Daily technical highlights – (RL, SAMCHEM)

kiasutrader

Publish date: Wed, 05 Apr 2023, 09:27 AM

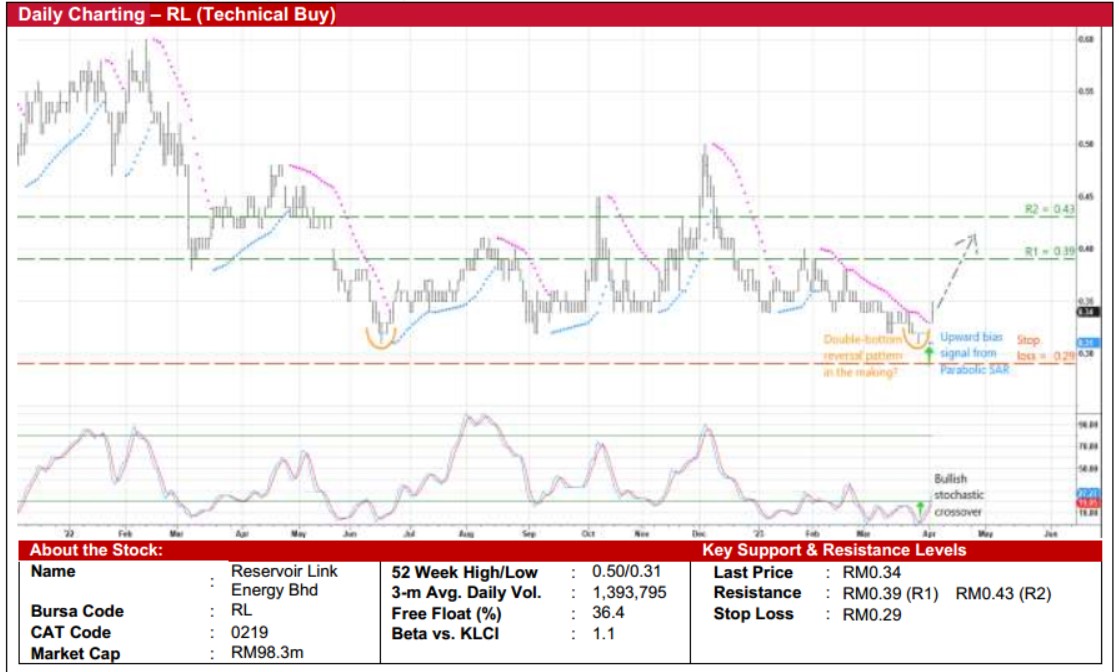

Reservoir Link Energy Bhd (Technical Buy)

• A double-bottom reversal pattern could be underway for RL’s share price following a gap-up from its low of RM0.31 in late March this year, which coincided with the previous trough in mid-June 2022 that had preceded a rally in the subsequent 5½ months.

• From a charting standpoint, the upward trajectory is expected to persist as the Parabolic SAR is signalling a rising trend while the stochastic indicator is in the midst of reversing from the oversold position.

• Riding on the strengthening momentum, the stock – which jumped 4.6% amid heavy trading interest to close at RM0.34 yesterday – could climb towards our resistance targets of RM0.39 (R1; 15% upside potential) and RM0.43 (R2; 26% upside potential).

• We have pegged our stop loss price level at RM0.29 (representing a downside risk of 15%).

• Business-wise, RL is a provider of well services for oil & gas operators, supporting the upstream segments of the industry via its range of services for well leak repair, perforation, well testing, wash & cement, wireline services production enhancement and the supply of oilfield products, equipment & technical personnel.

• The group reported net profit of RM3.4m (+286% YoY) in 4QFY22, narrowing FY December 2022’s net loss to RM2.6m (from a net profit of RM10.8m previously). Based on its book value per share of RM0.28 as of end-December 2022, the stock is presently trading at Price / Book Value multiple of 1.21x (or at slightly below the minus 1SD level from its historical mean).

• In terms of corporate development, in early March 2023, RL has proposed to undertake: (i) a diversification of the existing business activities to include the provision of wastewater treatment services as well as the engineering, procurement, construction and commissioning of wastewater treatment plant and related infrastructure, and (ii) a private placement exercise of up to 86.7m new shares (representing not more than 30% of its existing share base) to third-party investors to be identified later.

Samchem Holdings Bhd (Technical Buy)

• Following its retracement from a high of RM0.745 end-January 2023 to as low as RM0.555 in mid-March, SAMCHEM’s share price (which closed at RM0.58 yesterday) might have found an intermediate support after bouncing off from the descending trendline that stretches back to mid-July last year.

• An extended price run-up is currently anticipated based on the positive technical signals triggered by: (i) the MACD crossing over its signal line, (ii) the rising RSI indicator from the oversold zone, and (iii) the appearance of a bullish dragonfly doji candlestick.

• On the way up, the stock could challenge our resistance hurdles of RM0.66 (R1; 14% upside potential) and RM0.72 (R2; 24% upside potential).

• Our stop loss price level is set at RM0.52 (or a downside risk of 10%).

• SAMCHEM is a leading regional industrial chemicals and lubricants distributor, supplying approximately 500 different petrochemicals and services to more than 7,000 clients from industries such as automotive, paints & inks, oil & gas and agriculture across the region (mainly in Malaysia, Indonesia, Vietnam and Singapore).

• The group made net loss of RM2.1m in 4QFY22 (versus 4QFY21’s net profit of RM23.9m), taking FY December 2022’s bottomline to RM42.2m (-44% YoY).

• Valuation-wise, the stock is presently trading at Price / Book Value multiple of 1.18x (which is at 1.5SD below its historical mean) based on its book value per share of RM0.49 as of end-December 2022.

Source: Kenanga Research - 5 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024