Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Tue, 02 Jan 2024, 09:50 AM

Dow Jones Industrial Average (DJIA) (NEUTRAL)

- US stocks finished 2023 with a strong jump in DJIA that gained 13.7% YoY while S&P 500 and Nasdaq soared 24.2% and43.4%, respectively. The three major averages ripped higher in the final two months of 2023 after a pivot from the FederalReserve led to many investors increasingly betting that the central bank’s next interest rate adjustment will bring rates lower.

- Despite the positive close to the year, Wall Street remains cautious on 2024. Analysts suggest that the significant rally seen in2023 may limit stock gains in the upcoming year. Bloomberg's tracking of 20 Wall Street strategists indicates a median targetfor the S&P 500 at 4,850 in 2024, a less than 2% increase from its 2023 close. The outlook for 2024 hinges on the economicdirection post the anticipated rate cut. Goldman Sachs’ research indicates that U.S. stocks typically decline if a recessionoccurs within 12 months of the first Fed rate cut.

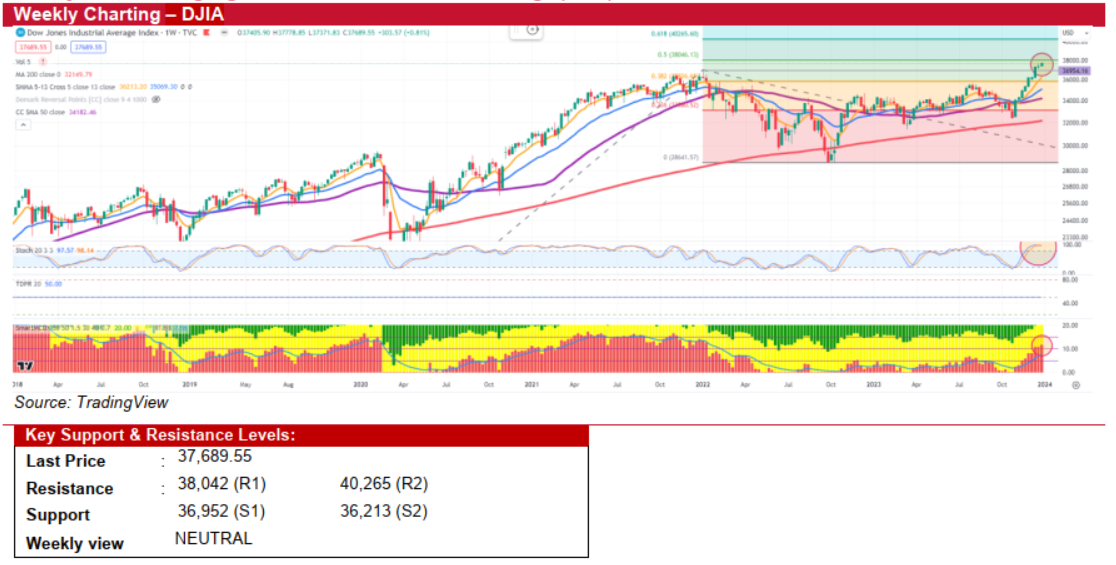

- Technically, while the DJIA's weekly upward trend persists, challenges may arise near the 38,046 level, aligning with its 50%trend-based Fibonacci extension. The overbought stochastic indicator, along with the VIX volatility index hitting a near 4-yearlow at 12.44, suggests that market optimism might have peaked, making a pullback likely.

- Key resistance levels for the DJIA are set at 38,042 and 40,265. Immediate support is seen at the previous high of 36,952, withadditional support around 36,213, coinciding with the 5-week SMA.

Source: Kenanga Research - 2 Jan 2024

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments