Daily technical highlights – (ELKDESA, KPS)

kiasutrader

Publish date: Tue, 05 Jul 2022, 09:29 AM

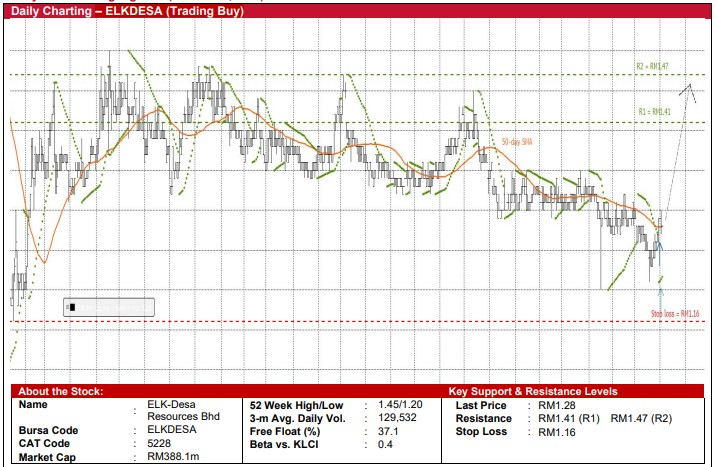

ELK-Desa Resources Bhd (Trading Buy)

• ELKDESA – a non-bank lender whose core business focus is in the under-served hire purchase financing for used motor vehicles – is an indirect proxy to rising used car sales. According on media reports, sales of used cars in Malaysia is projected to jump 12.1% YoY to 480,000 units in 2022.

• The positive industry outlook may drive the group’s forward earnings. For FY March 2022, ELKDESA (which also cross-sells general insurance products to its hire purchase customers and is involved in the business of trading and wholesaling of home furniture too) reported net profit of RM25.8m (-27% YoY).

• Valuation-wise, based on its latest book value per share of RM1.50 as of end-March 2022, the stock is presently trading at Price/Book Value multiple of 0.85x (or slightly below the minus 1SD level from its historical mean).

• From a charting standpoint, following a recent rebound from a low of RM1.21 in mid-June to close at RM1.28 yesterday, ELKDESA’s share price will probably extend its upward trajectory after crossing above the 50-day SMA as the Parabolic SAR indicator shows an uptick signal.

• Riding on the strengthening momentum, the stock could advance towards our resistance thresholds of RM1.41 (R1; 10% upside potential) and RM1.47 (R2; 15% upside potential).

• We have placed our stop loss price level at RM1.16 (which represents a downside risk of 9%).

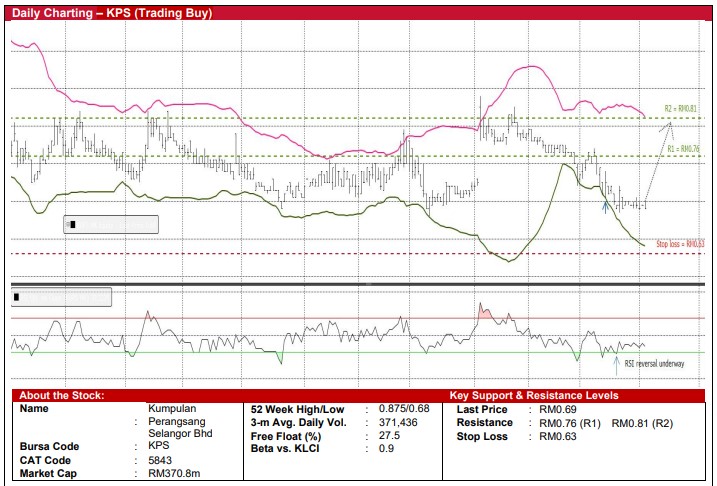

Kumpulan Perangsang Selangor Bhd (Trading Buy)

• KPS’ share price – after previously gapping up from RM0.725 in early April to a high of RM0.84 in reaction to the proposed disposal of its 20% effective stake in SPRINT (a toll highway concessionaire) – has pulled back subsequently to close below its pre-announcement level at RM0.69 yesterday.

• With the divestment exercise due to be concluded sometime in the third quarter of this year, KPS is on course to receive the sales proceeds of RM182.6m (which translates to 34.0 sen per share or nearly half the existing share price), the utilisation of which will be determined at a later date.

• After reporting net profit of RM56.2m (+65% YoY) in FY December 2021, KPS – which is an investment holding company with core investments in the manufacturing sector – made net earnings of RM10.3m (-6% YoY) in 1QFY22.

• From a technical perspective, following a decline of 18% from its early April peak to hover close to a support line (at RM0.66), KPS shares may be near a reversal point already.

• An upward shift is now anticipated as the share price has recently crossed back above the lower Bollinger Band while the RSI indicator is in the midst of climbing out from the oversold zone.

• With that, the stock could rise towards our resistance thresholds of RM0.76 (R1) and RM0.81 (R2), which represent upside potentials of 10% and 17%, respectively.

• Our stop loss price level is pegged at RM0.63 (or a 9% downside risk).

Source: Kenanga Research - 5 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024