Daily technical highlights – (POHUAT, MIECO)

kiasutrader

Publish date: Tue, 09 Aug 2022, 09:13 AM

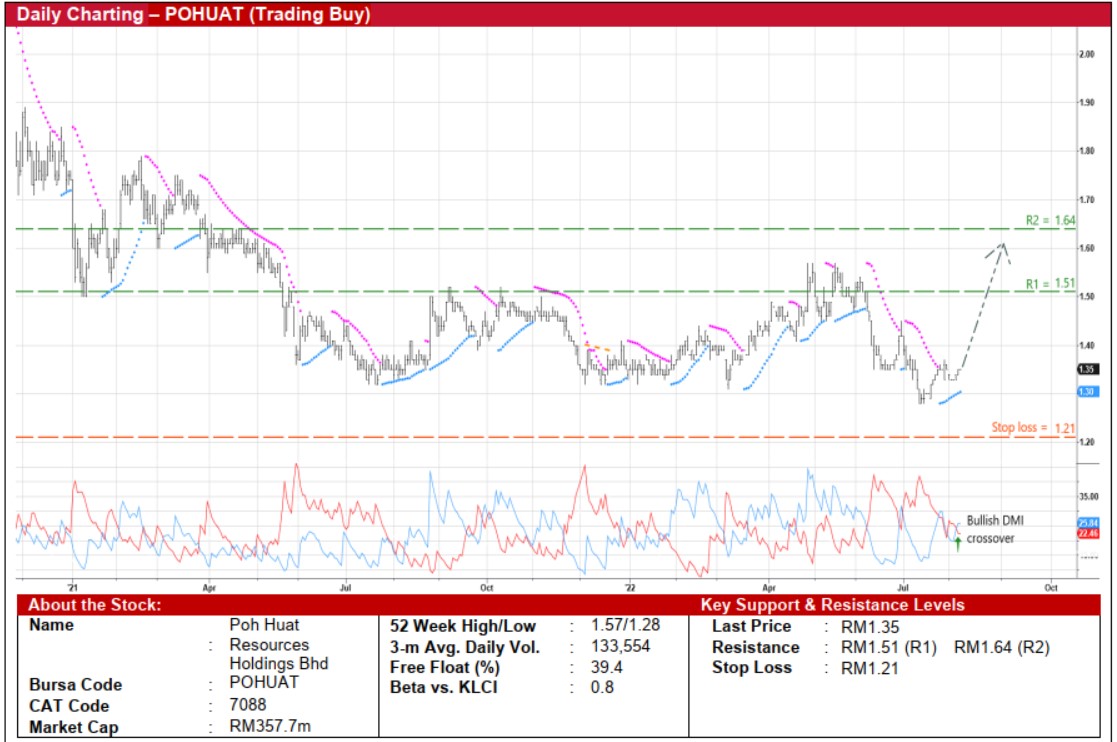

Poh Huat Resources Holdings Bhd (Trading Buy)

• Following its retracement from a high of RM1.57 in mid-May this year, a recent bounce-off from RM1.28 (which is near a key support area that stretches back to mid-July last year) suggests that POHUAT’s share price is currently on the rise.

• On the chart, the positive momentum is expected to persist on account of the increasing Parabolic SAR trend and the bullish crossover by the DMI Plus above the DMI Minus.

• With that said, the stock could advance towards our resistance thresholds of RM1.51 (R1; 12% upside potential) and RM1.64 (R2; 21% upside potential).

• We have pegged our stop loss price level at RM1.21 (representing a 10% downside risk from yesterday’s close of RM1.35).

• A leading furniture manufacturer and exporter in South East Asia with manufacturing bases in Malaysia and Vietnam, POHUAT is a net beneficiary of a stronger USD against the Ringgit as its sales proceeds are predominantly denominated in USD.

• The group made net profit of RM23.1m (+82% YoY) in 2QFY22, taking its 1HFY22 bottomline to RM38.4m (+72% YoY).

