Kenanga Research & Investment

Actionable Technical Highlights – (COASTAL CONTRACTS BHD)

kiasutrader

Publish date: Thu, 19 Oct 2023, 10:00 AM

COASTAL CONTRACTS BERHAD (Technical Buy)

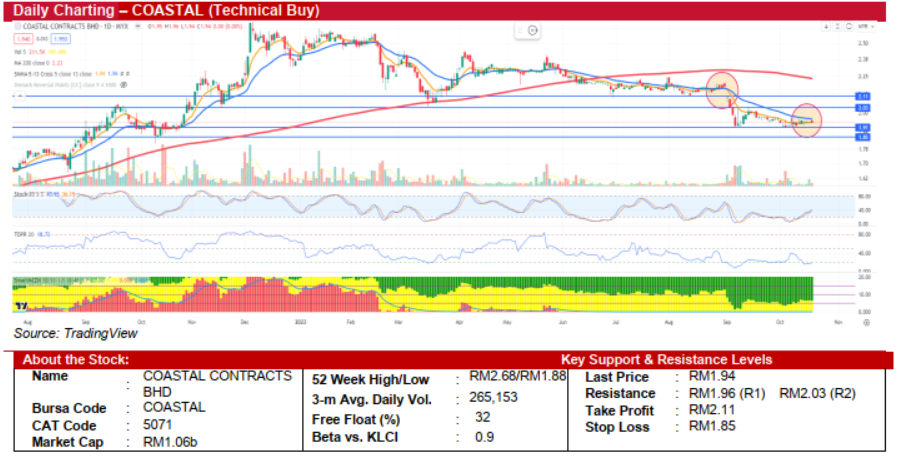

- Following a steep decline in early September, COASTAL has transitioned into a consolidation phase, oscillating between RM1.91 and RM2.03. The stock has established a more robust support level at RM1.91 and has been trading laterally for the past nine days. The short-term 5-day Simple Moving Average (SMA) is almost converging towards its 13-day counterpart, indicating a potential breakout if the stock closes above its 13-day SMA—or at RM1.96—with increased trading volume.

- On the technical side, both the Stochastic Oscillator and the Tom Demark Pressure Ratio (TDRP) are jointly displaying preliminary signs of an upward trajectory, suggesting a potential bullish outlook in the near term.

- A confirmed break above the immediate resistance level of RM1.96 could set the stage for subsequent rallies to RM2.03, RM2.11, and potentially RM2.17. On the contrary, a drop below the immediate support of RM1.91 could prompt the stock to retest its subsequent support level at RM1.85.

- We recommend traders to establish a position at RM1.94, with a take-profit objective set at RM2.11, which translates to an estimated upside potential of 9%. To mitigate downside risk, a stop-loss order at RM1.85 is advised, corresponding to a downside exposure of approximately 4.6%.

Source: Kenanga Research - 19 Oct 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Banking - Sep 2024 Statistics: Modest But Well-Supported (OVERWEIGHT)

Created by kiasutrader | Nov 01, 2024

US Presidential Election 2024 - A pivotal clash between progressivism and protectionism

Created by kiasutrader | Nov 01, 2024

Actionable Technical Highlights - BERJAYA CORPORATION BHD (BJCORP)

Created by kiasutrader | Nov 01, 2024

Kuala Lumpur Kepong - Industrial Property Contribution In Sight

Created by kiasutrader | Nov 01, 2024

Malaysia Money & Credit - M3 and loan growth slowed further in September on high base effect

Created by kiasutrader | Nov 01, 2024

Sunway Construction Group - RM265m VO for Yondr Data Centre Job

Created by kiasutrader | Nov 01, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments