Daily technical highlights – (DPHARMA, FIAMMA)

kiasutrader

Publish date: Thu, 30 Jun 2022, 11:33 AM

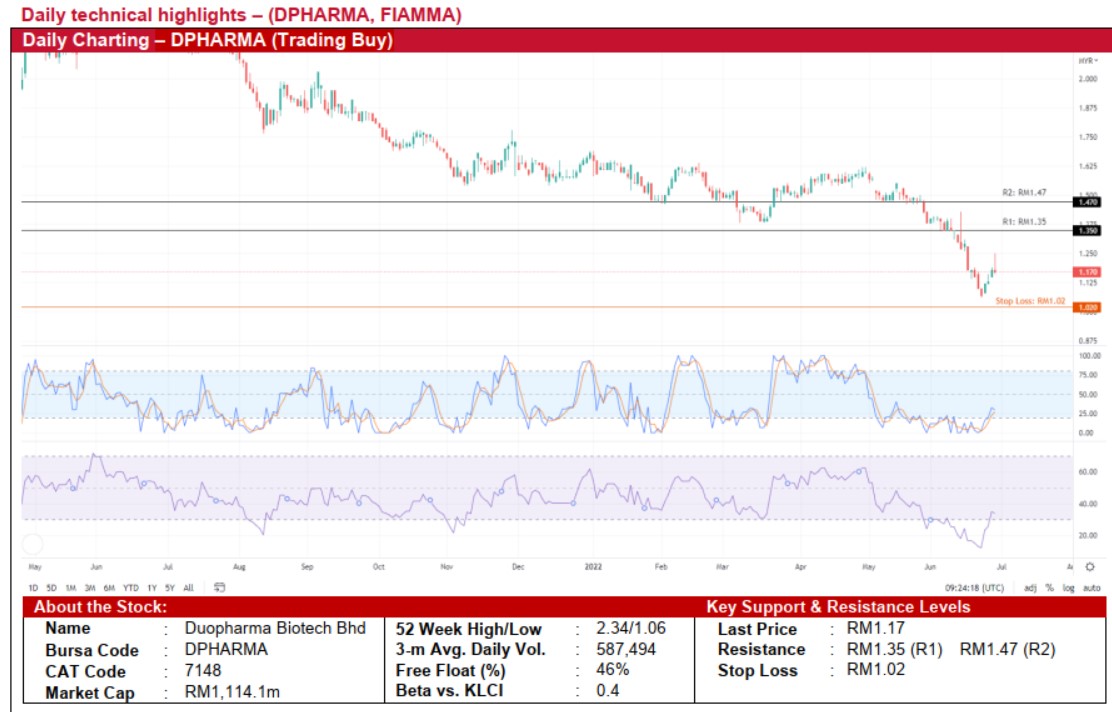

Duopharma Biotech Bhd (Trading Buy)

• DPHARMA’s share price has dipped to as low as RM1.06 in June 2022 following the formation of lower lows which was followed by the recent appearance of bullish candlesticks, indicating the return of buying interest.

• With both the stochastic and RSI indicators moving away from the oversold area, the stock is expected to shift higher ahead to extend the upward trajectory.

• Thus, we believe that DPHARMA’s share price could climb towards our resistance thresholds of RM1.35 (R1) and RM1.47 (R2), representing upside potentials of 15% and 26%, respectively.

• Our stop loss price is set at RM1.02 (or a downside risk of 13%).

• Business-wise, DPHARMA is mainly involved in the manufacturing and distribution of pharmaceutical products.

• Earning-wise, the group reported a stronger net profit of RM20.3m (+15% YoY, +29% QoQ) in 1QFY22, lifted by higher sales contributions from the consumer healthcare and private ethical sectors.

• Based on consensus estimates, the group is expected to report a net profit of RM79.7m in FY Dec 2022 and RM82.4m in FY Dec 2023, translating to forward PERs of 14.1x and 13.4x, respectively.

Fiamma Holdings Bhd (Trading Buy)

• After climbing in an ascending channel to peak at RM1.05 in Apr 2022, FIAMMA’s share price subsequently fell to a low of RM0.755 in June 2022.

• The share price has recently bounced off from the trough with the rising momentum likely to continue on the back of: (i) the positive stochastic crossover in the oversold area, and (ii) the Parabolic SAR indicator showing its first uptick signal.

• Hence, the stock could rise further to challenge our resistance levels of RM0.96 (R1; 14% upside potential) and RM1.05 (R2; 25% upside potential).

• We have pegged our stop loss at RM0.72, representing a downside risk of 14%.

• FIAMMA is engaged in the business of: (i) trading and services, focussing on the distribution and servicing of electrical home appliances, sanitaryware, kitchen and wardrobe system and built-in furniture, bathroom accessories, medical devices and healthcare products, and (ii) property development and property investment.

• The group reported a net profit of RM7.2m (-37% QoQ) in 2QFY22, taking its 1HFY22’s bottomline to RM18.6m (-15% YoY).

• Going forward, consensus is forecasting the group to record a net profit of RM34.5m in FY Sep 2022 and RM35.0m in FY Sep 2023, translating to forward PERs of 12.4x and 12.2x, respectively.

Source: Kenanga Research - 30 Jun 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024