Daily technical highlights – (BIMB, ASTRO)

kiasutrader

Publish date: Tue, 30 Aug 2022, 10:39 AM

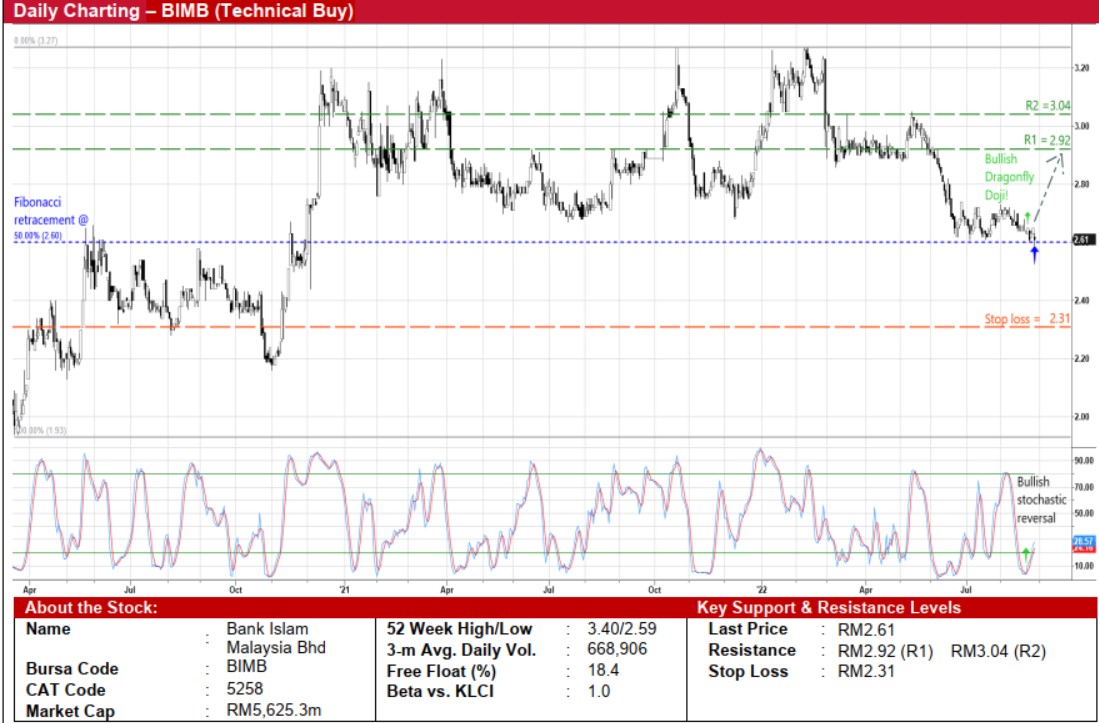

Bank Islam Malaysia Bhd (Technical Buy)

• BIMB shares could be near an intermediate bottom following a correction from a high of RM3.27 in October last year to as low as RM2.59 yesterday before stopping at RM2.61.

• On the chart, further downside risk is expected to be cushioned by the 50% Fibonacci retracement level (at RM2.60) as measured by the share price run-up from RM1.93 in March 2020 to a peak of RM3.27 in October 2021.

• A technical rebound is now anticipated in view of an ongoing reversal from the oversold zone by the stochastic indicator and the recent appearance of a bullish dragonfly doji candlestick.

• Riding on the positive momentum, the stock will probably advance towards our resistance thresholds of RM2.92 (R1; 12% upside potential) and RM3.04 (R2; 16% upside potential).

• We have placed our stop loss price level at RM2.31 (representing an 11% downside risk).

• A full-fledged and pure-play Islamic bank that provides banking and financial solutions in adherence to the Shariah rules and principles, BIMB reported net profit of RM105.9m (-33% YoY) in 1QFY22.

• According to consensus expectations, the group is forecasted to: (i) log net earnings of RM507.9m in FY December 2022 and RM625.5m in FY December 2023, and (ii) pay DPS of 10.6 sen this year and 13.3 sen next year, which imply FY22- FY23 dividend yields of 4.1%-5.1%, respectively.

• In terms of valuation, the stock is presently trading at Price/Book Value multiple of 0.84x (or just under the minus 1SD level from its historical mean) based on book value per share of RM3.09 as of end-March 2022.

Astro Malaysia Holdings Bhd (Technical Buy)

• A price reversal could be on the cards for ASTRO shares after falling from a high of RM1.10 in end-March 2022 to as low as RM0.83 in mid-August.

• The rising momentum will likely gain strength on the back of the existence of bullish divergence signal by the stochastic indicator (which has formed rising bottoms in the oversold area when the share price was drifting lower) and the sighting of dragonfly doji candlesticks while the RSI indicator is in the midst of climbing out from the oversold territory.

• With that said, the stock may be on its way to challenge our resistance targets of RM0.92 (R1; 9% upside potential) and RM0.98 (R2; 16% upside potential).

• Our stop loss price level is set at RM0.77 (or a 9% downside risk from its last traded price of RM0.845).

• ASTRO – which is a leading content and entertainment group serving its customers across the TV, radio, digital and commerce platforms – made net profit of RM100.0m (-29% YoY) in 1QFY23.

• This suggests that the group is on track to meet consensus net earnings projections of RM477.5m for FY January 2023 and RM539.8m for FY January 2024, translating to forward PERs of 9.2x and 8.2x, respectively (with its 1-year forward rolling PER currently hovering marginally below the minus 1SD level from its historical mean).

• The stock also offers attractive prospective dividend yields of 7.8% and 9.0% based on consensus DPS estimates of 6.6 sen for FY23 and 7.6 sen for FY24, respectively.

Source: Kenanga Research - 30 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024