Daily technical highlights – (EMICO, SKPRES)

kiasutrader

Publish date: Thu, 09 Jun 2022, 09:04 AM

Emico Holdings Bhd (Trading Buy)

• Following a peak of RM0.74 in mid-September 2021, EMICO’s share price fell to a low of RM0.255 (-66%) in May 2022 before climbing thereafter.

• With the ADX indicator rising steadily, this indicates the stock’s bullish momentum is intact.

• We believe the stock is poised to trend higher on the back of the positive technical signals arising from: (i) the rising Parabolic SAR indicator, (ii) the stock trading at the upper boundary of the Keltner’s Channel, and (iii) the increasing ADX indicator.

• Thus, the stock could rise to challenge our resistance levels of RM0.385 (R1; 13% upside potential) and RM0.445 (R2; 31% upside potential).

• We have pegged our stop loss at RM0.295, which represents a downside risk of 13%.

• Business-wise, EMICO is engaged in the manufacturing and trading of the trophy, souvenir and metal products, contract manufacturing, trading of home furnishing and household products and property development.

• For its recent results, the group’s revenue rose by 16% from RM34.0m in FY21 to RM39.6m in FY22 thanks to higher sales generated by the manufacturing and trading division. In tandem with the higher revenue, EMICO’s recovered from a net loss of RM2.4m in FY21 to RM1.2m in FY22.

• Valuation-wise, based on its book value per share of RM0.38 as of end-March 2022, the stock is currently trading at a Price/Book Value multiple of 0.90x (or at 1.5SD above its 3-year historical mean).

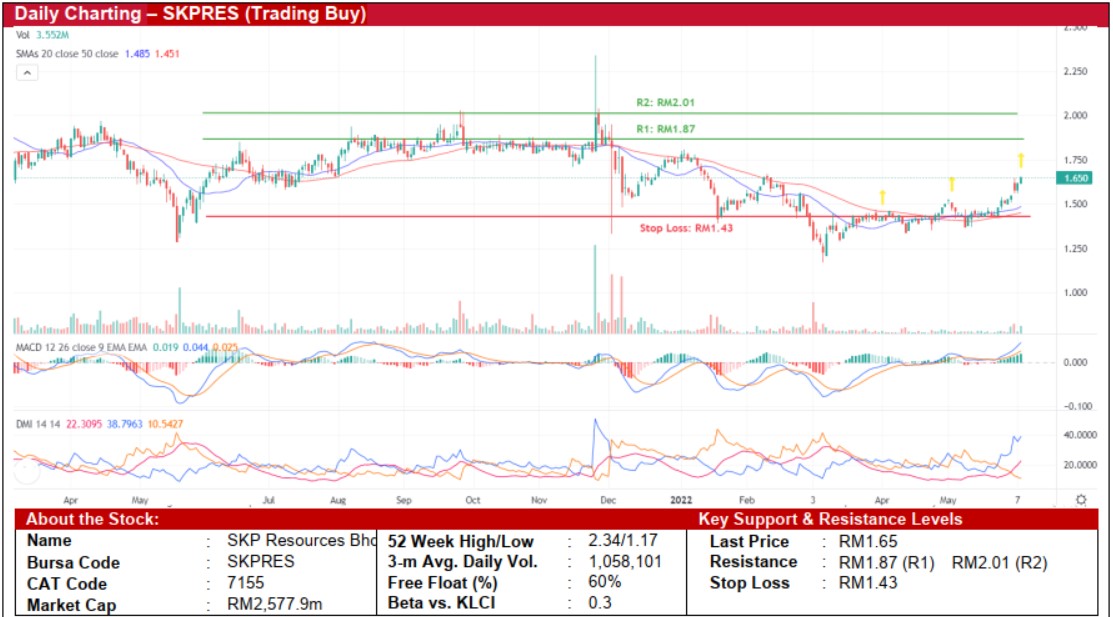

SKP Resources Bhd (Trading Buy)

• Chart-wise, SKPRES’s share price slid from a high of RM2.34 in late-November 2021 to a low of RM1.17 (-50%) in early March 2022 before plotting a sequence of higher highs to stage an intermediate trend reversal.

• The recent turnaround of the stock’s trend is gaining a steady bullish momentum as indicated by the rising ADX indicator.

• With the MACD histogram rising and the DMI Plus widening its gap from the DMI Minus along with the 20-day SMA treading higher than the 50-day SMA, this suggests that the stock will likely strengthen further to challenge our resistance levels of RM1.87 (R1; 13% upside potential) and RM2.01 (R2; 22% upside potential).

• On the downside, our stop loss price has been set at RM1.43, which translates to a downside risk of 13%.

• Business-wise, SKPRES is predominately engaged in the manufacturing of plastic products and molds, which are mainly carried out in Malaysia.

• For FY Mar 22, the group’s core PATAMI rose by 27% from RM133.2m in FY21 to RM169.8m in FY22 thanks to economies of scale and increased efficiency in its manufacturing process.

• Going forward, consensus is predicting the group to report a core net profit of RM182.3m in FY23 and RM212.6m in FY24, which translate to forward PERs of 13.9x and 12.2x, respectively.

Source: Kenanga Research - 9 Jun 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024