Daily technical highlights – (MBSB, EPMB)

kiasutrader

Publish date: Wed, 20 Jul 2022, 09:18 AM

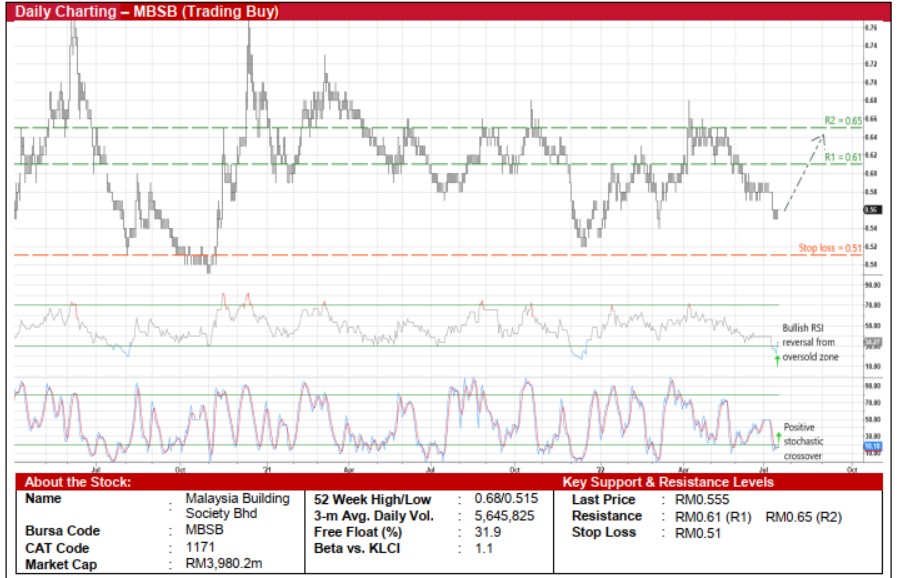

Malaysia Building Society Bhd (Trading Buy)

• A technical rebound may be in store for MBSB’s share price after touching a recent low of RM0.55 in mid-July. This follows its earlier fall from a high of RM0.68 in early April this year.

• On the chart, the positive momentum is expected to persist as both the RSI and stochastic indicators are in the midst of climbing out from the oversold territory.

• This could then lift the stock to challenge our resistance thresholds of RM0.61 (R1; 10% upside potential) and RM0.65 (R2; 17% upside potential).

• Our stop loss price level is pegged at RM0.51 (representing an 8% downside risk from yesterday’s close of RM0.555).

• A full-fledged Islamic banking group, MBSB registered a 63% YoY jump in net profit to RM438.7m in FY December 2021 that was followed by quarterly net earnings of RM58.2m (-8% YoY) in 1QFY22.

• Moving forward, consensus is forecasting the group’s bottomline to come in at RM624.0m in FY22 and RM757.5m in FY23.

• Valuation-wise, based on its book value per share of RM1.20 as of end-March 2022, the stock is currently trading at Price/Book Value multiple of 0.46x (or near the minus 1SD level from its historical mean).

• In terms of corporate development, MBSB is presently exploring the possibility of undertaking an acquisition of a 100% stake in Malaysian Industrial Development Finance (MIDF) with an announcement likely to be made by early October.

EP Manufacturing Bhd (Trading Buy)

• After hitting a trough of RM0.84 in mid-May this year, EPMB’s share price has subsequently plotted higher lows to form a possible symmetrical triangle pattern.

• An upward shift in the price – which finished at RM0.97 yesterday – is now anticipated in view of the bullish stochastic crossover by the %K line above the %D line in an oversold area.

• With that, a probable technical breakout from the symmetrical triangle could then drive the stock towards our resistance targets of RM1.08 (R1) and RM1.16 (R2), which translate to upside potentials of 11% and 20%, respectively.

• We have placed our stop loss price level at RM0.86 (or an 11% downside risk).

• The group – which is involved in the manufacturing and supply of automotive parts (such as metal body panels, chassis parts, rear axles, brake systems and fuel tanks) – offers an indirect exposure to the resilient domestic motor vehicles market.

• Earnings-wise, EPMB narrowed its net loss from RM15.2m in FY December 2020 to RM8.2m in FY21 before turning profitable with a slight net earnings of RM0.4m (-67% YoY) in 1QFY22.

Source: Kenanga Research - 20 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024