Daily technical highlights – (D&O, OPCOM)

kiasutrader

Publish date: Tue, 15 Nov 2022, 08:52 AM

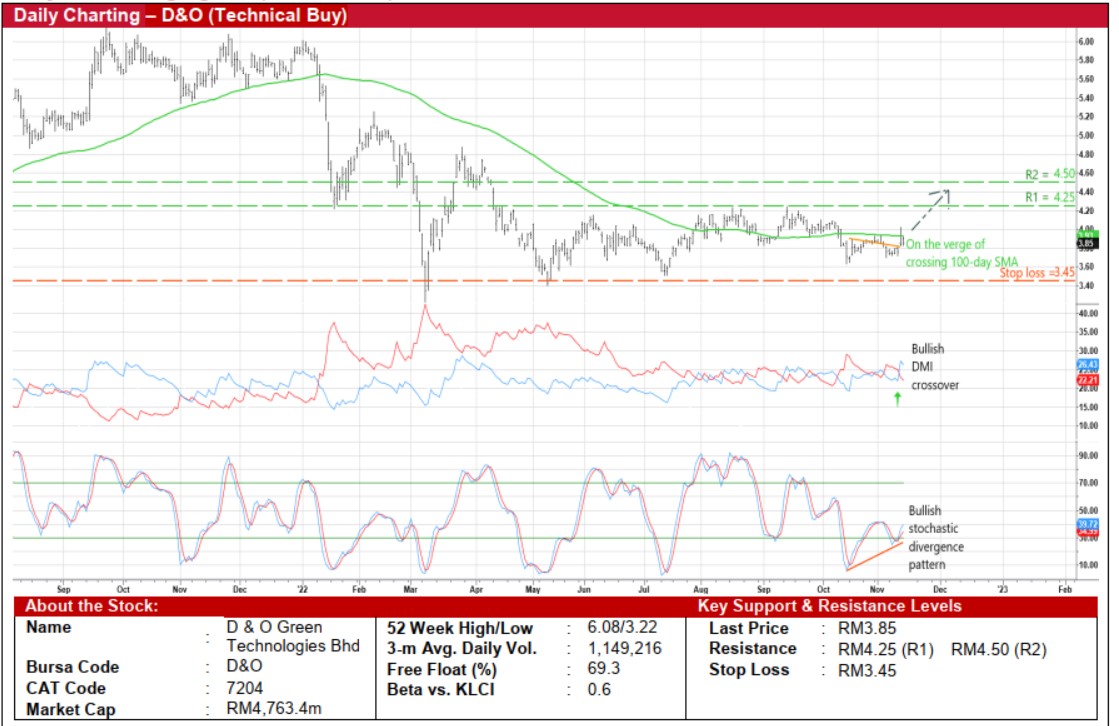

D & O Green Technologies Bhd (Technical Buy)

• D&O’s share price – after jumping as high as RM4.02 last Friday on higher-than-usual transaction volume – may be on its way to attempt a breakout from a sideways trading formation that has emerged since mid-April this year.

• An upward shift in the price is probable in view of the positive crossover by the DMI Plus above the DMI Minus and the existence of a bullish stochastic divergence pattern (following the plotting of rising bottoms in the oversold area by the stochastic indicator as the stock was drifting lower).

• This, in turn, could lift the share price to challenge our immediate resistance threshold of RM4.25 (R1; 10% upside potential). Should a technical breakout occur (by overcoming the 100-day SMA), the stock will probably climb towards our next resistance hurdle of RM4.50 (R2; 17% upside potential).

• Our stop loss price level is set at RM3.45 (or a 10% downside risk from yesterday’s close of RM3.85).

• A niche player in the global automotive LED industry via its one-stop smart-solution LED supply chain platform for automotive customers, D&O reported net profit of RM15.3m (-43% YoY) in 2QFY22, which brought 1HFY22 bottomline to RM45.8m (- 14% YoY). Its underlying performance was weighed mainly by RM19.3m in forex loss arising from unrealised translation loss of its USD denominated loans following the weakening of the Ringgit.

• In terms of earnings outlook, based on consensus estimates, the group is forecasted to make stronger net profit of RM143.2m in FY December 2022 and RM178.8m in FY December 2023.

• This translates to forward PERs of 33.3x this year and 26.6x next year, respectively with its 1-year rolling forward PER presently hovering at 0.5 SD below its historical mean.

