Daily technical highlights – (INNATURE, TAKAFUL)

kiasutrader

Publish date: Tue, 21 Jun 2022, 09:05 AM

InNature Bhd (Trading Buy)

• After sliding from a peak of RM0.885 in the second half of October last year, which broke a 20-month uptrend channel on the way down, a price reversal for INNATURE shares could be in the offing.

• An upward shift in the share price is now anticipated in view of the positive technical signals generated by: (i) a bullish stochastics divergence pattern (as the stochastic indicator has formed two rising bottoms in the oversold zone while the price was drifting listlessly), (ii) an ongoing RSI reversal from the oversold territory, and (iii) the MACD crossing above the signal line in an oversold area.

• With that, the stock – which closed at RM0.49 yesterday – is expected to advance towards our resistance thresholds of RM0.55 (R1; 12% upside potential) and RM0.59 (R2; 20% upside potential) to close a price gap that was left opened in late May this year.

• We have placed our stop loss price level at RM0.44 (which represents a 10% downside risk).

• Fundamentally speaking, INNATURE – a leading regional retailer of cosmetics and personal care products serving customers across Malaysia, Vietnam and Cambodia – is a proxy to robust retail sales momentum. According to Retail Group Malaysia, retail sales in Malaysia – after jumping 18.3% YoY in 1Q2022 – is forecasted to show a stronger growth rate of 25.7% YoY in 2Q2022.

• Earnings-wise, subsequent to its reported net profit of RM15.1m (-25% YoY) in FY December 2021, the group’s bottomline came in at RM4.5m (-11% YoY) in 1QFY22.

• Going forward, based on consensus estimates, INNATURE is projected to log better net earnings of RM23.2m for FY22 and RM26.5m for FY23, which translate to prospective PERs of 14.9x this year and 13.1x next year, respectively (with its 1-year forward rolling P/E currently hovering slightly above the minus 2SD level from its historical mean).

• Financially steady, the group’s balance sheet is backed by net cash & cash equivalent holdings of RM50.5m (or 7.2 sen per share) as of end-March 2022.

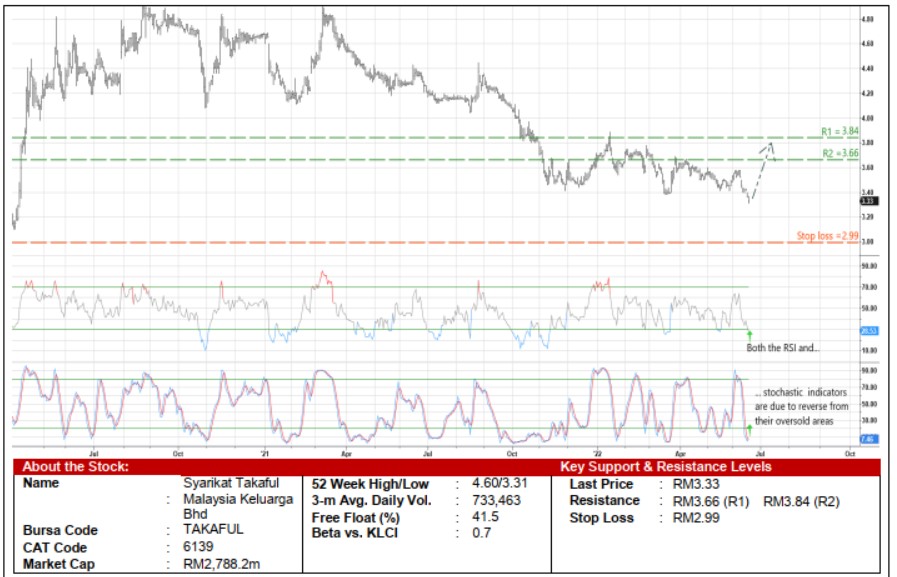

Syarikat Takaful Malaysia Keluarga Bhd (Trading Buy)

• From a high of RM5.08 in the first half of March last year, TAKAFUL’s share price has trended down, plotting lower highs and lower lows along the way. Following a tumble of 34% to end at RM3.33 yesterday, its lowest closing since early April 2020, a technical rebound may be around the corner.

• On the chart, the shares will likely get a lift ahead as both the RSI and stochastic indicators are in the midst of reversing from their oversold position.

• Riding on the strengthening momentum, the stock could climb towards our resistance targets of RM3.66 (R1; 10% upside potential) and RM3.84 (R2; 15% upside potential).

• Our stop loss price level is set at RM2.99 (or a 10% downside risk).

• Fundamental-wise, TAKAFUL – which has two licenced entities to manage the Family Takaful business and the General Takaful business – reported net profit of RM411.4m (+14% YoY) in FY December 2021 that was followed by a quarterly net earnings of RM86.8m (-14% YoY) in 1QFY22.

• Consensus is presently projecting the group to make net profit of RM331.4m in FY22 and RM376.0m in FY23.

• In terms of valuations, TAKAFUL is currently trading at Price/Book Value multiple of 1.48x (or at 1.5 SD below its historical mean) based on its book value per share of RM2.25 as of end-March 2022.

Source: Kenanga Research - 21 Jun 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024