Daily technical highlights – (JHM, SLVEST)

kiasutrader

Publish date: Fri, 03 Mar 2023, 09:17 AM

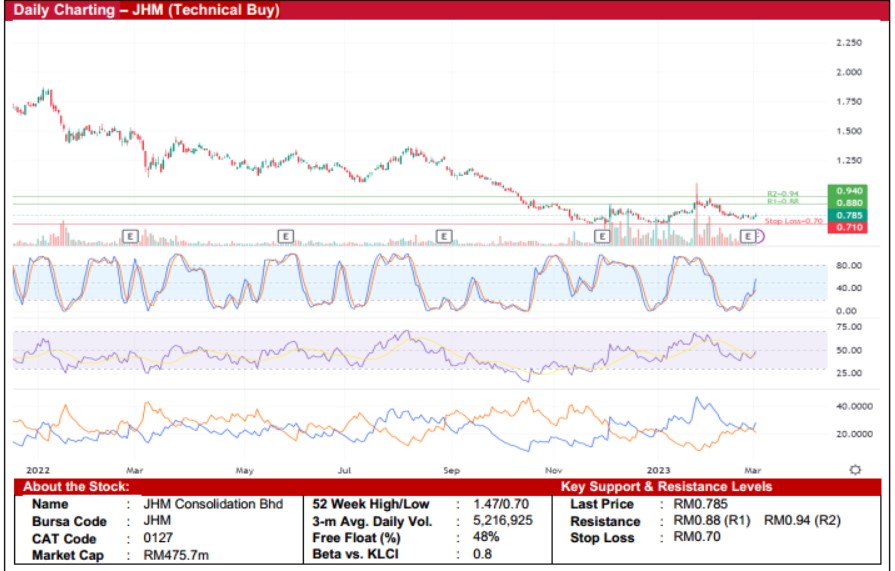

JHM Consolidation Bhd (Technical Buy)

• JHM’s share price has been trending down since February 2021 from a peak of RM2.67 to hit a 52-week low of RM0.70 inNovember 2022 before moving sideways since then.

• From a charting perspective, a technical rebound will likely be forthcoming in view of: (i) both the RSI and Stochasticindicators are in the midst of climbing out from the oversold area, and (ii) the DMI Plus is pulling away from the DMI Minus.

• An upward shift could then propel the stock towards our resistance targets of RM0.88 (R1; 12% upside potential) andRM0.94 (R2; 20% upside potential).

• Conversely, our stop loss price level has been identified at RM0.70 (representing an 11% downside risk).

• Business-wise, JHM is primarily engaged in two key segments: (a) electronics business unit, which is involved in themanufacture and assembly of surface mount technology of automotive rear, interior and front headlamp lighting (for theautomotive industry) and motor controller (for the industrial sector), and (b) mechanical business unit, which provides onestop solutions from fabrication of tooling, design to assembly and test of LED lighting applications, microelectroniccomponents as well as precision mechanical parts.

• The group reported a net profit of RM2.2m in 4QFY22 compared with a net profit of RM12.8m in 4QFY21 (mainly draggedby an additional tax assessment of RM4.9m coupled with a penalty of RM0.7m). This took FY22 bottomline to RM22.6m(versus net profit of RM34.4m previously).

• Based on consensus forecasts, JHM’s net earnings are projected to increase to RM36.1m in FY December 2023 andRM44.3m in FY December 2024, which translate to forward PERs of 13.2x this year and 10.7x next year, respectively.

Solarvest Holdings Bhd (Technical Buy)

• The share price of SLVEST has slid from a peak of RM2.00 in February 2021 to as low as RM0.595 in March 2022 beforemaking a rebound since then to close at RM0.92 yesterday.

• On the chart, the share price is expected to resume its upward momentum backed by an anticipated reversal by: (i) both theRSI and Stochastic indicators from the oversold area, and (ii) the stock price from the lower Keltner Channel.

• Hence, we expect the stock to rise and test our resistance thresholds of RM1.02 (R1; 11% upside potential) and RM1.08 (R2;17% upside potential).

• Our stop loss level is pegged at RM0.82 (representing an 11% downside risk).

• Fundamentally speaking, SLVEST is the leading solar turnkey engineering, procurement, construction and commissioning(EPCC) provider in Malaysia, having installed a cumulative capacity of over 400MWp of solar photovoltaic systems.

• Earnings-wise, the group reported a net profit of RM5.2m in 3QFY23, reversing from a net loss of RM2.0m in 3QFY22 drivenby the recognition of progress billings for the LSS4 projects. This took 9MFY22 bottomline to RM14.5m (versus net loss ofRM3.2m previously).

• Based on consensus forecasts, SLVEST’s net earnings are projected to come in at RM21.1m in FY March 2023 andRM29.3m in FY March 2024, which translate to forward PERs of 29.1x this year and 21.0x next year, respectively.

Source: Kenanga Research - 3 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024