Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Mon, 30 Oct 2023, 10:53 AM

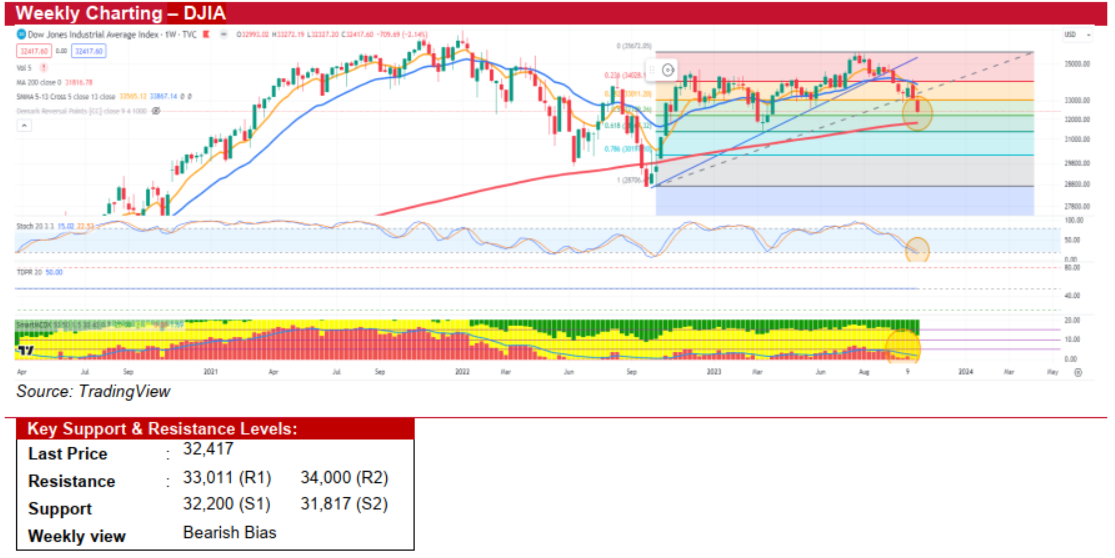

Dow Jones Industrial Average (DJIA) (Bearish Bias)

- Stocks recently entered correction territory, down about 10% from their late-July peak. Mixed tech earnings and rising 10-year Treasury yields were key factors behind the DJIA and S&P 500 hitting a seven/five-month low, respectively. The 'Magnificent Seven' tech giants that drove the previous rally, also contributed to the recent market decline since mid-October.

- This week, we anticipate ongoing high volatility driven by the Federal Reserve meeting on Wednesday, the release of the latest US jobs report on Friday, and Apple’s earnings report on Thursday. These events could significantly influence the direction of both stocks and bonds for the remainder of the year. While most investors believe that the Fed's tightening cycle is over, following Chair Jerome Powell's remarks that rising long-term yields reduce the need for further rate increases, there remains a faction that anticipates the possibility of another hike at the central bank's upcoming December meeting.

- Technically speaking, the DJIA's daily chart has exhibited three consecutive long red candles, commonly known as "Three Black Crows," signalling the potential onset of a bearish trend. The weekly chart has witnessed a second consecutive week of extended declines, with the stochastic indicator yet to reach oversold levels.

- We maintain a bearish outlook and expect another ‘down week’ on the DJIA in light of expected volatility. The index is likely to revisit immediate support levels at 32,200 and its 200-week SMA at 31,817. If these levels are breached, the next crucial support lies at 31,367, aligning with the 61.8% Fibonacci retracement. Conversely, strong earnings from major corporations or positive economic data could propel the index towards resistance levels at 33,011 and the psychological barrier of 34,000.

Source: Kenanga Research - 30 Oct 2023

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments