Daily technical highlights – (MASTEEL, LEONFB)

kiasutrader

Publish date: Tue, 02 Aug 2022, 09:12 AM

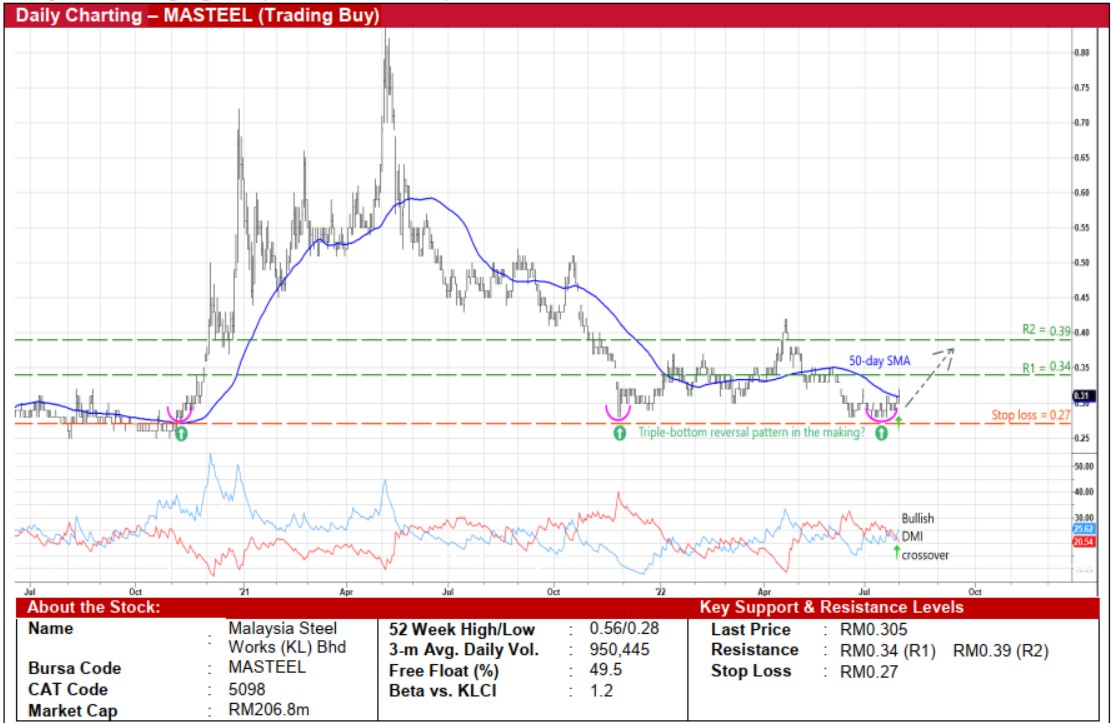

Malaysia Steel Works (KL) Bhd (Trading Buy)

• A bounce-off from a recent low of RM0.28 – which coincided with two preceding troughs (in November 2020 and November 2021) that had then paved the way for a subsequent rebound in MASTEEL shares – suggests that a triple-bottom reversal pattern could be in the making.

• Technically speaking, backed by the simultaneous crossovers of the DMI Plus above the DMI Minus and the share price above the 50-day SMA, the stock – which ended at RM0.305 yesterday amid heavy trading interest – will likely extend the positive trajectory ahead.

• An anticipated upward shift is expected to lift the stock price towards our resistance thresholds of RM0.34 (R1; 11% upside potential) and RM0.39 (R2; 28% upside potential).

• We have set our stop loss price level at RM0.27 (which represents a downside risk of 11%).

• An integrated steel manufacturer focusing on the production of high-tensile deformed steel bars, mild steel round bars and steel billets (which are mostly used in the construction and infrastructure sectors), MASTEEL made net profit of RM32.5m in FY December 2021 (versus FY20’s net loss of RM14.7m) that was followed by quarterly net earnings of RM13.2m (+57% YoY) in 1QFY22.

