Daily technical highlights – (GHLSYS, INARI)

kiasutrader

Publish date: Thu, 25 Aug 2022, 09:59 AM

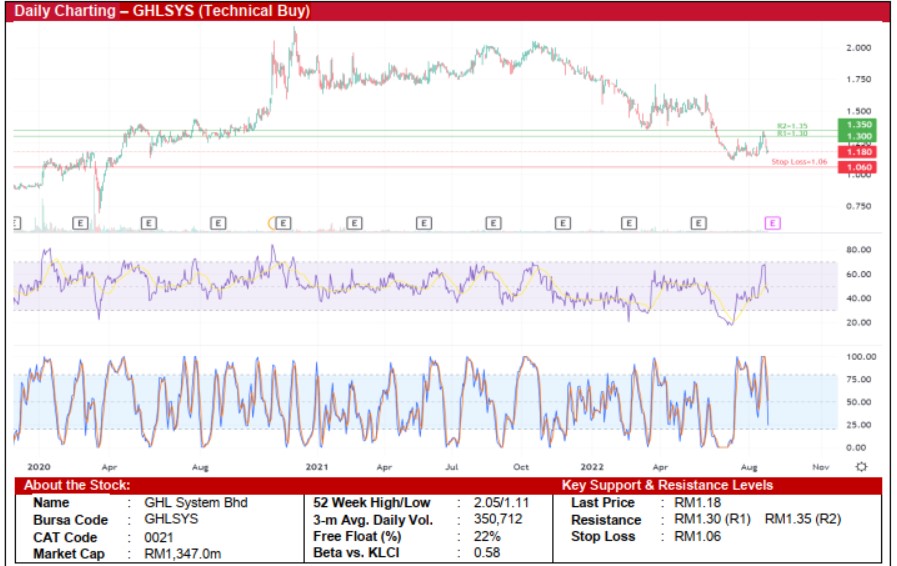

GHL System Bhd (Technical Buy)

• GHLSYS’ share price has fallen 42% since late October 2021 from its 52-week high of RM2.05 to close at RM1.18 yesterday. With the share price falling towards its 52-week low, further downside risk may be cushioned by the short-term support line at RM1.11.

• On the chart, a technical rebound is anticipated as both the Stochastic and RSI indicators climb out from the oversold zone.

• Hence, the stock could rise and test our resistance thresholds of RM1.30 (R1; 10% upside potential) and RM1.35 (R2; 14% upside potential).

• Conversely, our stop loss price has been identified at RM1.06 (representing a 10% downside risk).

• A leading ASEAN payment solutions provider, GHLSYS is a proxy to a recovery in consumer spending, offering multiple payment services (physical, e-commerce and QR pay) via its footprint of more than 380,000 payment touchpoints across Malaysia, Philippines, Thailand, Indonesia, Singapore and Australia.

• Earnings-wise, the group reported a net profit of RM5.2m in 1QFY22, down slightly from a net profit of RM5.9m in 1QFY21 mainly due to lower gross margin.

• Based on consensus forecasts, GHLSYS’ net earnings are projected to come in at RM33.4m in FY December 2022 and RM40.5m in FY December 2023, which translate to forward PERs of 40.3x this year and 33.3x next year, respectively.

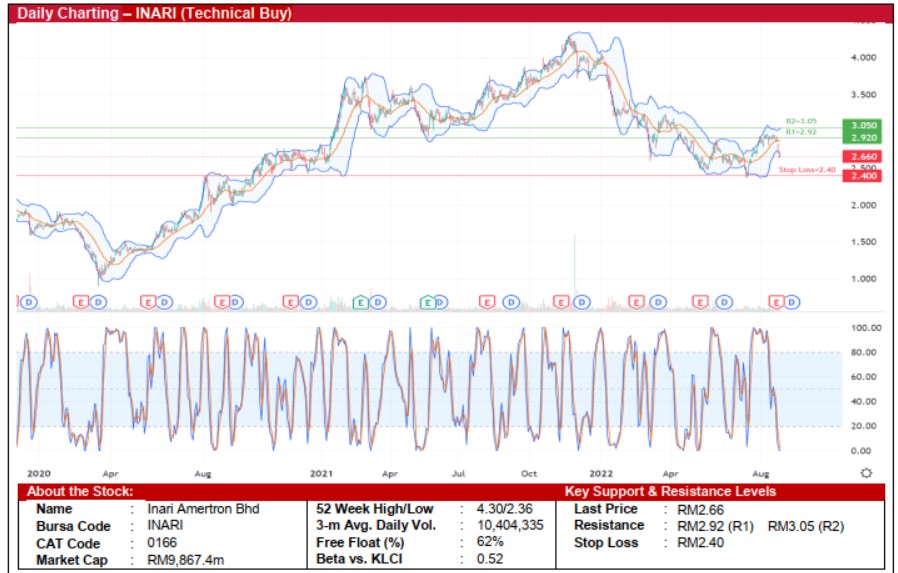

Inari Amertron Bhd (Technical Buy)

• The share price of INARI has slid from a peak of RM4.30 in late November 2021 to as low as RM2.36 (a 52-week low) in July 2022 before closing at RM2.66 yesterday.

• Following the rebound, the share price is expected to continue its upward momentum as the stochastic indicator is set to climb out from the oversold area while the stock price has crossed back above the lower Bollinger Band.

• Thus, we believe that the share price will rise further to challenge our resistance levels of RM2.92 (R1; 10% upside potential) and RM3.05 (R2; 15% upside potential).

• Our stop loss level is pegged at RM2.40 (representing a 10% downside risk).

• Fundamentally speaking, INARI is involved in the electronics manufacturing services (EMS) industry, providing Outsourced Semiconductor Assembly and Test (OSAT) niche services in Radio Frequency (RF) System in Package (SiP) for smart mobile devices, fiber-optic transceivers and other electronics manufacturing services.

• Earnings-wise, the group reported a net profit of RM85.9m in 4QFY22 compared with a net profit of RM85.4m in 4QFY21. This took 12MFY22 bottomline to RM388.5m (versus RM324.3m previously).

• Based on consensus forecasts, INARI’s net earnings are projected to come in higher at RM439m in FY June 2023 and RM486.2m in FY June 2024, which translate to forward PERs of 22.5x this year and 20.3x next year, respectively.

Source: Kenanga Research - 25 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024