Kenanga Research & Investment

Actionable Technical Highlights – (MALAYSIA AIRPORTS HOLDINGS BHD)

kiasutrader

Publish date: Tue, 12 Dec 2023, 09:47 AM

MALAYSIA AIRPORTS HOLDINGS BHD (Technical Buy)

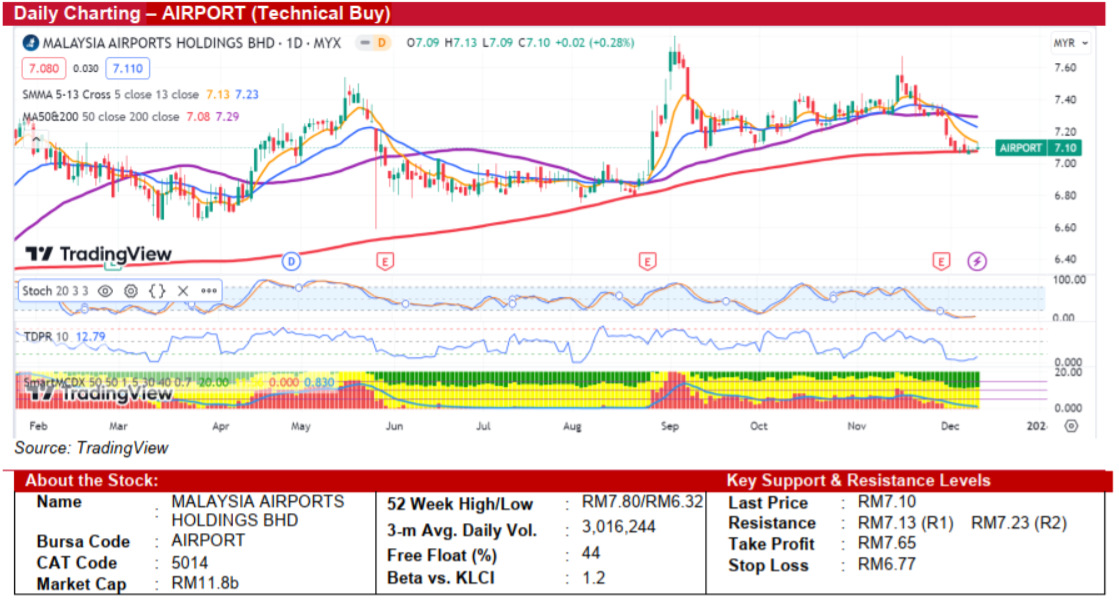

- AIRPORT experienced a pullback after reaching a recent high of RM7.67 on 16 November. Yesterday, the stock exhibited an ‘inverted hammer’ pattern following the recent downtrend, signalling a potential market reversal. Historically, the stock tends to be poised for a rebound from its solid support level at the 200-day SMA, thus increasing the likelihood for the stock to shift in trend.

- Technically, the Stochastic Oscillator has entered oversold territory and showing early signs of a potential rebound. Likewise, the Tom Demark Pressure Ratio (TDPR) has rebounded from the oversold territory, which implies a potential resurgence in buying interest. Additionally, the MCDX's banker chip is nearing the zero level, indicating reduced selling pressure. These indicators collectively enhance the probability of an upward trend for the stock.

- A decisive breakthrough above the immediate resistance level of RM7.13, which aligns with its 5-day SMA could pave the way for the stock to challenge the next resistance levels at RM7.23, RM7.29 and then RM7.67. Conversely, a decline below the crucial 200-day SMA support at RM7.08 may trigger a downward trend, with the next support level at RM6.78.

- We recommend entering the stock at RM7.10 with a target take-profit level set at RM7.65, offering a potential upside of about 7.7%. To manage risk, we suggest setting a stop-loss at RM6.77, thereby limiting potential losses to approximately 4.6%.

Source: Kenanga Research - 12 Dec 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - HUP SENG INDUSTRIES BHD (HUPSENG)

Created by kiasutrader | Nov 20, 2024

Actionable Technical Highlights - FOCUS POINT HOLDINGS BHD (FOCUSP)

Created by kiasutrader | Nov 20, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments