Daily technical highlights – (JTIASA, HEVEA)

kiasutrader

Publish date: Wed, 24 Aug 2022, 10:10 AM

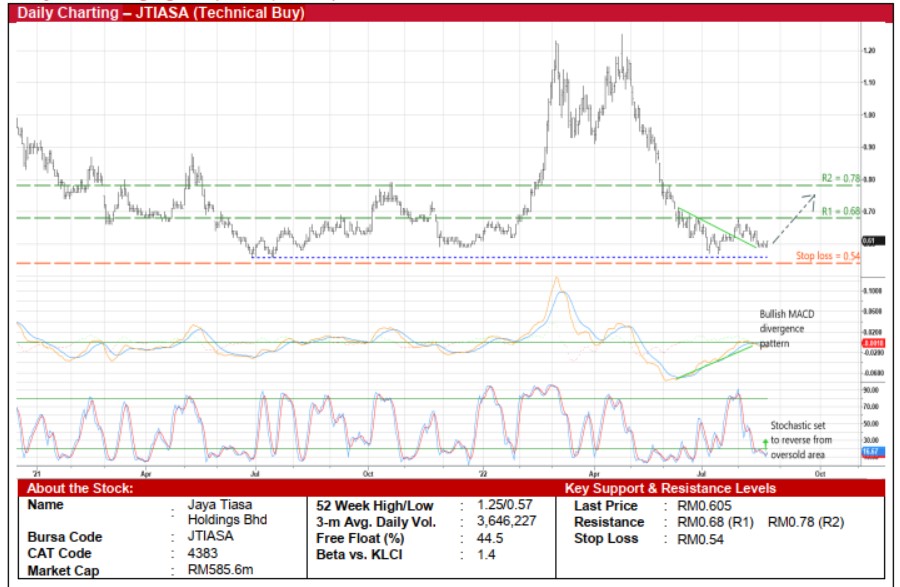

Jaya Tiasa Holdings Bhd (Technical Buy)

• After bouncing off a support line that stretches back to end-June last year, JTIASA shares may ride on the rising momentum to plot a positive trajectory ahead.

• Technically speaking, the upward bias in the share price will be underpinned by the existence of a bullish divergence signal by the MACD indicator (which has climbed from an oversold area while the price was weakening) and the stochastic reversal from an oversold position.

• Following which, the stock could advance to challenge our resistance targets of RM0.68 (R1; 12% upside potential) and RM0.78 (R2; 29% upside potential).

• We have set our stop loss price level at RM0.54 (representing a downside risk of 11% from yesterday’s close of RM0.605).

• Earnings-wise, JTIASA – which is principally involved in the oil palm and timber businesses – reported net profit of RM93.5m (an YoY increase of more than seven-fold) in 9MFY22.

• Based on consensus estimates, the group is forecasted to make net earnings of RM127.0m in FY June 2022 to be followed by RM94.8m in FY23 and RM67.0m in FY24.

• This translates to forward PERs of 6.2x and 8.7x for the subsequent two financial years respectively with its 1-year forward rolling PER currently hovering at 1SD below its historical mean.

• In addition, JTIASA is expected to reward its shareholders with consensus DPS estimates of 3.9 sen in FY22 and 2.9 sen in FY23, which imply dividend yields of 6.4% and 4.8%, respectively.

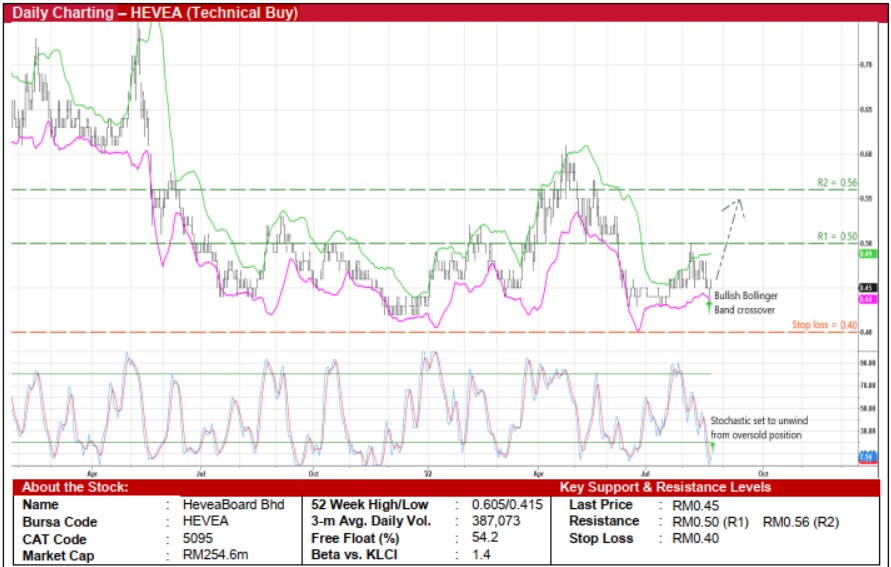

HeveaBoard Bhd (Technical Buy)

• A technical rebound may be forthcoming for HEVEA shares after the pullback from a recent high of RM0.605 in late April this year to a low of RM0.43 in mid-July.

• Following the share price’s recent crossing back above the lower Bollinger Band and the stochastic indicator’s ongoing reversal from an oversold position, the stock is expected to shift higher ahead.

• Riding on the positive momentum, HEVEA could climb towards our resistance thresholds of RM0.50 (R1; 11% upside potential) and RM0.56 (R2; 24% upside potential).

• Our stop loss price level is pegged at RM0.40 (or an 11% downside risk).

• With an involvement in three key business activities (namely particleboard manufacturing, ready-to-assemble products and fungi cultivation), HEVEA’s latest quarter financial results saw a turnaround from net loss of RM3.8m in 2QFY21 to net profit of RM2.8m in 2QFY22, bringing 1HFY22 bottomline to RM8.0m (versus net loss of RM4.8m previously).

• Based on consensus expectations, the group is projected to log net earnings of RM18.8m in FY December 2022 and RM25.3m in FY December 2023.

• In terms of valuation, this translates to forward PERs of 13.5x this year and 10.1x next year respectively with its 1-year forward rolling PER currently trading at 1SD below its historical mean.

• On account of its steady balance sheet that is backed by net cash holdings of RM132.7m (or 23.4 sen per share representing slightly more than half of its existing share price) as of end-June 2022, consensus is anticipating HEVEA would pay DPS of 2.5 sen in FY22 and 3.5 sen in FY23, which imply dividend yields of 5.6% and 7.8%, respectively.

Source: Kenanga Research - 24 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024