Daily technical highlights – (SAM, DIALOG)

kiasutrader

Publish date: Wed, 06 Jul 2022, 05:53 PM

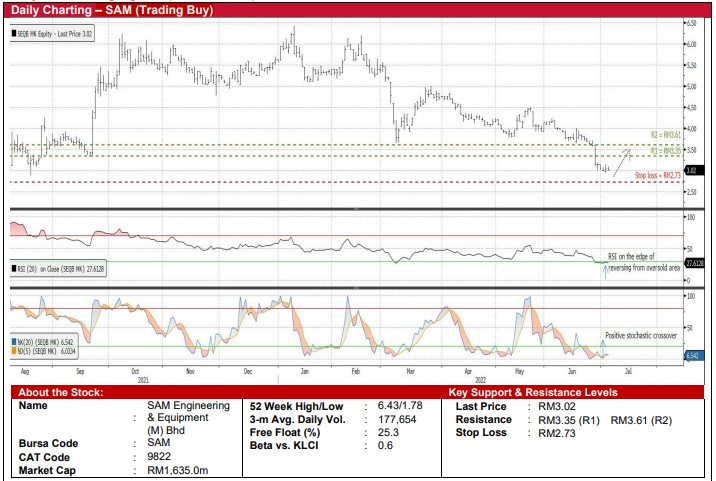

SAM Engineering & Equipment (M) Bhd (Trading Buy)

• A technical rebound could be on the horizon for SAM shares following the steep plunge from a peak of RM6.20 in midFebruary this year to close at RM3.02 yesterday, back to where it was in August last year.

• This comes as both the RSI and stochastic indicators are poised to climb out from the oversold territory.

• On the chart, the share price will probably stage a run-up towards our resistance levels of RM3.35 (R1; 11% upside potential) and RM3.61 (R2; 20% upside potential).

• Our stop loss price threshold is pegged at RM2.73 (which represents a downside risk of 10%).

• Earnings-wise, SAM – which has two business segments namely aerospace (involving the manufacturing and assembly of aircraft equipment, spares, components & precision engineering parts etc) and equipment (catering to the semiconductor and data storage industries) – reported net profit of RM21.8m (-8% YoY) in 4QFY22, bringing its full-year bottomline to RM75.5m (+28 YoY).

• Going forward, consensus is forecasting the group to post higher net earnings of RM92.6m (+23% YoY) in FY March 2023 and RM122.0m (+32% YoY) in FY March 2024, which translate to forward PERs of 17.7x and 13.4x, respectively

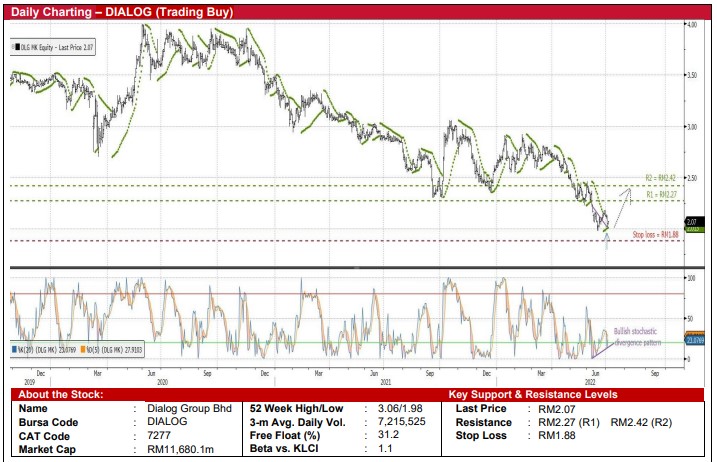

Dialog Group Bhd (Trading Buy)

• A continuous slide from a peak of RM3.95 in mid-November 2020 has brought DIALOG’s share price to as low as RM1.98 last month, its lowest level since September 2017. This may set the stage for an ensuing technical rebound.

• From a charting standpoint, the emergence of a bullish stochastic divergence pattern (which saw the stochastic indicator forming rising bottoms in the oversold area as the price was drifting lower) and an uptick signal by the Parabolic SAR indicator could pave the way for the shares to shift higher ahead.

• With that, the stock is expected to rise towards our resistance thresholds of RM2.27 (R1; 10% upside potential) and RM2.42 (R2; 17% upside potential).

• We have placed our stop loss price level at RM1.88 (representing a downside risk of 9% from its last traded price of RM2.07).

• An integrated technical service provider to the upstream, mid-stream and downstream segments in the oil & gas and petrochemical industry, DIALOG logged net profit of RM133.1m (-2% YoY) in 3QFY22, taking cumulative earnings to RM389.8m (-4% YoY) for 9MFY22.

• This suggests that the group is on track to meet its full-year consensus estimate of RM542.1m in FY June 2022 while its net earnings is forecasted to increase further to RM609.7m in FY June 2023.

• In terms of valuation, the stock is trading at consensus-derived forward PERs of 21.5x this year and 19.2x next year, respectively with the 1-year forward rolling PER currently hovering slightly below the minus 2SD level from its historical mean.

Source: Kenanga Research - 6 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

DIALOG2024-11-22

DIALOG2024-11-22

DIALOG2024-11-22

SAM2024-11-21

DIALOG2024-11-21

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

SAM2024-11-19

DIALOG2024-11-19

SAM2024-11-18

DIALOG2024-11-18

SAM2024-11-15

SAMMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024