• Based on consensus estimates, POHUAT is forecasted to show net earnings of RM62.4m in FY October 2022 and RM59.2m in FY October 2023. This implies forward PERs of 5.7x this year and 6.0x next year, respectively (with its 1-year forward rolling PER currently hovering near the minus 1 SD level from its historical mean).

• Moreover, the group’s balance sheet is backed by net cash & short-term investment holdings of RM178.3m (translating to 67.3 sen per share or almost half of the existing share price) as of end-April 2022.

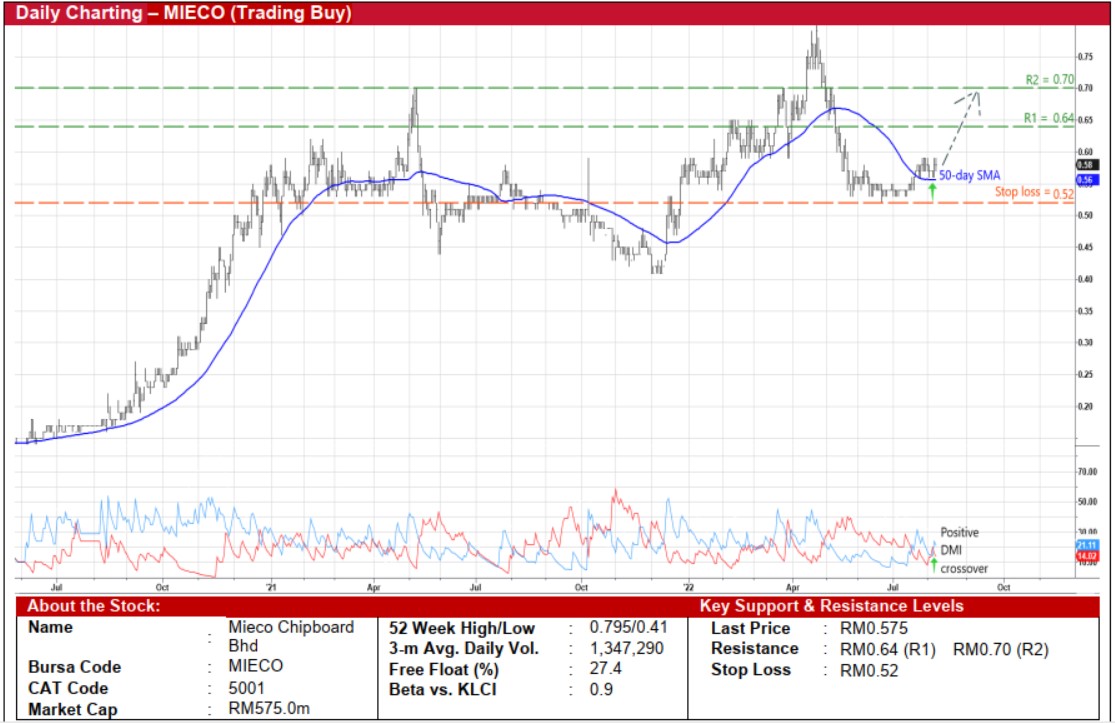

Mieco Chipboard Bhd (Trading Buy)

• A technical rebound may be currently in progress for MIECO shares after swinging up from a recent trough of RM0.525 in mid-July to close at RM0.575 yesterday.

• Riding on the underlying momentum that is driven by the positive DMI Plus crossover above the DMI Minus and the share price overcoming the 50-day SMA, the stock could be on its way to challenge our resistance targets of RM0.64 (R1; 11% upside potential) and RM0.70 (R2; 22% upside potential).

• Conversely, our stop loss price level is set at RM0.52 (representing a 10% downside risk).

• MIECO’s core business is in the manufacturing and distribution of particle boards, catering to the domestic market demand mostly from the furniture and renovation & fit-out construction industries.

• After turning around with net profit of RM27.5m in FY December 2021 (from net loss of RM4.5m previously), the group’s quarterly performance subsequently came in at RM1.2m (-82%) in 1QFY22.

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 1.37x based on its latest book value per share of RM0.42 as of end-March 2022, which is slightly above its historical mean level.

Source: Kenanga Research - 9 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024