Daily technical highlights – (JHM, KPJ)

kiasutrader

Publish date: Tue, 01 Nov 2022, 09:14 AM

JHM Consolidation Bhd (Technical Buy)

• A technical rebound is in sight for JHM’s share price – which jumped as much as 4.7% before closing 1.8% higher at RM0.865 yesterday – following the reversal from a recent trough of RM0.82 two Fridays ago (its lowest point since mid-June 2020).

• The upward shift will likely persist in view of: (i) the bullish divergence RSI and stochastic patterns with both the indicators plotting rising bottoms in an oversold area as the price was drifting lower, and (ii) the appearance of a bullish dragonfly doji candlestick.

• With that said, the stock could climb to reach our resistance thresholds of RM0.97 (R1; 12% upside potential) and RM1.06 (R2; 23% upside potential). We have placed our stop loss price level at RM0.77 (or an 11% downside risk).

• JHM’s business is segregated into 2 key segments: (a) electronics business unit, which is involved in the manufacture and assembly of surface mount technology of automotive rear, interior and front headlamp lighting (for the automotive industry) and motor controller (for the industrial sector), and (b) mechanical business unit, which provides one-stop solutions from fabrication of tooling, design to final assembly and test of LED lighting modules/applications, microelectronic components as well as precision mechanical parts.

• Hence, JHM is a proxy to global car sales (via its supply of automotive LED lighting modules) and the rolling out of 5G technology (which requires various electronic components).

• The group posted net profit of RM9.8m (+5% YoY) in 2QFY22, bringing 1HFY22 bottomline to RM19.4m (+6% YoY).

• Going forward, consensus is forecasting JHM would make net earnings of RM35.2m in FY December 2022 and RM46.8m in FY December 2023. This translates to forward PERs of 13.7x and 10.3x, respectively with its 1-year rolling forward PER currently hovering at 1.5 SD below its historical mean.

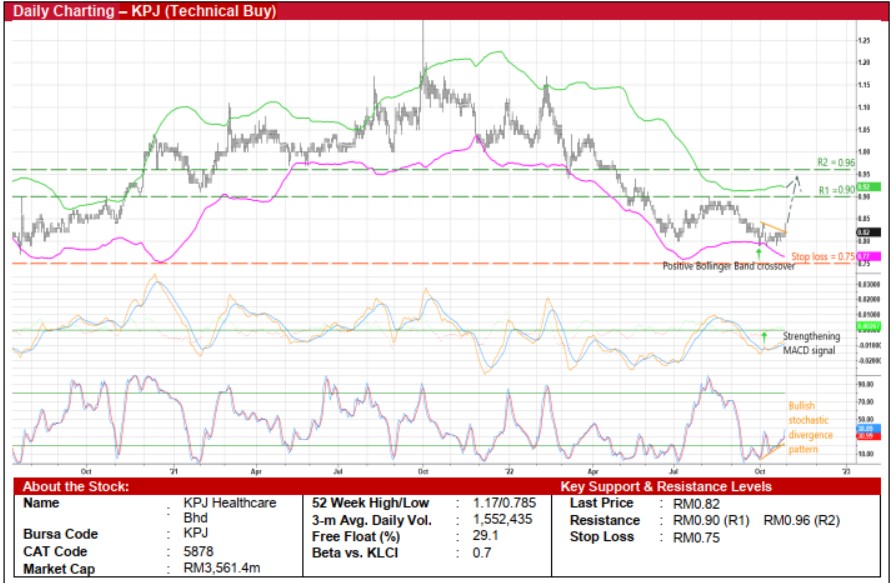

KPJ Healthcare Bhd (Technical Buy)

• After lifting off from a recent low of RM0.785 in end-September – a support level previously tested in early July this year that was followed by an ensuing rebound – KPJ shares may be on the way to shift higher ahead.

• The positive bias stance is backed by the bullish technical signals triggered by: (a) the price crossing back above the lower Bollinger Band, (ii) the MACD cutting over the signal line, and (iii) the existence of a bullish stochastic divergence pattern.

• As the price momentum gathers strength, the stock could advance towards our resistance thresholds of RM0.90 (R1; 10% upside potential) and RM0.96 (R2; 17% upside potential).

• Our stop loss price level is set at RM0.75 (representing a 9% downside risk from yesterday’s close of RM0.82).

• Earnings-wise, KPJ – a healthcare services provider managing a network of specialist hospitals – reported net profit of RM27.1m (+289% YoY) in 2QFY22, bringing YTD bottomline to RM49.3m (+147% YoY) in 1HFY22.

• According to consensus expectations, the group is projected to log net earnings of RM113.0m in FY December 2022 and RM153.4m in FY December 2023.

• In terms of valuation, based on consensus estimates, the stock is currently trading at forward PER multiples of 31.5x for FY22 and 23.2x for FY23 with its 1-year rolling forward PER currently hovering just slightly above its historical mean.

Source: Kenanga Research - 1 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

KPJ2024-11-22

KPJ2024-11-22

KPJ2024-11-21

KPJ2024-11-21

KPJ2024-11-20

KPJ2024-11-20

KPJ2024-11-20

KPJ2024-11-19

KPJ2024-11-19

KPJ2024-11-19

KPJ2024-11-18

KPJ2024-11-18

KPJ2024-11-15

KPJ2024-11-15

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-13

KPJ2024-11-13

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-12

KPJMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024