• Valuation-wise, based on a book value per share of RM1.26 as of end-March 2022, the stock is presently trading at a Price/Book Value multiple of 0.24x (or approximately 0.5 SD below its historical mean).

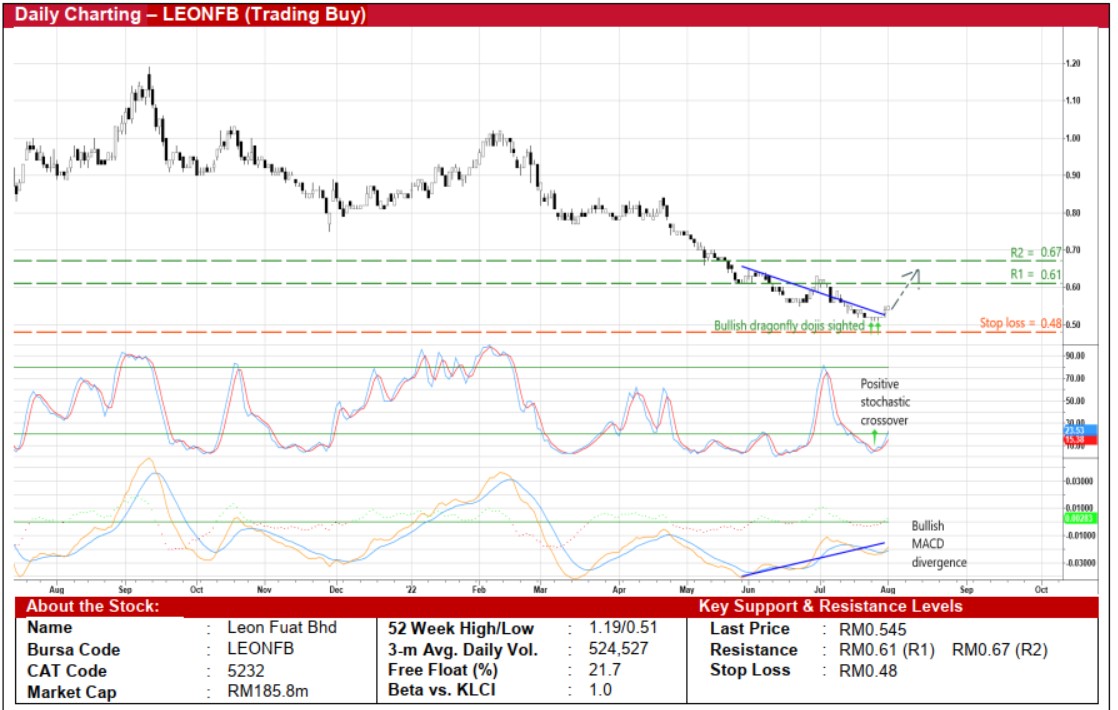

Leon Fuat Bhd (Trading Buy)

• A technical rebound may be due for LEONFB shares after sliding from a peak of RM1.31 in early May last year to as low as RM0.51 last week (or back to where it was in February 2021).

• On the chart, the share price is expected to move up from yesterday’s close of RM0.545 based on the positive technical signals triggered by: (i) the existence of a bullish divergence pattern in the MACD indicator (which has been rising in the oversold zone as the price was weakening), (ii) the positive stochastic crossover in an oversold territory, and (iii) the appearance of successive dragonfly doji candlesticks.

• Riding on the strengthening momentum, the stock could climb to challenge our resistance targets of RM0.61 (R1) and RM0.67 (R2), translating to upside potentials of 12% and 23%, respectively.

• Our stop loss price level is pegged at RM0.48 (representing a 12% downside risk).

• Earnings-wise, after reporting net profit of RM136.0m (or nearly a five-fold increase) in FY December 2021, LEONFB – which is principally involved in the trading and processing of a diverse range of flat and long steel products – made net earnings of RM23.9m (-34% YoY) in 1QFY22.

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 0.33x (or slightly above the minus 1 SD level from its historical mean) based on its book value per share of RM1.64 as of end-March 2022.

Source: Kenanga Research - 2 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024