Daily technical highlights – (ECONBHD, ABMB)

kiasutrader

Publish date: Tue, 09 May 2023, 09:20 AM

Econpile Holdings Bhd (Technical Buy)

• After bouncing off from a trough of RM0.13 in late October last year – plotting higher lows along the way – ECONBHD shares(which jumped 7.5% amid strong trading interest to close at RM0.215 yesterday) may attract renewed buying interest.

• With the share price finding support at the 100-day SMA and following the bullish crossover by the DMI Plus above the DMIMinus, a continuation of the upward trajectory is anticipated.

• On the chart, the stock could advance to challenge our resistance targets of RM0.25 (R1) initially and RM0.29 (R2)subsequently, offering upside potentials of 16% and 35%, respectively.

• Our stop loss price level is pegged at RM0.18 (representing a downside risk of 16%).

• A specialist provider of bored piling and foundation services primarily for high-rise property developments and infrastructureprojects, ECONBHD logged a narrower net loss of RM1.6m in 2QFY23 (versus net losses of RM5.4m in 2QFY22 andRM4.8m in 1QFY23), bringing 1HFY23’s net loss to RM6.5m (an improvement from 1HFY22’s net loss of RM11.2m).

• And the worst is probably over as consensus is forecasting the group (backed by an order book of RM433.9m as of endDecember 2022) would turn around and register net profit of RM6.7m in FY June 2023 before increasing further to RM15.6min FY24 and RM18.6m in FY25.

• Valuation-wise, this translates to forward FY24-FY25 PERs of 19.5x and 16.4x, respectively with its 1-year rolling forwardPER currently standing around 1 SD above its historical mean.

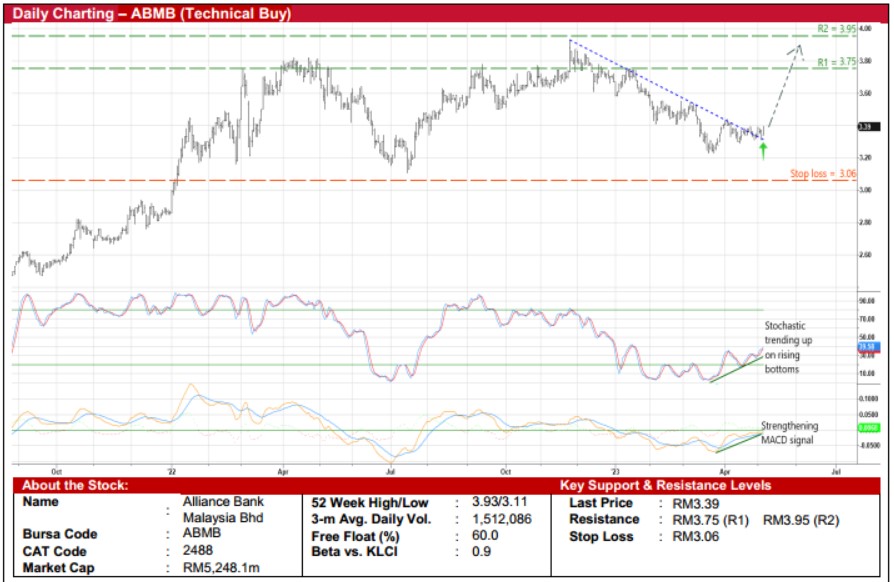

Alliance Bank Malaysia Bhd (Technical Buy)

• Following a retracement of 13.7% from the high of RM3.93 in late November last year to close at RM3.39 yesterday, ABMBshares may stage a technical rebound ahead.

• After overcoming a negative sloping trendline that stretches back to late November 2022, the share price will likely climbfurther as the stochastic indicator is trending up (by plotting rising bottoms in the oversold territory) while the MACD is alsoshowing strengthening signal.

• Riding on the positive momentum, the stock could shift higher towards our resistance thresholds of RM3.75 (R1; 11% upsidepotential) and RM3.95 (R2; 17% upside potential).

• We have placed our stop loss price level at RM3.06 (or a downside risk of 10%).

• A financial group comprising consumer, SME, corporate, commercial and Islamic banking, ABMB reported net profit ofRM177.1m (+17% YoY) in 3QFY23, which lifted 9MFY23’s bottomline to RM547.7m (+17% YoY).

• According to consensus estimates, the group is projected to show rising net earnings trend of RM682.3m for FY March 2023,RM720.8m for FY March 2024 and RM756.5m for FY March 2025.

• Based on its book value per share of RM4.23 as of end-December 2022, ABMB shares are presently trading at Price / BookValue multiple of 0.80x (or at approximately 0.5SD above its historical mean).

Source: Kenanga Research - 9 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024