Daily technical highlights – (AEON, GHLSYS)

kiasutrader

Publish date: Tue, 19 Jul 2022, 09:08 AM

AEON Co. (M) Bhd (Trading Buy)

• After pulling back from a high of RM1.68 in mid-May this year, a recent bounce-off from a low of RM1.26 – which broadly coincided with the preceding troughs in the second half of December last year and the second half of February this year – has paved the way for AEON shares to shift higher ahead.

• Backed by a bullish MACD crossover above the signal line and an uptick signal by the Parabolic SAR indicator, the share price – which closed at RM1.36 yesterday – is expected to resume its upward trajectory that began in early November 2020.

• With that, the stock could advance to challenge our resistance thresholds of RM1.53 (R1; 12% upside potential) and RM1.64 (R2; 21% upside potential).

• We have set our stop loss price level at RM1.19 (representing a 12% downside risk).

• A leading general merchandise stores cum supermarket chain in Malaysia, AEON saw its bottomline increased to RM85.3m (+106% YoY) in FY December 2021 that was followed by a strong quarterly net profit of RM28.1m (+28% YoY) in 1QFY22.

• On the back of a recovery in consumer spending, consensus is projecting the group to make net earnings of RM106.2m in FY22 and RM122.3m in FY23. This translates to forward PERs of 18.0x this year and 15.6x next year, respectively with its 1-year rolling forward PER currently hovering around its historical mean.

• The stock also offers prospective dividend yields of 2.8%-3.1% based on consensus DPS forecasts of 3.8 sen in FY22 and 4.2 sen in FY23, respectively.

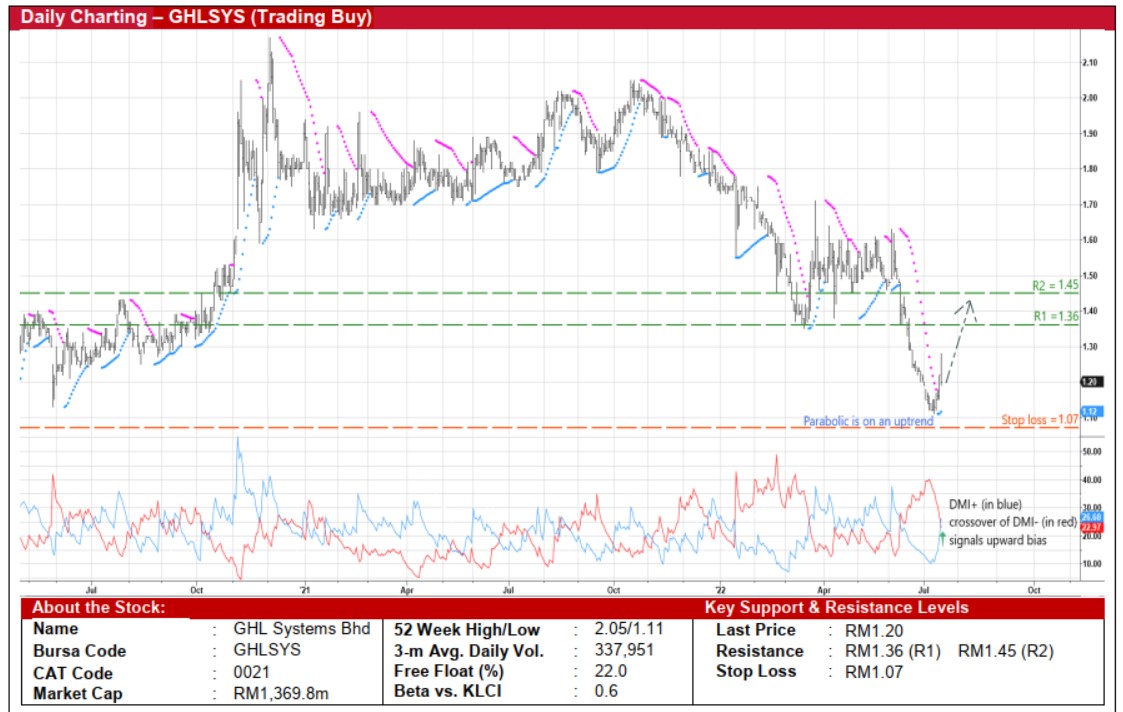

GHL Systems Bhd (Trading Buy)

• Following a 32% retracement from a high of RM1.63 in early June this year to as low as RM1.11 last Tuesday, GHLSYS’ share price – which has since recovered to close at RM1.20 yesterday – may extend its technical rebound ahead.

• On the chart, the bullish momentum will probably continue based on the positive technical signals generated by the DMI Plus crossing over the DMI Minus and the rising Parabolic SAR trend.

• Consequently, the stock is expected to climb towards our resistance thresholds of RM1.36 (R1; 13% upside potential) and RM1.45 (R2; 21% upside potential).

• Our stop loss price level is pegged at RM1.07 (or an 11% downside risk).

• A leading ASEAN payment solutions provider offering multiple payment services (physical, e-commerce and QR pay), GHLSYS is a proxy to the regional consumer spending via its footprint of more than 380,000 payment touchpoints across Malaysia, Philippines, Thailand, Indonesia, Singapore and Australia.

• After posting net profit of RM28.2m (+108% YoY) in FY December 2021, the group’s bottomline came in at RM5.2m (-12% YoY) in 1QFY22.

• Going forward, consensus is projecting GHLSYS to log net earnings of RM33.4m in FY22 and RM40.4m in FY23, which translate to forward PERs of 41.0x this year and 33.9x next year, respectively (with its 1-year rolling forward PER currently trading marginally below its historical mean).

• An added investment merit is its healthy balance sheet that is backed by net cash holdings & other short-term investments of RM194.5m (or 17.0 sen per share) as of end-March 2022.

Source: Kenanga Research - 19 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024