Daily technical highlights – (MUDAJYA, GFM)

kiasutrader

Publish date: Wed, 27 Jul 2022, 09:14 AM

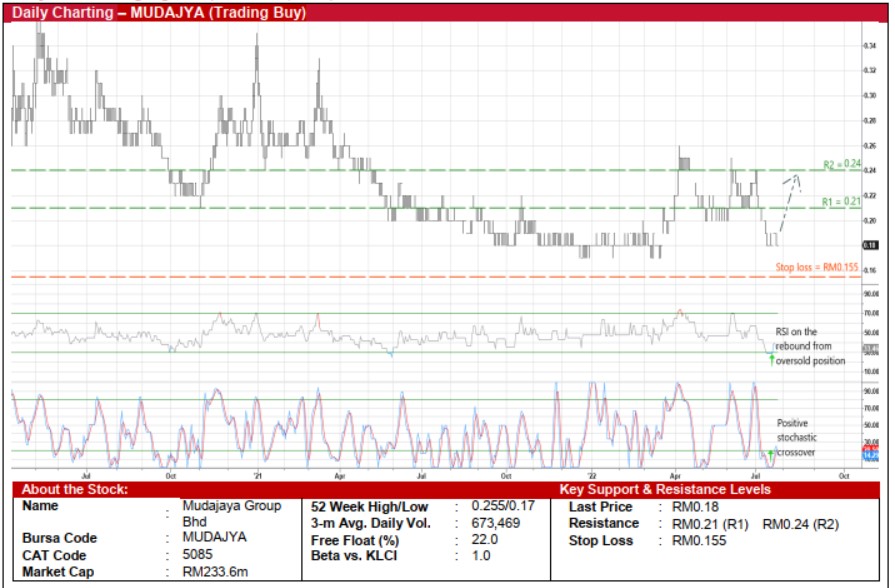

Mudajaya Group Bhd (Trading Buy)

• After swinging down and up and down again to be back to where it was in mid-March this year, MUDAJYA’s share price is poised to shift higher ahead.

• Essentially, a technical rebound may be due as both the stochastic and RSI indicators are in the midst of climbing out form the oversold zone.

• With that, the stock could be on its way to challenge our resistance targets of RM0.21 (R1) and RM0.24 (R2), offering upside potentials of 17% and 33%, respectively.

• We have set our stop loss price level at RM0.155 (representing a downside risk of 14% from yesterday’s close of RM0.18).

• Earnings-wise, MUDAJYA – which is principally involved in four core businesses, namely construction, property development, trading & manufacturing of construction materials as well as power generation – has turned around with net profit of RM6.4m in FY December 2021 (from net loss of RM47.9m in FY20). The positive earnings momentum continued when its bottomline came in at RM1.4m in 1QFY22 (versus net loss of RM3.6m in 1QFY21).

• In terms of corporate developments, the group has recently announced: (i) the award of a contract (valued at RM104m) to undertake the construction of earthworks and associated works for a gas power plant in Gurun, Kedah, and (ii) the proposed acquisition of a 100% stake in Real Jade Limited (which is involved in the manufacturing and sales of cement & clinker and trading of cement in China) for an indicative cash consideration of HKD400m (RM224.3m).

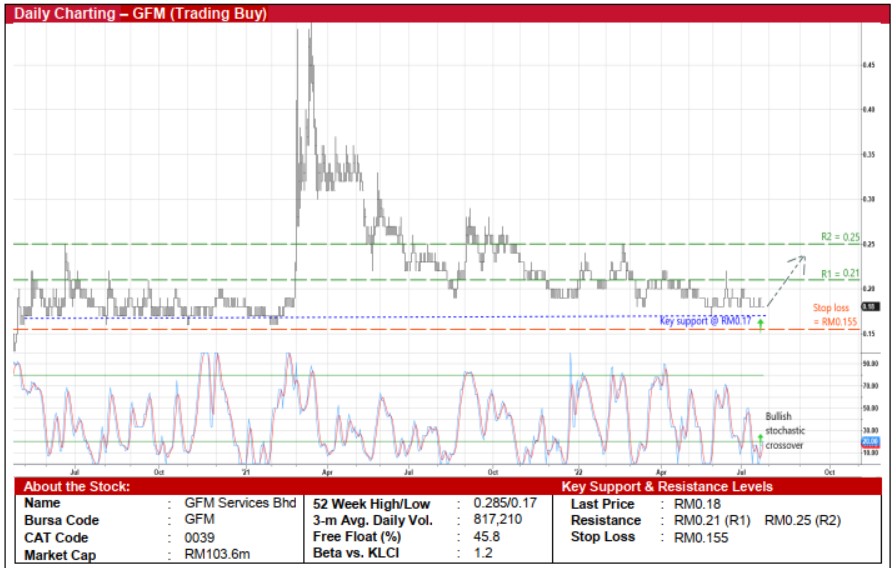

GFM Services Bhd (Trading Buy)

• After falling from a peak of RM0.50 in mid-March last year to RM0.18 currently, GFM shares may bounce off a key support line (at RM0.17) that stretches back to end-April 2020.

• On the chart, the share price is expected to ride on the strengthening momentum as the stochastic indicator reverses from an oversold position.

• Hence, the stock will probably climb towards our resistance thresholds of RM0.21 (R1; 17% upside potential) and RM0.25 (R2; 39% upside potential).

• Our stop loss price level is pegged at RM0.155 (or a 14% downside risk).

• Business-wise, GFM is a service provider offering a one-stop integrated facilities management solutions.

• After registering net profit of RM10.0m (+17% YoY) in FY December 2021, the group subsequently logged net earnings of RM2.6m (+4%) in 1QFY22.

• On the corporate news front, GFM has recently secured a 5-year contract worth RM367.2m to provide facilities management services for Istana Negara in Kuala Lumpur, thus boosting its outstanding orderbook to RM1.4b.

Source: Kenanga Research - 27 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024