Kenanga Research & Investment

Actionable Technical Highlights – (MESTRON HOLDINGS BHD)

kiasutrader

Publish date: Wed, 01 Nov 2023, 09:27 AM

MESTRON HOLDINGS BERHAD (Technical Buy)

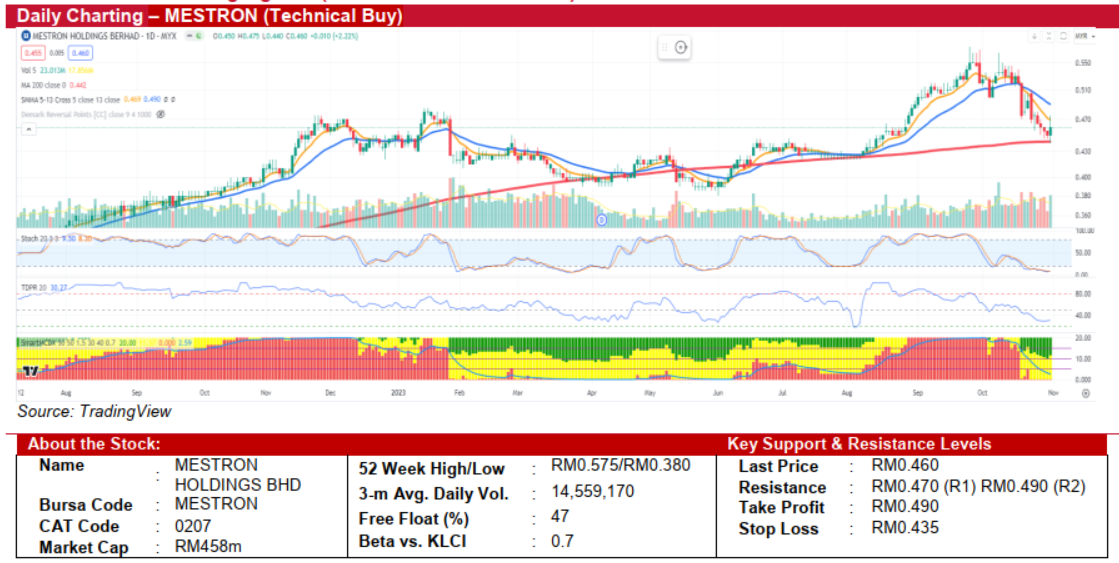

- After achieving an all-time intraday peak of RM0.575 on September 25, MESTRON underwent a 20% corrective decline. At the most recent close at RM0.460, the stock exhibited a 'Bullish Engulfing' candlestick formation on its daily chart, signalling a potential trend reversal. Moreover, the stock successfully tested and remained above its 200-day Simple Moving Average (SMA), further bolstering the case for a bullish turnaround.

- Technically speaking, both the Stochastic Oscillator and the Tom Demark Pressure Ratio (TDRP) have either entered or are nearing oversold conditions. This heightens the probability of an impending trend reversal and should be closely monitored by investors.

- From a price perspective, a consistent close above the 5-day SMA of RM0.470 could serve as a catalyst for a rally towards RM0.490. Conversely, a break below the immediate support level of RM0.440, which aligns with its 200-day SMA, could initiate a new bearish cycle.

- We advise entering a position at the current market price of RM0.460, targeting a take-profit level of RM0.490. This approach yields an estimated upside potential of around 6.5%. To safeguard against downside volatility, we recommend setting a stop-loss at RM0.435, which equates to a potential downside risk of approximately 5.4%.

Source: Kenanga Research - 1 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments