Daily technical highlights – (HSSEB, ECONBHD)

kiasutrader

Publish date: Wed, 14 Sep 2022, 09:15 AM

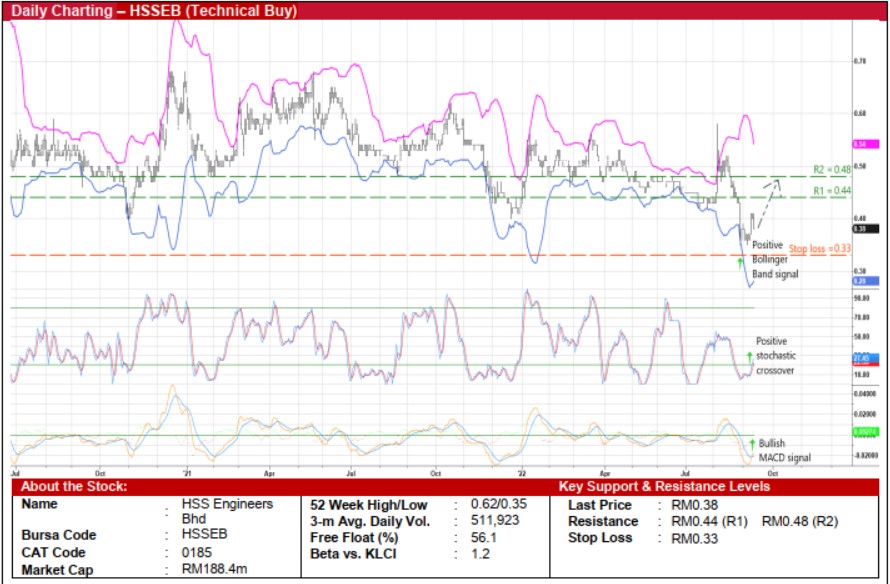

HSS Engineers Bhd (Technical Buy)

• After its sharp plunge from a recent high of RM0.575 early last month to as low as RM0.35 in end-August, HSSEB’s share price has since rebounded slightly to close at RM0.38 yesterday.

• Its upward shift will likely continue backed by bullish technical signals arising from: (i) the price moving back above the lower Bollinger Band, (ii) the stochastic indicator reversing from an oversold position, and (iii) the MACD indicator crossing over the signal line.

• This could then lift the stock towards our resistance thresholds of RM0.44 (R1) and RM0.48 (R2), which represent upside potentials of 16% and 26%, respectively.

• We have pegged our stop loss price level at RM0.33 (translating to a downside risk of 13%).

• An engineering consultancy group specialising in the provision of engineering and project management services, HSSEB is a proxy to the rolling out of infrastructure projects such as the Mass Rapid Transit Line 3 (MRT3) (following the award of a contract worth RM997.9m in early August to provide project management consultancy services over 11 years).

• The group posted net earnings of RM3.9m (+148% YoY) in 2QFY22, taking first half’s bottomline to RM6.4m (+82% YoY).

• According to consensus estimates, HSSEB is forecasted to make net earnings of RM12.3m for FY December 2022 and RM20.9m for FY December 2023. This translates to forward PERs of 15.3x this year and 9.0x next year, respectively (with its 1-year forward rolling PER currently hovering at 2SD below its historical mean).

• In terms of recent corporate news, in mid-August, it has proposed to undertake: (i) a bonus issue of free warrants on the basis of 1 warrant for every 3 existing shares, and (ii) a private placement of up to 20% of the share base at an issue price to be determined later.

Econpile Holdings Bhd (Technical Buy)

• A lift-off from its historical low price of RM0.155 recently may pave the way for ECONBHD shares – which ended at RM0.175 yesterday – to stage a technical rebound ahead.

• On the chart, a continuation of its run-up is anticipated as the share price is on the edge of overcoming the 50-day SMA while the stochastic indicator’s %K line has just crossed above the %D line in the oversold zone.

• Riding on the technical strength, the stock could climb towards our resistance thresholds of RM0.20 (R1; 14% upside potential) and RM0.23 (R2; 31% upside potential).

• Our stop loss price level is set at RM0.15 (representing a downside risk of 14%).

• Earnings-wise, ECONBHD – a specialist provider of bored piling and foundation services primarily for high-rise property developments and infrastructure projects – reported a net loss of RM13.3m in 4QFY22 (from a net profit of RM1.1m in 4QFY21), ending FY June 2022 with a net loss of RM40.7m (versus FY21’s net profit of RM11.1m).

• Nonetheless, as the worst is probably over, consensus is projecting the group to turn around with net profit of RM11.8m in FY23 and RM14.4m in FY24.

• This translates to forward PERs of 21.0x and 17.2x, respectively with its 1-year forward rolling PER currently standing at 1.5SD above its historical mean.

Source: Kenanga Research - 14 Sept 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024