Daily technical highlights – (CJCEN, CTOS)

kiasutrader

Publish date: Wed, 12 Apr 2023, 09:20 AM

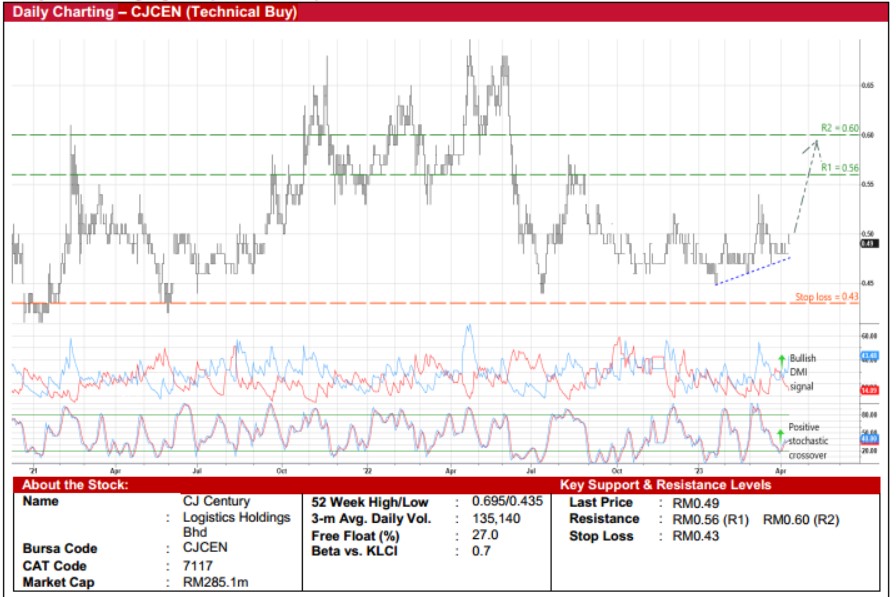

CJ Century Logistics Holdings Bhd (Technical Buy)

• After lifting off from its low of RM0.45 in mid-January this year, tracking an ascending trendline along the way, CJCEN’s share price is poised to extend its rising trajectory ahead.

• An upward shift in the shares – which saw a price gap-up yesterday to close 2.1% higher at RM0.49 – is likely in view of the positive crossovers by: (i) the DMI Plus above the DMI Minus, and (ii) the stochastic indicator which is in the midst of reversing from the oversold territory.

• Riding on the strengthening momentum, the stock could climb towards our resistance thresholds of RM0.56 (R1) and RM0.60(R2), which translate to upside potentials of 14% and 22%, respectively.

• Our stop loss price level is placed at RM0.43 (or a downside risk of 12%).

• A leading total logistics solutions provider offering warehousing and distribution services, CJCEN reported net profit ofRM5.3m (-14% YoY) in 4QFY22, taking FY December 2022’s bottom line to RM28.2m (+49% YoY).

• According to consensus expectations, the group is forecasted to register rising net earnings of RM33.9m in FY23 and RM42.0m in FY24.

• In terms of valuation, the stock is trading at prospective PERs of 8.4x this year and 6.8x next year, respectively with its 1-year rolling forward PER currently hovering slightly above the minus 1SD level from its historical mean.

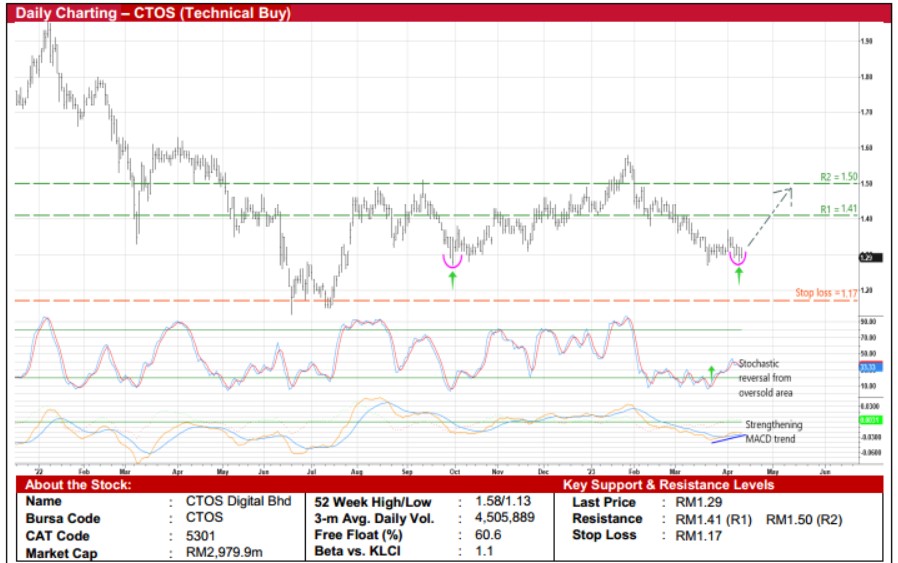

CTOS Digital Bhd (Technical Buy)

• An upward reversal in CTOS’ share price may be underway following a bounce-up from its recent low of RM1.27 on 21 March this year, which coincided with the trough in end-September 2022 (that had preceded a run-up in the subsequent four months).

• On the chart, an ongoing unwinding by the stochastic indicator from the oversold position and the strengthening MACD trend will likely lift the shares to higher levels ahead.

• That being the case, the stock could advance towards our resistance targets of RM1.41 (R1; 9% upside potential) and RM1.50 (R2; 16% upside potential).

• We have set our stop loss price level at RM1.17 (representing a downside risk of 9% from its last traded price of RM1.29).

• Business-wise, CTOS is a provider of credit information and analytics digital services and solutions that are widely used by banking & financial institutions, insurance and telecommunication companies, large corporations, small medium enterprises and consumers for self-check.

• The group logged net profit of RM13.7m (+15% YoY) in 4QFY22, which brought FY December 2022’s bottomline toRM71.4m (+64% YoY).

• Going forward, consensus has forecasted the group would register stronger net earnings of RM104.9m in FY23 and RM122.8m in FY24.

• In terms of valuation, this implies forward PERs of 28.4x this year and 24.3x next year, respectively with its 1-year rolling forward PER currently trading marginally below the minus 1SD level from its historical mean.

Source: Kenanga Research - 12 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

CJCEN2024-11-22

CJCEN2024-11-22

CJCEN2024-11-22

CJCEN2024-11-22

CJCEN2024-11-22

CJCEN2024-11-22

CJCEN2024-11-22

CTOS2024-11-19

CJCEN2024-11-18

CJCEN2024-11-18

CJCEN2024-11-18

CTOS2024-11-15

CTOS2024-11-13

CTOS2024-11-13

CTOS2024-11-13

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOSMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024