Daily technical highlights – (UEMS, PLS)

kiasutrader

Publish date: Tue, 28 Mar 2023, 09:13 AM

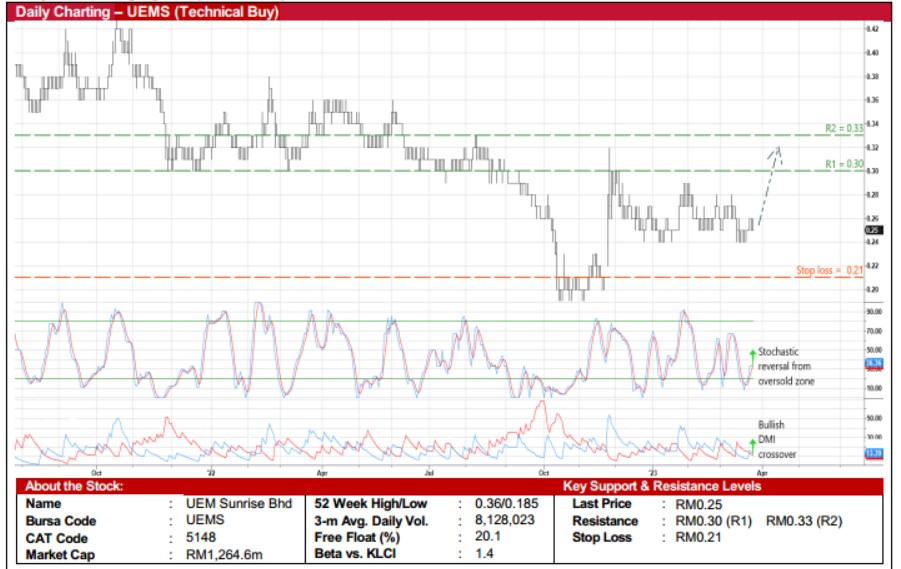

UEM Sunrise Bhd (Technical Buy)

• After oscillating inside a price range of between RM0.235 and RM0.275 since early February this year, UEMS shares – which closed at RM0.25 yesterday – may attempt to break out from the sideways pattern ahead.

• On the back of positive crossovers by: (i) the stochastic indicator’s %K line above the %D line in the oversold territory, and (ii)the DMI Plus overcoming the DMI Minus, an upward shift in the share price is now anticipated.

• With that said, the stock could climb towards our resistance thresholds of RM0.30 (R1; 20% upside potential) and RM0.33(R2; 32% upside potential).

• Our stop loss price level is pegged at RM0.21 (translating to a downside risk of 16%).

• Fundamental-wise, UEMS – which is involved in the property development business – made net profit of RM20.5m in4QFY22 (versus 4QFY21’s net loss of RM151.0m), taking full-year bottom line to RM80.5m (a turnaround from FY21’s net loss of RM213.0m).

• According to consensus expectations, the group is projected to post net earnings of RM84.7m for FY December 2023 and RM97.5m for FY December 2024.

• In terms of valuation, UEMS is presently trading at a Price / Book Value multiple of 0.19x (or at approximately 1.5 SD below its historical mean) based on its book value per share of RM1.34 as of end-December 2022.

• On the news front, over the weekend, a business weekly reported that UEMS has put a portfolio of assets located in Kuala Lumpur – comprising hospitality, retail, parking bays and district cooling systems – up for sale at an indicative selling price of as much as RM1b.

PLS Plantations Bhd (Technical Buy)

• Following its retracement from a recent high of RM1.18 in early February this year to close at RM0.935 yesterday, PLS’ share price could stage a technical rebound ahead.

• On the chart, the shares will probably bounce off from an ascending trendline and the 100-day SMA while the stochastic indicator is in the midst of climbing out from the oversold territory.

• Riding on the strengthening momentum, the stock is expected to advance towards our resistance targets of RM1.05 (R1) and RM1.12 (R2), offering upside potentials of 12% and 20%, respectively.

• We have placed our stop loss price level at RM0.83 (representing a downside risk of 11%).

• Business-wise, PLS is involved in the management and operation of forest, oil palm and durian plantations, as well as the processing, distribution and sale of durian products.

• The group made net profit of RM1.6m (-78% YoY) in 2QFY23, which brought 1HFY23 bottomline to RM3.6m (-76% YoY).

• Based on its book value per share of RM0.69 as of end-December 2022, the stock is currently trading at a Price / Book Value multiple of 1.36x (or at 0.5 SD below its historical mean).

• In terms of corporate development, early this month, PLS has entered into a joint venture cum shareholders’ agreement withMYFARM (a Kyoto-based Japanese integrated agriculture company) to launch a 1,000-hectare of durian, agriculture and aquaculture cultivation project in Pahang, which would see MYFARM investing RM210m into the joint venture company.

Source: Kenanga Research - 28 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024