Daily technical highlights – (BONIA, OWG)

kiasutrader

Publish date: Thu, 28 Jul 2022, 09:33 AM

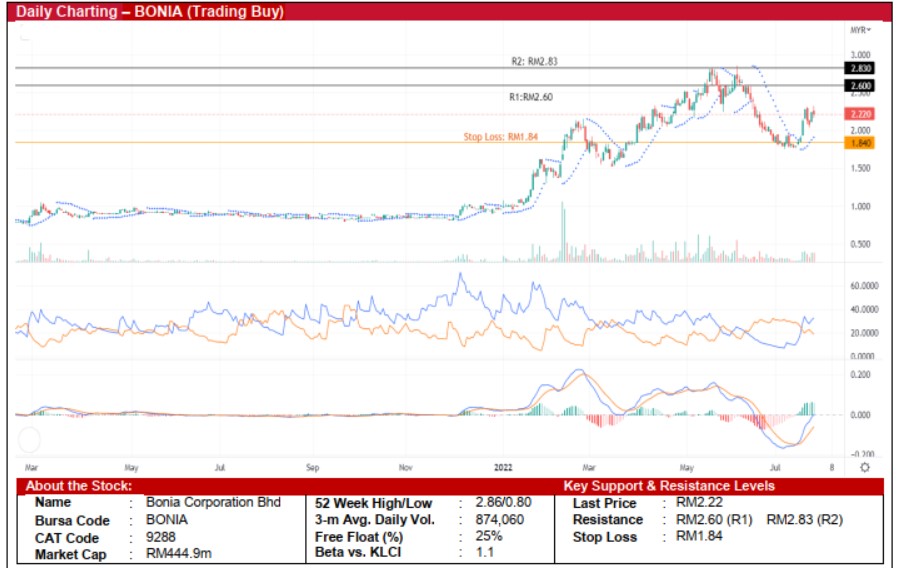

Bonia Corporation Bhd (Trading Buy)

• BONIA’s share price has pulled back from a peak of RM2.86 in May 2022 that was followed by a recent rebound from a low of RM1.77 before closing at RM2.22 yesterday.

• On the chart, the stock is expected to climb further as: (i) the MACD line has crossed over the signal line, (ii) the DMI Plus has cut above the DMI Minus, and (iii) the Parabolic SAR is showing an uptrend signal.

• Thus, the stock could rise further and challenge our resistance levels of RM2.60 (R1; 17% upside potential) and RM2.83 (R2; 27% upside potential).

• We have pegged our stop loss price set at RM1.84, which translates to a downside risk of 17%.

• Business-wise, BONIA is involved in the design, manufacturing, retailing and wholesale of leatherwear, footwear, men’s apparel and accessories.

• Fundamental-wise, BONIA reported a net profit of RM14.8m in 3QFY22 (-36% QoQ) which brought 9MFY22 net profit to RM32.9m (+128% YoY), lifted by the reopening of economic activities and strong consumer spending during the festive seasons.

• Based on consensus forecasts, the group is expected to record a net profit of RM36.7m in FY June 2022 and RM43.8m in FY June 2023, translating to forward PERs of 12.1x and 10.1x, respectively.

• BONIA’s balance sheet is backed by net cash holdings and short-term funds of RM49.7m (translating to 24.8 sen per share) as of end-March 2022.

Only World Group Holdings Bhd (Trading Buy)

• After a bounce-off from a low at RM0.425 to form a double-bottom reversal pattern in January and July 2022, the recent formation of bullish candlesticks has indicated the return of buying interest in OWG shares.

• On the chart, the upward momentum will likely continue based on the positive technical signals arising from: (i) the rising Parabolic SAR trend, and (ii) the DMI Plus crossing above the DMI Minus.

• Thus, we believe that OWG’s share price could climb towards our resistance thresholds of RM0.58 (R1) and RM0.62 (R2), representing upside potentials of 12% and 19%, respectively.

• Our stop loss price is set at RM0.465 (or a downside risk of 11%).

• OWG is engaged in the provision of leisure and hospitality services focussing on three key segments: (i) food services, (ii) amusement, and (iii) recreation operations.

• Earnings-wise, the group has turned around with a slight net profit of RM0.04m in 3QFY22 (vs net loss of RM0.4m in 2QFY22 and net loss of RM14.1m in 3QFY21), which brought its 9MFY22 to a net loss of RM11.2m.

Source: Kenanga Research - 28 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024