Daily technical highlights – (PGF, MYNEWS)

kiasutrader

Publish date: Thu, 29 Sep 2022, 09:30 AM

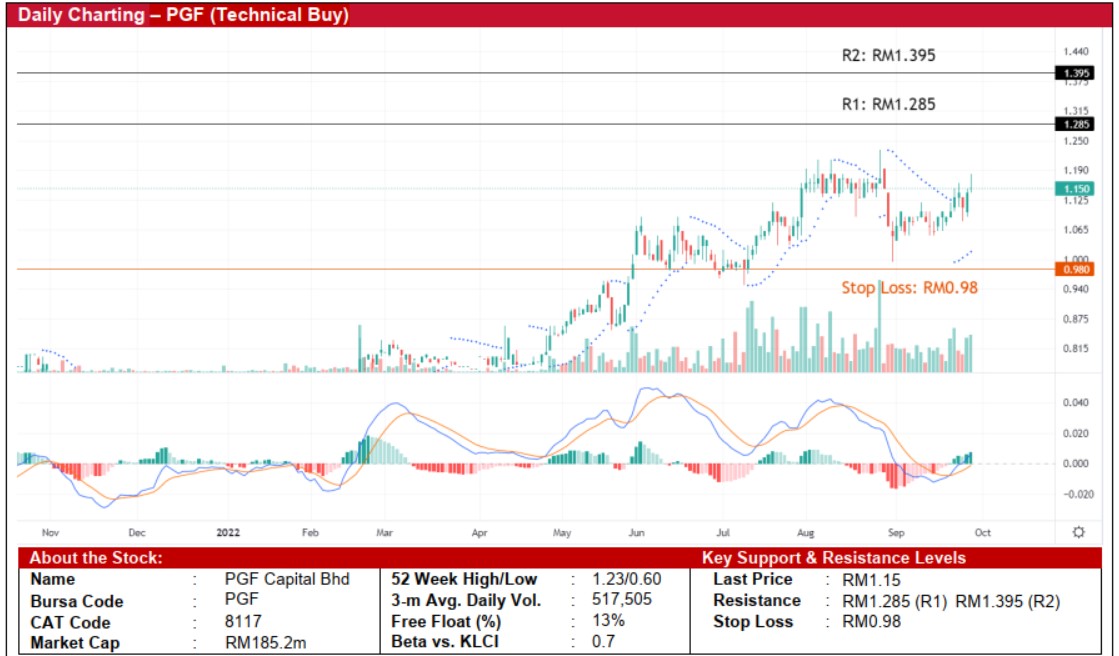

PGF Capital Bhd (Technical Buy)

• PGF’s share price pulled back from its peak of RM1.23 reached in Aug 2022 before bouncing up with the formation of several bullish candlesticks in recent days to close at RM1.15 yesterday.

• Backed by the MACD line crossing above the zero line and the rising Parabolic SAR indicator, the stock is expected to move higher.

• Thus, the stock could rise to challenge our resistance levels of RM1.285 (R1; 12% upside potential) and RM1.395 (R2; 21% upside potential).

• We have pegged our stop loss price at RM0.98, representing a downside risk of 11%.

• PGF is involved in the manufacture of fiber glass wool and property development.

• Earnings-wise, the group’s net profit improved by 395% QoQ to RM5.0m in 1QFY22 (vs. 4QFY22 of RM1.0m)

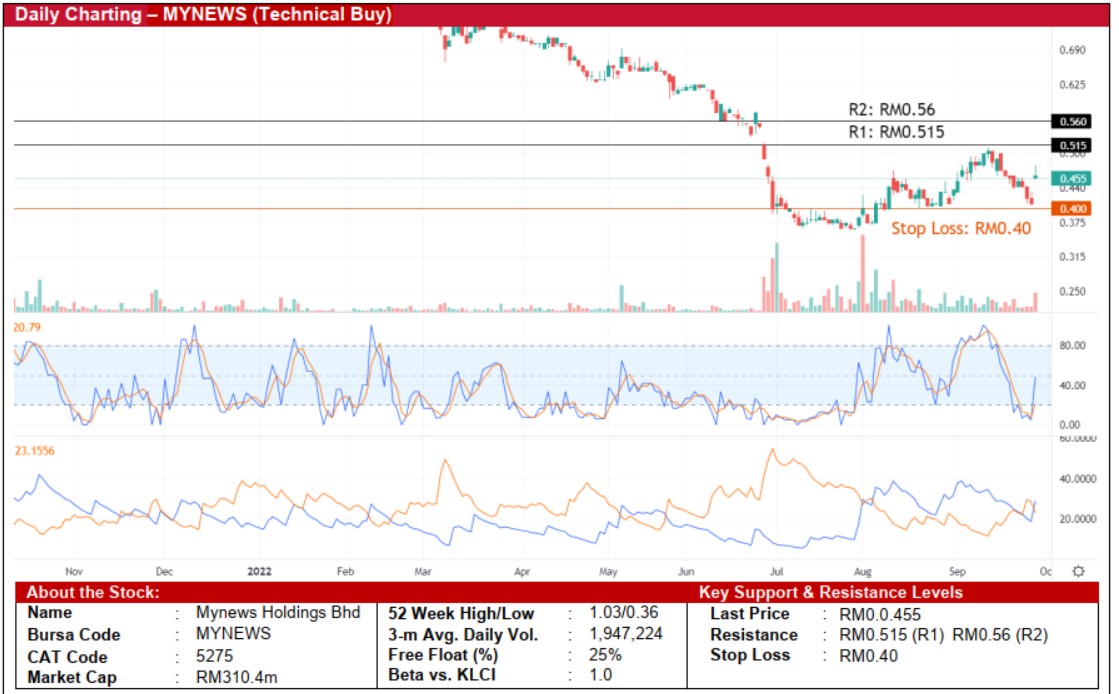

MyNews Holdings Bhd (Technical Buy)

• Chart-wise, MYNEWS’ share price started to climb from a low of RM0.36 in early-Aug 2022 and has broken out from its support level of RM0.405 in Aug and Sept 2022 to close at RM0.455 yesterday.

• With the DMI Plus crossing above DMI Minus and bullish stochastic crossover in the oversold territory, the stock is expected to shift higher ahead.

• Thus, we believe that MYNEWS could climb towards our resistance thresholds of RM0.515 (R1) and RM0.56 (R2), representing upside potentials of 13% and 23%, respectively.

• Our stop loss price is set at RM0.40 (or a downside risk of 12%).

• MYNEWS is involved in convenience retailing business and manufacture of fresh food items.

• Earnings-wise, the group reported a net loss of RM1.5m in 3QFY22 (-90% QoQ), which took 9MFY22 to a net loss of RM19.5m.

Source: Kenanga Research - 29 Sept 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024