Daily technical highlights – (TUNEPRO, LYC)

kiasutrader

Publish date: Tue, 26 Jul 2022, 09:22 AM

Tune Protect Group Bhd (Trading Buy)

• A probable double-bottom reversal pattern could propel TUNEPRO shares to higher levels ahead following a tumble from as high as RM0.445 in the first half of April this year to close at RM0.345 yesterday.

• From a technical perspective, an upward shift in the share price may be on the horizon based on the positive signals triggered by: (i) a bullish stochastic divergence pattern (which saw the formation of two rising bottoms in the oversold zone while the price was drifting lower), and (ii) an anticipated reversal by the RSI indicator from an oversold position.

• On the back of the rising momentum, the stock is expected to climb towards our resistance thresholds of RM0.38 (R1; 10% upside potential) and RM0.40 (R2; 16% upside potential).

• Our stop loss price level is pegged at RM0.31 (representing a 10% downside risk).

• A financial holding company that provides underwriting and reinsurance services for non-life insurance products (such as motor personal accident protection, fire insurance, insurance plans for foreign workers, global travel protection etc), TUNEPRO saw its quarterly net loss narrowing to RM3.0m in 1QFY22, versus net losses of RM15.4m in 1QFY21 and RM12.1m in 4QFY21.

• According to consensus estimates, the group’s forward net earnings is projected to rebound to RM14.1m for FY December 2022 before doubling to RM28.2m for FY December 2023. This translates to forward PERs of 18.4x this year and 9.2x next year, respectively.

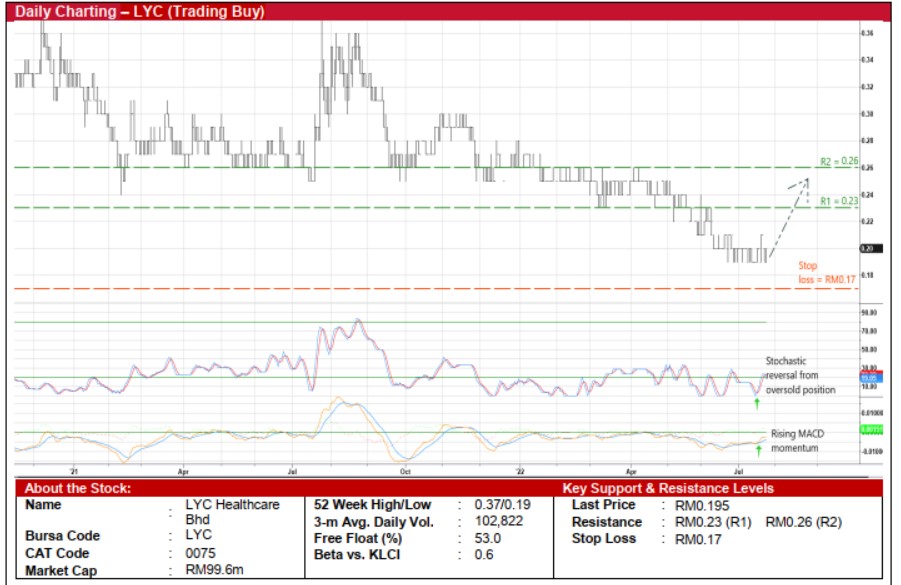

LYC Healthcare Bhd (Trading Buy)

• After sliding from a high of RM0.36 in mid-August last year to RM0.195 currently, or back to where it was in the beginning of April 2020, a technical rebound may be forthcoming for LYC shares.

• On the chart, the share price will probably show an upward bias on account of the strengthening MACD signal and an unwinding of the stochastic indicator from the oversold area.

• With that, the stock could be on its way to scale towards our resistance targets of RM0.23 (R1) and RM0.26 (R2), which translate to upside potentials of 18% and 33%, respectively.

• We have placed our stop loss price at RM0.17 (or a 13% downside risk).

• A niche player in the healthcare industry, LYC is a provider of mother and child care related services such as postnatal & postpartum care and confinement care. It is also involved in other healthcare segments (such as senior living homes, family clinic, childcare services, cosmetic & aesthetic and fertility services) as well as the operation of medical centres in Singapore.

• More recently, LYC has announced acquisition plans to venture into the nutraceutical business and dental treatment services to diversify its income streams.

• The group has turned slightly profitable with net earnings of RM0.3m in 4QFY22 (compared with net losses of RM3.3m in 3QFY22 and RM1.7m in 4QFY21), narrowing its full-year net loss to RM9.1m in FY March 2022 (versus FY21’s net loss of RM11.7m).

Source: Kenanga Research - 26 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024