Kenanga Research & Investment

Actionable Technical Highlights – (MALAYSIA BUILDING SOCIETY BHD)

kiasutrader

Publish date: Thu, 09 Nov 2023, 09:56 AM

MALAYSIA BUILDING SOCIETY BERHAD (Technical Buy)

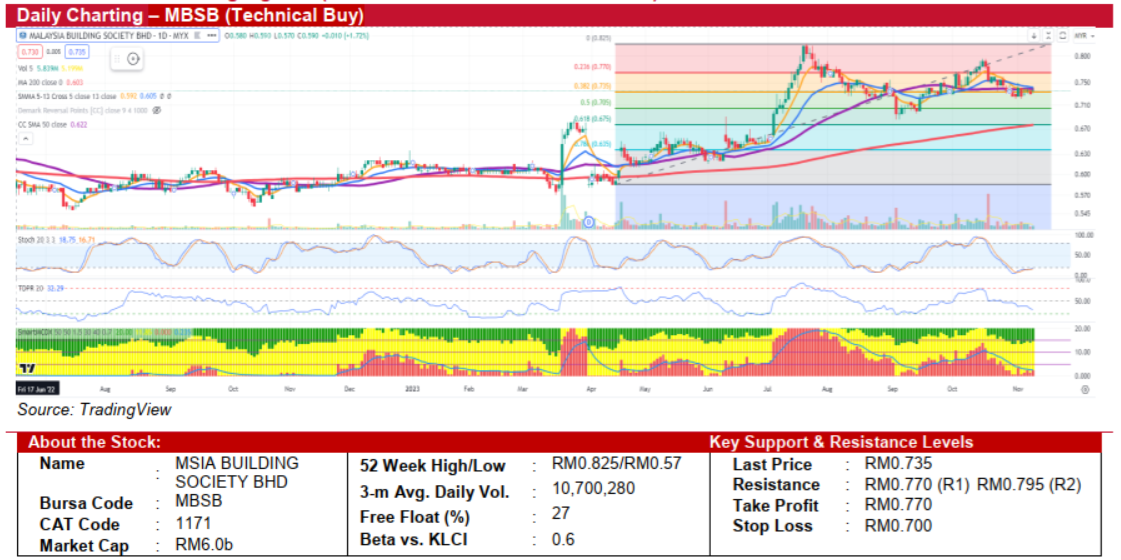

- In consolidation mode since late October, MBSB closed 0.68% higher at RM0.735 yesterday. The closing price formed a 'Doji' chart pattern and is interestingly aligned closely with the short, middle, and long-term (5, 13, 50-day) Simple Moving Average (SMA) lines. Additionally, the closing price coincided with the 38.2% Fibonacci retracement line. These factors suggest the possibility of a significant price movement in the near term.

- From a technical perspective, the Stochastic Oscillator is displaying signs of recovery from oversold conditions, indicating the possibility of renewed buying interest on the horizon. Although the Tom Demark Pressure Ratio (TDRP) has yet to show a full reversal, it has dipped below the 50-threshold, suggesting a potential decrease in selling pressure. These factors collectively suggest increased odds of the stock trending higher.

- A decisive breakthrough above the critical 50-day SMA resistance level at RM0.740 could potentially propel the stock to challenge the pivotal resistance level at RM0.770. Conversely, a significant decline below the key support of RM0.705 might trigger a downward trend.

- Our recommendation is to consider an entry around RM0.735, close to the 50-day SMA, with a target take-profit at RM0.770, offering an upside potential of approximately 5.0%. To manage risk, setting a stop-loss at RM0.700, representing a potential downside of roughly 4.7% is advised.

Source: Kenanga Research - 9 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments