cash holdings and short-term funds of RM49.7m (translating to 24.8 sen per share) as of end March 2022.

Power Root Bhd (Trading Buy)

• PWROOT shares bounced up from a low of RM1.24 in March 2022 to form an ascending price channel since then.

• On the chart, the share price is expected to climb further in view of: (i) the rising Parabolic SAR indicator, (ii) the strengthening MACD signal, and (iii) the DMI Plus hovering above the DMI Minus.

• Riding on the positive momentum, the stock could rise to challenge our resistance levels of RM1.86 (R1; 11% upside potential) and RM2.02 (R2; 20% upside potential).

• We have pegged our stop loss at RM1.50, which represents a downside risk of 11%.

• Fundamental-wise, PWROOT is involved in the manufacturing and distribution of beverage products.

• The group reported a net profit of RM6.0m (+7% QoQ) in 3QFY22, which took 9MFY22 bottomline to RM13.7m (-48% YoY) as higher administrative costs (such as advertising and marketing expenses) and freight cost more than offset the higher sales in both the local and export markets.

• Going forward, in anticipation of robust domestic sales on the back of stronger consumer spending and improved ASPs, consensus is predicting PWROOT to report a net profit of RM19.5m in FY March 2022 before increasing to RM32.1m in FY March 2023, which translate forward PERs of 33.6x and 21x, respectively.

Source: Kenanga Research - 20 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024