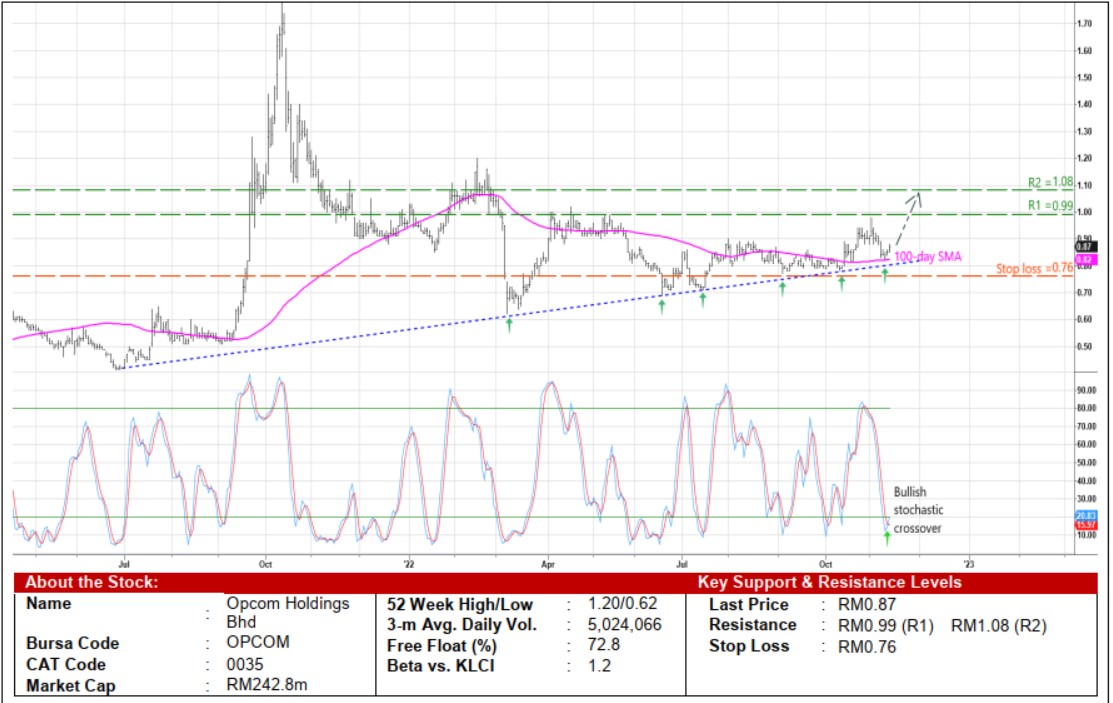

Opcom Holdings Bhd (Technical Buy)

• Following a recent correction from a high of RM0.975 in the beginning of November to as low as RM0.82 last Thursday, OPCOM shares – which surged 2.4% yesterday to close at RM0.87 amid heavy trading interest – might have hit an intermediate bottom already.

• On the chart, a resumption of the upward trajectory may be underway after the share price recently bounced off from an ascending trendline and the 100-day SMA while the stochastic indicator has plotted a bullish crossover in the oversold zone.

• Riding on the strengthening momentum, the stock is expected to advance towards our resistance thresholds of RM0.99 (R1; 14% upside potential) and RM1.08 (R2; 24% upside potential).

• We have set our stop loss price level at RM0.76 (representing a 13% downside risk).

• A manufacturer of fibre optic cables and cable-related products that are sold mainly to telecommunications network operators and electrical utility providers, OPCOM is a proxy to increased demand for fibre optic cables amid the ongoing implementation of JENDELA (the country’s national digital infrastructure plan to provide greater digital connectivity) and the 5G network rollouts.

• Earnings-wise, the group’s bottomline came in at RM3.9m (+53% YoY) in FY March 2022 that was followed with a quarterly net profit of RM1.5m (-44% YoY) in 1QFY23.

• Financially steady, OPCOM has a debt-free balance sheet that is backed by cash holdings of RM92.8m (translating to 33.3 sen per share or more than one-third of its existing share price) as of end-June 2022.

• Based on a book value per share of RM0.58 as of end-June 2022, the stock is presently trading at Price/Book Value multiple of 1.5x (or at 0.5 SD above its historical mean).

• In terms of recent corporate development, OPCOM has announced in September this year its plans to acquire a 100% stake in T&J Engineering (TJE) for RM90.0m. The acquisition of TJE will enable OPCOM to diversify into the provision of telecommunication network infrastructure solutions particularly in Sarawak.

Source: Kenanga Research - 15 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024