Daily technical highlights – (AGMO, RESINTC)

kiasutrader

Publish date: Thu, 26 Jan 2023, 09:53 AM

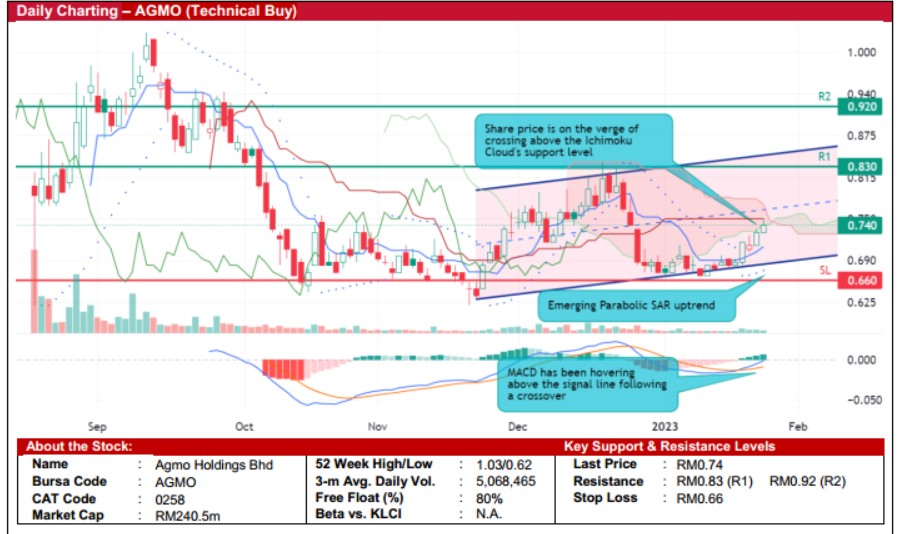

Agmo Holdings Bhd (Technical Buy)

• Following a steep fall from the peak of RM0.82 in mid-December 2022 to as low as RM0.665 on 3 January 2023, we believethat AGMO’s share price is set to climb higher after bouncing off from an ascending trendline to close at RM0.74 yesterday.

• Technically speaking, an extension of the upward bias could be on the horizon as the stock price is on the verge of crossingabove the Ichimoku Cloud’s support level amid the emerging Parabolic SAR uptrend and strengthening MACD signal.

• With that said, the stock could advance towards our resistance targets of RM0.83 (R1; 12% upside potential) and RM0.92(R2; 24% upside potential).

• Our stop loss level is pegged at RM0.66, representing a downside risk of 11%.

• A digital solutions and application development specialist focussing on the development of mobile and web applications aswell as provision of digital platform-based services, AGMO reported a net profit of RM2.2m (+5% QoQ) in 2QFY23 whichthen lifted its 1HFY23 earnings to RM4.3m (there is no comparable YoY result as the company was only listed in August lastyear at an IPO offer price of RM0.26 per share).

• Valuation-wise, the stock is currently trading at a Price/Book Value multiple of 5.7x based on its book value per share ofRM0.13 as of end-September 2022.

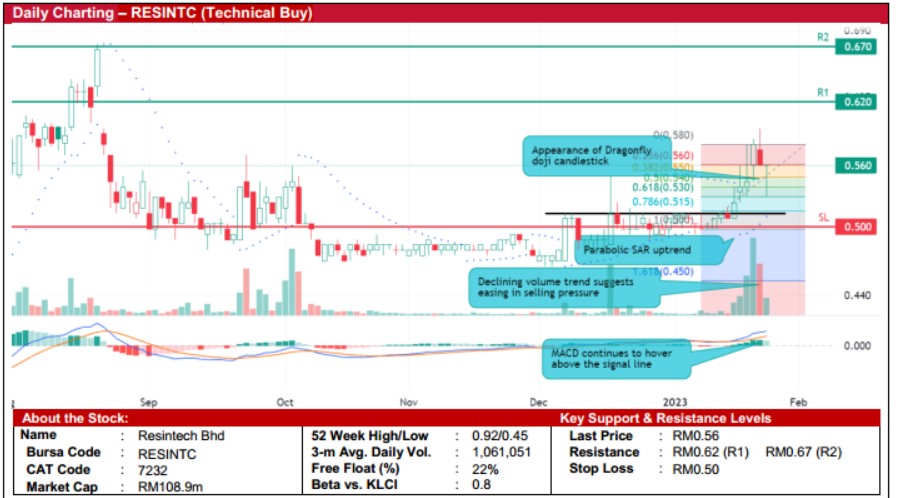

Resintech Bhd (Technical Buy)

• Following a breakout from the immediate resistance line on 16 January 2023, RESINTC’s share price has since pulled back(amid a declining trading volume) from a high of RM0.595 on 20 January 2023 to the trough of RM0.53 (which coincidedwith the 61.8% Fibonacci retracement level) before bouncing up to close at RM0.56 yesterday.

• Chart-wise, the share price is poised to resume its upward momentum backed by: (i) the appearance of a bullish dragonflydoji candlestick, (ii) the emerging Parabolic SAR uptrend, and (iii) the MACD is still hovering above the signal line.

• Hence, the stock could rise to challenge our resistance thresholds of RM0.62 (R1; 11% upside potential) and RM0.67 (R2;20% upside potential).

• We peg our stop loss level at RM0.50, representing a downside risk of 11%.

• RESINTC – which is primarily involved in the production and distribution of diversified plastic building materials - slippedmarginally into the red when it reported a net loss of RM0.8m in 2QFY23 (from a net profit of RM0.6m in 2QFY22), resultingin a cumulative net loss of RM0.3m in 1HFY23 (compared with a net profit of RM1.5m in 1HFY22).

• Valuation-wise, based on its book value per share of RM0.88 as of end-September 2022, the stock is currently trading at aPrice/Book Value multiple of 0.63x.

Source: Kenanga Research - 26 Jan 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024