Daily technical highlights – (HEXTAR, FGV)

kiasutrader

Publish date: Fri, 15 Jul 2022, 09:27 AM

Hextar Global Bhd (Trading Buy)

• HEXTAR’s share price has plunged by 28% to a low of RM1.45 in June 2022 from a peak of RM2.00 in early April 2022 before staging a rebound to close at RM1.70 yesterday. The recent formation of bullish candlesticks has indicated the return of buying interest.

• On the back of the rising Parabolic SAR indicator and coupled with a bullish crossover by the DMI Plus above the DMI Minus, we anticipate the stock will continue to climb further to extend its upward trajectory since early this month.

• Thus, we believe that HEXTAR’s share price could rise towards our resistance thresholds of RM1.95 (R1) and RM2.17 (R2), representing upside potentials of 15% and 28%, respectively.

• Our stop loss price is set at RM1.45 (or a downside risk of 15%).

• HEXTAR is involved in: (i) the plantation industry, selling agro-chemicals products, and (ii) the consumer segment via the distribution of wet wipes, sanitary towels and tissue products.

• Earnings-wise, the group reported a stronger net profit of RM15.6m (+46% YoY, +10% QoQ) in 1QFY22, lifted by higher contribution from the specialty chemical segment.

• Based on consensus estimates, the group is expected to report a net profit of RM68.5m in FY Dec 2022 and RM72.5m in FY Dec 2023, translating to forward PERs of 32.1x and 30.4x, respectively.

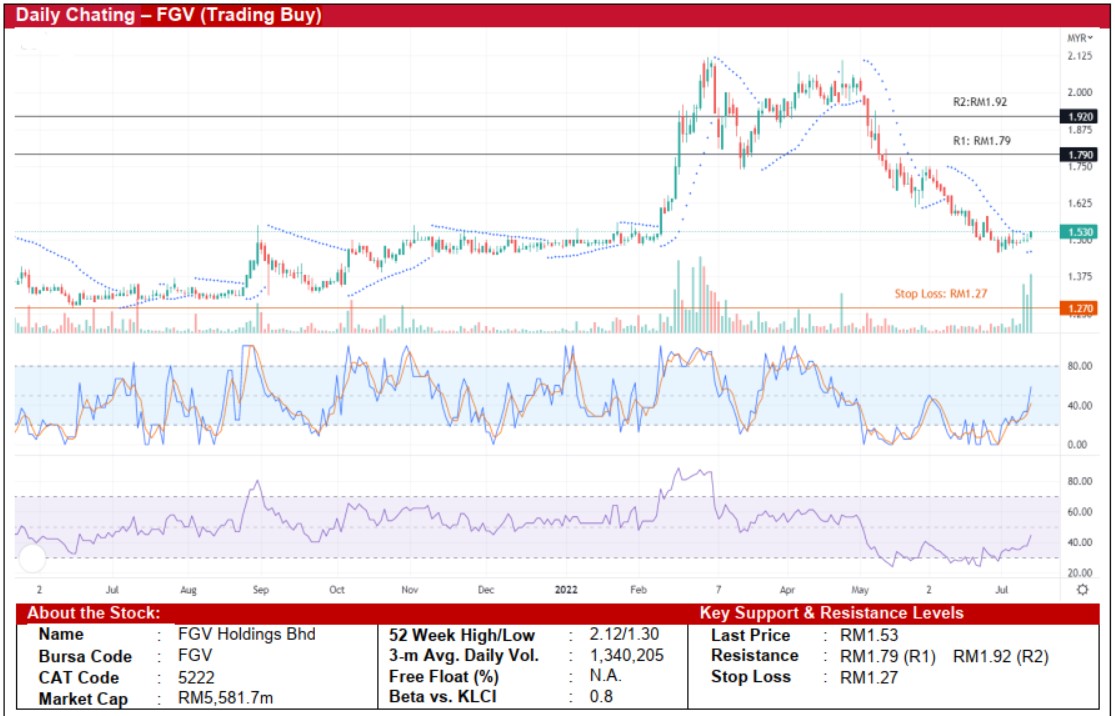

FGV Holdings Bhd (Trading Buy)

• A double-top formation has led FGV’s share price to fall from its peak of RM2.12 in Mar and Apr 2022 to as low as RM1.46 in end- June 2022.

• With the chart showing a bounce-off from the trough recently the upward momentum will likely continue based on the positive technical signals arising from: (i) the rising Parabolic SAR trend, (ii) the positive stochastic crossover, and (iii) the reversal by the RSI indicator from an oversold area.

• Consequently, the stock could rise to challenge our resistance levels of RM1.79 (R1; 17% upside potential) and RM1.92 (R2; 25% upside potential).

• We have pegged our stop loss at RM1.27, representing a downside risk of 17%.

• FGV is involved in three core business segments, namely plantations (focussing on both upstream and downstream crude palm oil activities), sugar (mainly through 51%-owned MSM Malaysia Holdings) and logistics (by providing services in bulking/storage and transport facilities).

• Based on the latest 1QFY22 results, the group recorded a net profit of RM369.2m (-21% QoQ; net loss of RM35.4m in 1QFY21) mainly due to lower Fresh Fruit Bunches (FFB) production.

• Going forward, consensus is forecasting FGV to report net profit of RM1,032.1m in FY December 2022 and RM624.3m in FY December 2023, which translate to forward PERs of 5.5x and 9.0x, respectively.

Source: Kenanga Research - 15 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024