Kenanga Research & Investment

Weekly Charting – DJIA

kiasutrader

Publish date: Tue, 13 Feb 2024, 11:56 AM

Dow Jones Industrial Average (DJIA) (Neutral)

- The major stock indices marked their 14th positive week in the last 15 weeks, with the S&P 500 surpassing the 5,000 mark for the first time last Friday. This achievement came on pedestrian economic events but stronger corporate earnings exceeding expectations. With 75% of S&P 500 companies having reported earnings for now, the benchmark index is on pace to report its second straight quarter of earnings growth. Additionally, comments from Federal Reserve officials echoed the central bank's cautious stance, emphasizing the need for greater confidence in the inflation downward trajectory.

- The upcoming week could test the market rally with important updates on inflation and consumer spending. Tuesday's anticipated Consumer Price Index (CPI) for January is expected to show a 2.9% increase for the headline CPI and a 3.7% increase for the core CPI - a slight decline from the previous 3.9%. Retail Sales and the Consumer Sentiment Index, significant for consumer spending insights, are also due later in the week. Additionally, about 15% of S&P 500 companies, including Coca-Cola, Airbnb, Shopify, ANET, AMAT, and Cisco, will release their earnings.

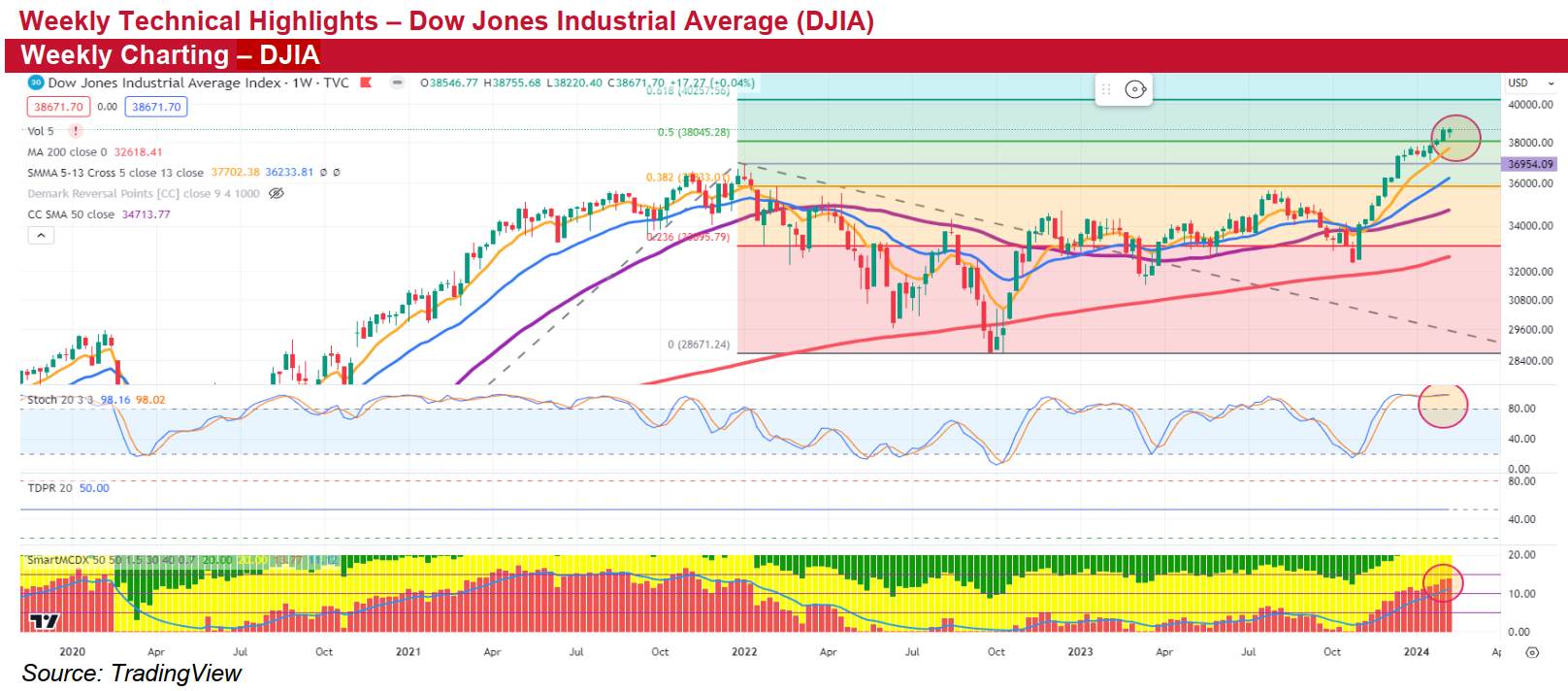

- The DJIA continues its strong weekly uptrend, firmly above the 38,056 level, a significant resistance-turned-support point matching its 50% Fibonacci extension. Yet, upcoming inflation and consumer spending data may test the uptrend. Additionally, financial disclosures from AI and semiconductor firms like ANET and AMAT are on the horizon. Any underwhelming results from these companies could dampen the current market optimism, largely fuelled by AI stocks.

- Overall, we anticipate the major indices’ trading pattern to continue to extend this week, but at a slower space, with key resistance levels earmarked at recent highs of 38,783 and then 40,273. Immediate support is identified at 38,056, with additional support located at 37,702, close to the 5-week Simple Moving Average (SMA).

Source: Kenanga Research - 13 Feb 2024

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments