Daily technical highlights – (HSPLANT, AXIATA)

kiasutrader

Publish date: Wed, 23 Nov 2022, 10:06 AM

Hap Seng Plantations Holdings Bhd (Technical Buy)

• After retracing from a high of RM3.50 in late April this year to as low as RM1.92 in end-September that was followed by a subsequent rebound, HSPLANT’s share price has treaded sideways since then.

• An upward shift may be on the horizon following the emergence of a bullish RSI divergence pattern (as the RSI indicator has been rising when the price was drifting listlessly) with both the Parabolic SAR and MACD indicators showing positive momentum.

• A technical breakout from the consolidation mode could then push the stock towards our resistance thresholds of RM2.24 (R1; 11% upside potential) and RM2.45 (R2; 21% upside potential).

• We have pegged our stop loss price level at RM1.81 (which represents a 10% downside risk from yesterday’s close of RM2.02).

• In the oil palm plantation business, HSPLANT reported net profit of RM66.9m (+41% YoY) in 2QFY22, bringing 1HFY22 bottomline to RM168.6m (+120% YoY) as its overall performance was lifted by higher average selling prices for oil palm products.

• Going forward, consensus is forecasting the group to make net earnings of RM245.0m in FY December 2022 and RM156.5m in FY December 2023, translating to forward PERs of 6.6x this year and 10.3x next year, respectively (with its 1-year rolling forward PER currently hovering at marginally below the minus 1SD line from its historical mean).

• Moreover, based on consensus DPS projections of 18.8 sen in FY22 and 12.9 sen in FY23, the stock offers dividend yields of 9.3% and 6.4%, respectively.

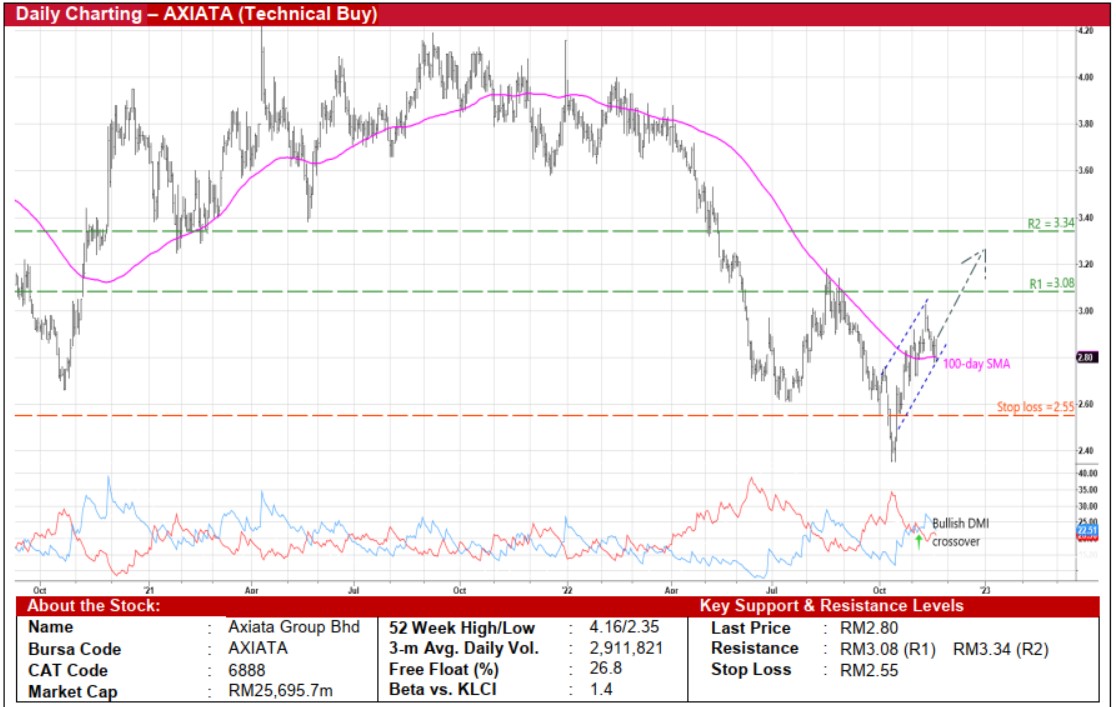

Axiata Group Bhd (Technical Buy)

• AXIATA’s share price is still on an upward trajectory despite encountering a pullback from its recent high of RM3.03 on 11 November to close at RM2.80 yesterday.

• On the chart, following its earlier reversal from a trough of RM2.35 in mid-October that saw the subsequent formation of an ascending price channel, the stock will likely resume its climb after bouncing up from the 100-day SMA as the DMI Plus crossed above the DMI Minus.

• With that said, the share price could advance towards our resistance thresholds of RM3.08 (R1) and RM3.34 (R2), which offer upside potentials of 10% and 19%, respectively.

• Our stop loss price level is set at RM2.55 (or a 9% downside risk).

• A diversified telecommunications and digital conglomerate focusing on digital telcos, digital businesses and infrastructure in ASEAN and South Asia, AXIATA reported net loss of RM106.4m in 2QFY22 (versus net profit of RM277.8m), taking 1HFY22 bottomline to RM149.4m (from 1HFY21’s net profit of 353.3m) as its underlying performance was hit mainly by significant foreign exchange losses (amounting to RM788.1m) arising from its mobile operations in Sri Lanka.

• According to consensus expectations, the group is projected to make net earnings of RM1.26b for FY December 2022 and RM1.48b for FY December 2023, which translate to forward PERs of 20.4x this year and 17.4x next year, respectively (with its 1-year rolling forward PER presently hovering at almost 2SD below its historical mean).

• Meanwhile, the stock is offering dividend yields of 3.7% and 4.5% based on consensus DPS estimates of 10.3 sen in FY22 and 12.5 sen in FY23, respectively.

• In terms of recent corporate development, its shareholders have just approved the proposed merger of the telecommunication operations of Celcom Axiata and Digi.com.

Source: Kenanga Research - 23 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024