Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Mon, 11 Dec 2023, 09:14 AM

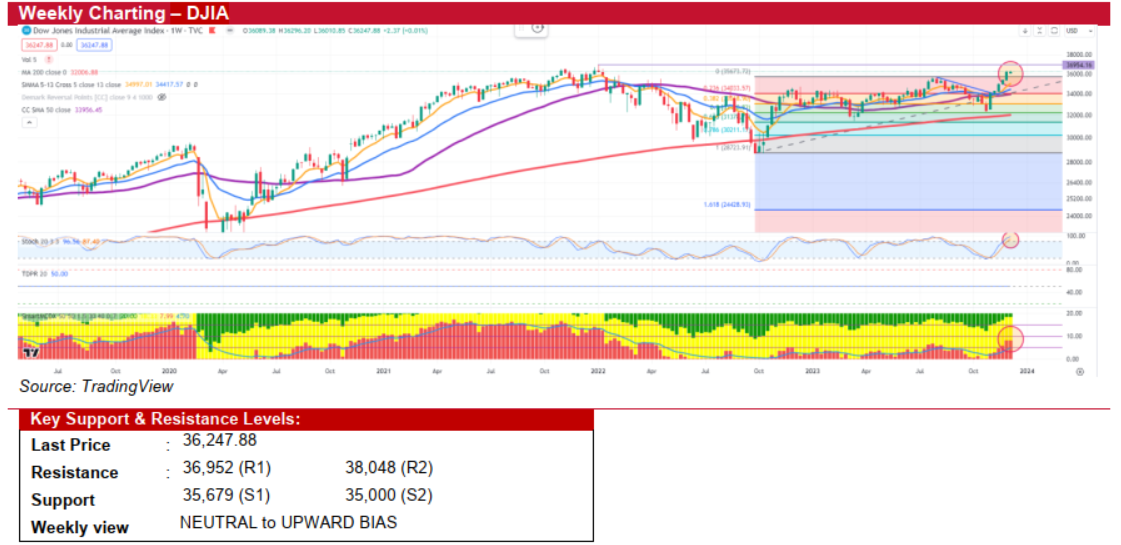

Dow Jones Industrial Average (DJIA) (NEUTRAL to UPWARD BIAS)

- Last week, the DJIA extended its impressive winning streak, the longest since 2019, driven by a stronger-than-expected jobs report and optimism about the US economy avoiding a recession, potentially leading to a rate cut next year. The S&P 500 achieved a new yearly closing high at 4,604.36, up 0.21%, while the DJIA notched a sixth consecutive weekly gain, rising 0.01% WoW to 36,247.88. Additionally, the tech-heavy Nasdaq climbed 0.69% WoW, underlining the overall positive market sentiment.

- In the upcoming weeks, the focus will be on the final Fed’s decision meeting of the year on 14 December and the release of November's inflation data just prior to the rate decision. Market expectations suggest that the Fed will adopt a cautious approach toward future rate hikes, considering economic deceleration. While there's speculation about a potential rate cut by March, Fed Chair Jerome Powell is expected to temper such expectations, emphasizing that any rate hikes will be contingent on preventing a resurgence of inflation.

- From a technical perspective, the DJIA's weekly chart exhibits a consistent upward trend, bolstered by the Stochastic Oscillator and MCDX's banker chip, which are both trending upward. This positive momentum is expected to persist, with the possibility of testing the all-time high at 36,952 before the Federal Reserve meeting. However, it's important to note that any unexpected guidance from Fed Chair Powell regarding economic challenges and the future of monetary policy could trigger a market selloff.

- Key resistance levels are identified at 36,952 and 38,048, while immediate support is noted at the previous high of 35,679, with additional support at 35,000 or the 5-week SMA.

Source: Kenanga Research - 11 Dec 2023

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments