Kenanga Research & Investment

Actionable Technical Highlights – (WELLSPIRE HOLDINGS BHD)

kiasutrader

Publish date: Wed, 08 Nov 2023, 09:45 AM

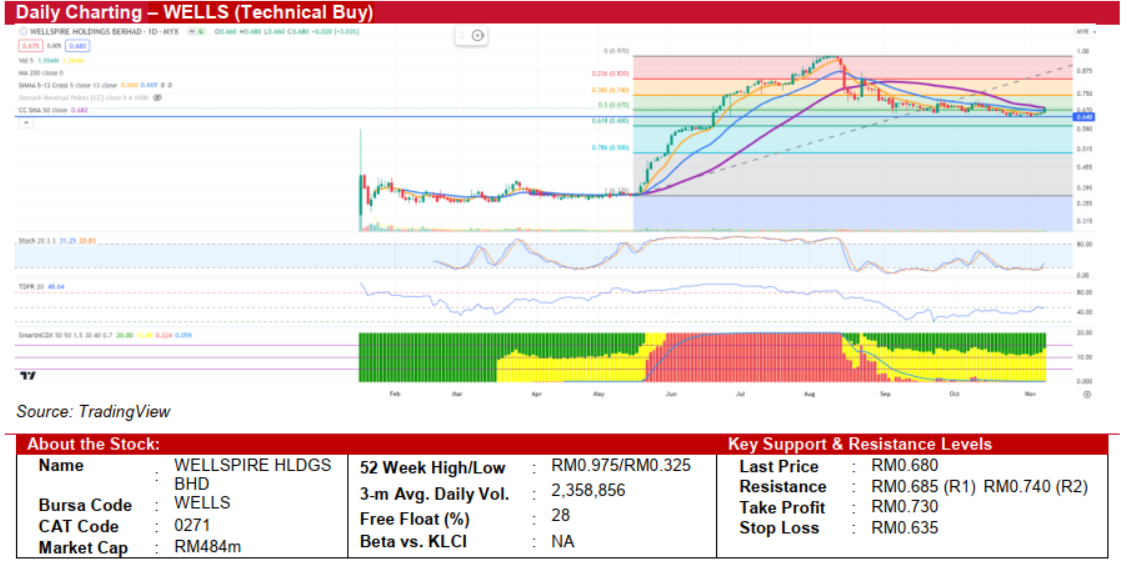

WELLSPIRE HOLDINGS BERHAD (Technical Buy)

- WELLS has been consolidating since early September and closed 3% higher at RM0.680 yesterday. It surpassed both the short-term (3-day) and medium-term (13-day) Simple Moving Averages (SMA), positioning itself just below the long-term (50- day) SMA, suggesting a sturdy foundation for potential bullish prospects.

- From a technical standpoint, the Stochastic Oscillator is showing signs of recovery from oversold territory, while the Tom Demark Pressure Ratio (TDRP) remains stable around the 50 threshold, indicating potential renewed buying interest.

- A clear break above the critical 50-day SMA resistance level at RM0.685 could propel the stock to challenge pivotal resistance levels at RM0.740 and RM0.830. Conversely, a significant drop below the key support of RM0.640 might initiate a downward trend.

- Our suggestion is to consider an entry point around RM0.680, close to the 13-day SMA, with a target take-profit at RM0.730, offering an upside potential of about 7.3%. To manage risk, setting a stop-loss at RM0.635, translating to a potential downside of approximately 6.6% is recommended.

Source: Kenanga Research - 8 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments