Daily technical highlights – (PRLEXUS, IJM)

kiasutrader

Publish date: Wed, 22 Feb 2023, 10:23 AM

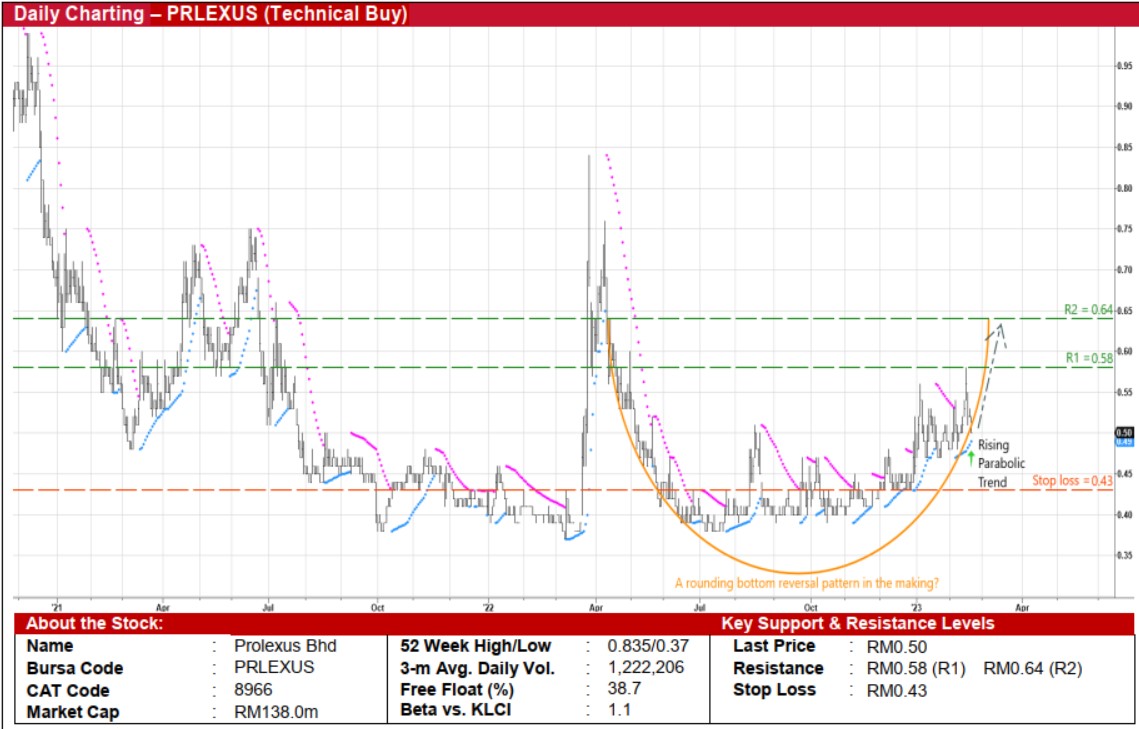

Prolexus Bhd (Technical Buy)

• A trend reversal could be in the making for PRLEXUS’ share price following a tumble from its peak of RM0.835 in end-March last year to as low as RM0.375 in mid-July 2022 before closing at RM0.50 yesterday.

• Technically speaking, the stock is poised to continue its climb amid the emergence of a probable saucer bottom reversal pattern as the Parabolic SAR indicator is signalling a rising trend too.

• Tracking the upward trajectory, the stock price is anticipated to swing higher to challenge our resistance hurdles of RM0.58 (R1; 16% upside potential) and RM0.64 (R2; 28% upside potential).

• We have pegged our stop loss price level at RM0.43 (representing a downside risk of 14%).

• Earnings-wise, after reporting net earnings of RM8.7m (-48% YoY) in FY July 2022, this manufacturer of sportswear apparels (for major international brands) and reusable fabric face masks saw a net profit jump from RM0.5m in 1QFY22 to RM10.5m in 1QFY23 (albeit mainly attributable to gain on foreign currency exchange and other investments).

• Financially steady, the group’s balance sheet is backed by net cash holdings & other investments of RM55.4m (translating to 20.1 sen per share or about 40% of its existing share price) as of end-October 2022.

IJM Corporation Bhd (Technical Buy)

• From a trough of RM1.47 in the second half of November last year, IJM’s share price has since rebounded to chart a sequence of higher lows along the way before settling at RM1.57 yesterday.

• With the stock now approaching the apex of a symmetrical triangle pattern, a price breakout may be forthcoming in view of the bullish crossover by the DMI Plus above the DMI Minus.

• On the chart, an upward shift could then lift the stock price towards our resistance thresholds of RM1.72 (R1) and RM1.84 (R2). This represents upside potentials of 10% and 17%, respectively.

• Our stop loss price level is seen at RM1.43 (or a downside risk of 9%).

• A diversified group with four core businesses (namely construction, property development, quarrying & building materials manufacturing and infrastructure concessions), IJM registered core net profit of RM71m (-6% YoY) in 2QFY23, bringing 1HFY23 bottomline to RM148m (up from net core loss of RM38m previously).

• Going forward, consensus is projecting the group to log net earnings of RM305.4m for FY March 2023 and RM371.6m for FY March 2024.

• Valuation-wise, this translates to forward PERs of 18.1x and 14.8x, respectively with its 1-year rolling forward PER presently trading at 1 SD below its historical mean.

Source: Kenanga Research - 22 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

IJM2024-11-22

IJM2024-11-22

IJM2024-11-21

IJM2024-11-21

IJM2024-11-21

IJM2024-11-20

IJM2024-11-20

IJM2024-11-19

IJM2024-11-18

IJM2024-11-18

IJM2024-11-15

IJM2024-11-15

IJM2024-11-15

IJM2024-11-15

IJM2024-11-14

IJM2024-11-14

IJM2024-11-14

IJM2024-11-13

IJM2024-11-13

IJM2024-11-13

IJM2024-11-13

IJM2024-11-12

IJM2024-11-12

IJM2024-11-12

IJM2024-11-12

IJMMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024