Kenanga Research & Investment

Weekly Technical Highlights – FBM KLCI

kiasutrader

Publish date: Mon, 06 Nov 2023, 09:14 AM

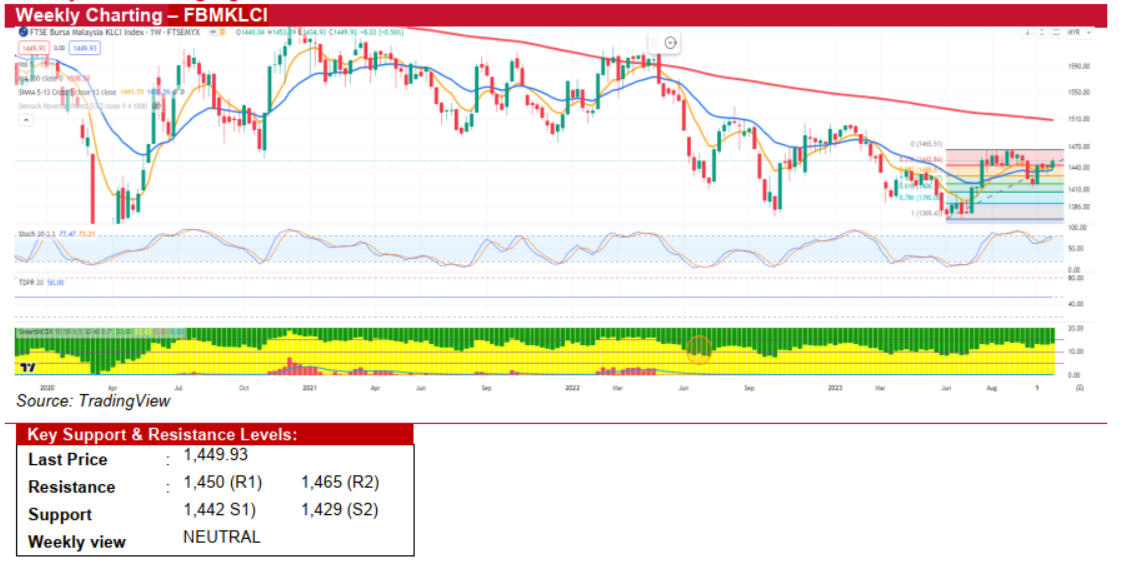

FBM KLCI (NEUTRAL)

- The FBM KLCI advanced by 8.03 points or 0.56% week-on-week, settling at 1,449.93 last Friday. This uptick was influenced by a stronger performance in regional markets, fuelled by strong US performance, thanks to falling Treasury yields, favourable rate decision, and comments from Fed Chief Jerome Powell

- While the FBM KLCI surpassed key resistance at 1,442.8 (aligned with the 23.8% Fibonacci retracement), an expected healthy pullback in the US following last week's strong rally could potentially impact regional market sentiment in the short term. Additionally, the 3.4-point gap created by last Friday's strong opening is likely to close this week.

- From a technical standpoint, the FBM KLCI is anticipated to retest its immediate resistance-turned-support level at 1,442 this week, and oscillating within the 1,436-1,450 range. Investors are likely to closely monitor developments in the ongoing 3QCY23 earnings season.

- A firm break above 1,450 could lead the index to challenge its recent high of 1,465, while a fall below its 13-week SMA at 1,442 may prompt a retest of the next support at 1,429, aligned with the 38.2% Fibonacci retracement.

Source: Kenanga Research - 6 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments