Daily technical highlights – (JTIASA, AFFIN)

kiasutrader

Publish date: Wed, 15 Jun 2022, 09:16 AM

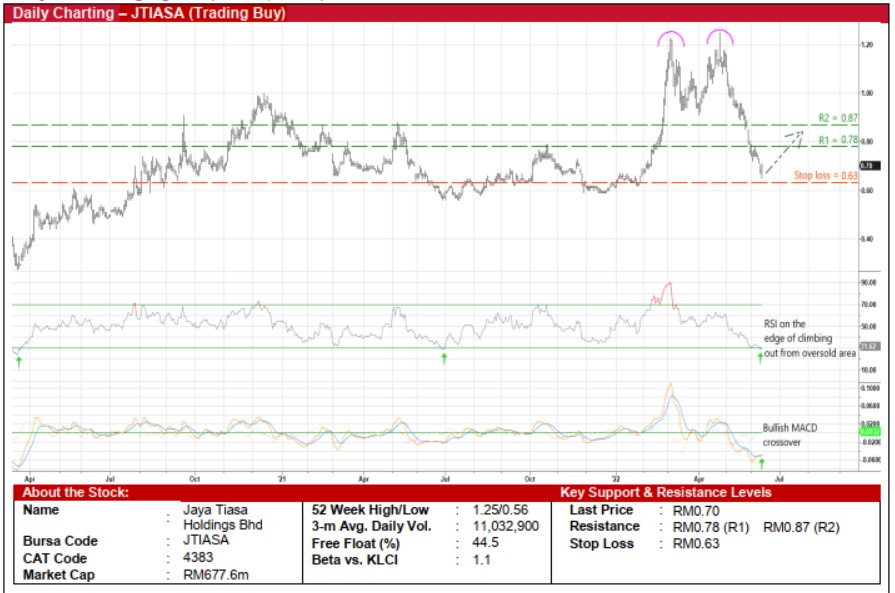

Jaya Tiasa Holdings Bhd (Trading Buy)

• After tumbling 44% from a double-top formation to RM0.70 currently, JTIASA shares may stage a technical rebound ahead.

• On the chart, an upward shift in the share price is anticipated in view of the positive signals triggered by: (i) the RSI indicator in the midst of climbing out from an oversold zone, and (ii) the MACD indicator cutting above the signal line.

• A trend reversal could then propel the stock to challenge our resistance thresholds of RM0.78 (R1; 11% upside potential) and RM0.87 (R2; 24% upside potential).

• We have placed our stop loss price level at RM0.63 (representing a 10% downside risk).

• Fundamentally speaking, JTIASA – which is principally involved in the oil palm and timber businesses – stands to benefit from elevated CPO prices. Reflecting this, the group reported net profit of RM93.5m (an YoY increase of more than seven-fold) in 9MFY22.

• Going forward, consensus is forecasting net earnings of RM129.5m in FY June 2022 and RM103.9m in FY June 2023, which translate to forward PERs of 5.2x this year and 6.5x next year, respectively (with its 1-year forward rolling PER currently hovering below the minus 2SD level from its historical mean).

• On the back of the strong earnings momentum, JTIASA will likely reward its shareholders with consensus DPS estimates of 4.0 sen in FY22 and 3.2 sen in FY23, implying dividend yields of 5.7% and 4.6%, respectively (with its 1-year forward blended dividend yield currently standing at 1.5 SD above its historical average).

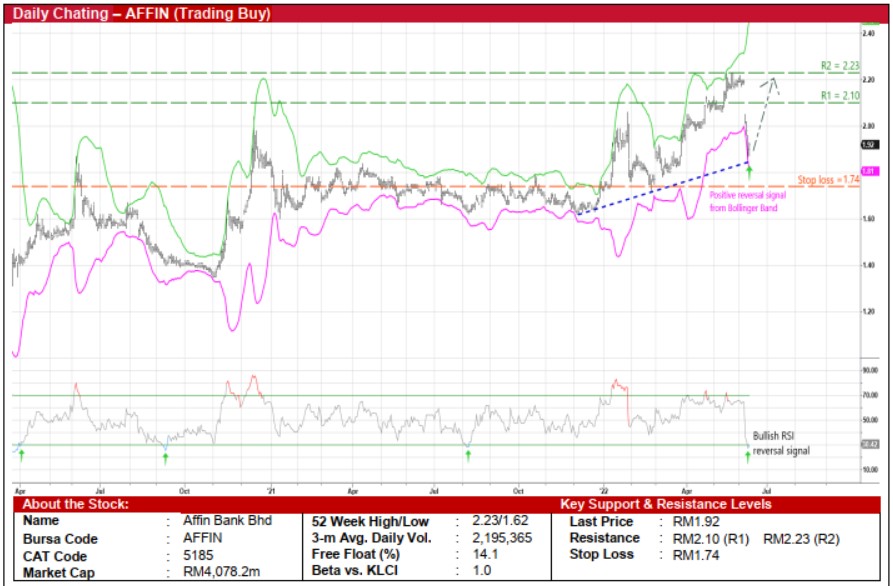

Affin Bank Bhd (Trading Buy)

• An uptick in AFFIN’s share price is anticipated following its retracement from a recent high of RM2.23 in late May to RM1.92 currently (which is back to where it was in late March this year).

• This comes as the stock price has just crossed back above the lower Bollinger Band while the RSI indicator is in the midst of reversing from an oversold position.

• A resumption of the upward trajectory could then pave the way for the shares to climb towards our resistance thresholds of RM2.10 (R1) and RM2.23 (R2), which translate to upside potentials of 9% and 16%, respectively.

• Our stop loss price level is set at RM1.74 (or a 9% downside risk).

• A financial group that offers a suite of financial products and services to both retail and corporate customers, AFFIN announced a strong net profit of RM526.9m (+129% YoY) in FY December 2021. The robust earnings momentum subsequently carried over to 1QFY22 when its bottomline soared to RM142.7m (+107% YoY).

• Following which, consensus is currently projecting the group would post net profit of RM534.0m for FY22 and RM658.4m for FY23.

• In terms of dividend returns, based on consensus FY22-FY23 DPS forecasts of 12.3 sen and 12.7 sen, the shares (which have just traded ex-entitlement on 9 June for FY21 DPS of 12.5 sen) currently offer attractive prospective yields of 6.4% and 6.6%, respectively (with its 1-year forward blended dividend yield hovering above the +2SD level from its historical average).

• Valuation-wise, based on its book value per share of RM4.71 as of end-March 2022, the stock is presently trading at Price/Book multiple of 0.41x (or at 0.5 SD above its historical mean).

Source: Kenanga Research - 15 Jun 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024