Daily technical highlights – (DIGI, MAXIS)

kiasutrader

Publish date: Tue, 14 Jun 2022, 09:10 AM

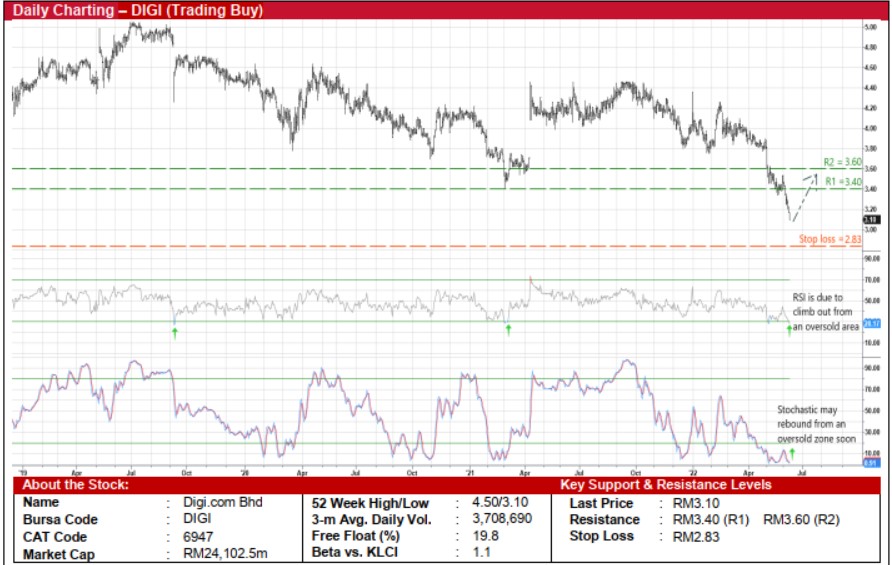

Digi.com Bhd (Trading Buy)

• A technical rebound may be around the corner for DIGI shares after plunging from a recent high of RM4.26 in mid-February this year to close at RM3.10 yesterday, its lowest level since October 2011 (which is also way below the Covid-19-triggered trough of RM3.82 in March 2020).

• Following the price sell-down, both the RSI and stochastic indicators have now entered into the oversold territory, setting the stage for an intermittent reversal ahead.

• An ensuing bounce-off could then lift DIGI’s share price towards our resistance thresholds of RM3.40 (R1; 10% upside potential) and RM3.60 (R2; 16% upside potential).

• We have placed our stop loss price level at RM2.83 (or a 9% downside risk).

• On the fundamental front, DIGI – a mobile connectivity and internet services provider in Malaysia – is expected to post net profit of RM1.07b for FY December 2022 and RM1.26b for FY December 2023. The group recently announced 1QFY22’s net earnings of RM236.1m (-11% YoY), which was mainly affected by the imposition of a one-off prosperity tax by the government.

• Driven by its relatively resilient earnings profile, consensus is anticipating dividend payments of 13.7 sen per share for FY22 and 16.0 sen per share for FY23. This translates to attractive forward dividend yields of 4.4% and 5.2%, respectively with its 1-year forward blended yield presently hovering at 3SD above its historical mean.

• In terms of Price/Book Value multiple – a valuation metric typically used to gauge the floor price in a falling market – the stock is now trading at 44.3x (which is at 2.5SD below its historical average) based on its book value of RM0.07 per share as of end-March 2022.

• In a sense, the prevailing depressed dividend yield and Price/Book Value valuations might have already reflected the broad market sell-off effect and lingering policy uncertainties on the impending implementation of Malaysia’s 5G Single Wireless Network (SWN) project.

Maxis Bhd (Trading Buy)

• MAXIS shares could stage a technical rebound ahead following a sharp fall from a recent high of RM4.54 in mid-February this year to a fresh record low closing price of RM3.28 yesterday (which is also way below the Covid-19-triggered trough of RM4.59 in March 2020).

• Capturing the sliding share price performance, both the RSI and stochastic indicators have slipped into the oversold area, suggesting that an intermediate reversal may be near.

• With that, the stock will probably make its way towards our resistance thresholds of RM3.60 (R1; 10% upside potential) and RM3.80 (R2; 16% upside potential).

• Our stop loss price level is set at RM2.94 (or a 10% downside risk).

• Fundamentally speaking, MAXIS – a converged telecommunication provider of digital services and connectivity solutions – is projected to log net profit of RM1.29b for FY December 2022 and RM1.48b for FY December 2023 after recently reported net earnings of RM298m (-11% YoY) in 1QFY22 (dragged mainly by higher depreciation and amortisation charges).

• Valuation-wise, MAXIS is backed by: (i) compelling prospective dividend yields of 5.5% and 5.7% (with a 1-year forward blended yield standing at 4.5SD above its historical mean) based on consensus DPS estimates of 17.9 sen for FY22 and 18.7 sen for FY23, respectively, and (ii) a Price/Book Value multiple of 3.86x (or slightly below the minus 3SD level from its historical average) based on its book value per share of RM0.85 as of end-March 2022.

• From a risk perspective, the broad market sell-off effect and lingering policy uncertainties on the impending rollout of Malaysia’s 5G Single Wireless Network (SWN) project might have already been factored into the existing depressed dividend yield and Price/Book Value valuations.

Source: Kenanga Research - 14 Jun 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

CDB2024-11-22

CDB2024-11-21

MAXIS2024-11-20

CDB2024-11-19

CDB2024-11-19

CDB2024-11-19

CDB2024-11-19

CDB2024-11-19

CDB2024-11-19

CDB2024-11-19

CDB2024-11-19

CDB2024-11-19

CDB2024-11-19

CDB2024-11-19

MAXIS2024-11-18

CDB2024-11-18

CDB2024-11-15

MAXIS2024-11-14

MAXIS2024-11-13

CDB2024-11-13

CDB2024-11-13

MAXIS2024-11-13

MAXIS2024-11-12

CDB2024-11-12

CDB2024-11-12

MAXIS2024-11-12

MAXISMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024