Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Mon, 05 Aug 2024, 10:49 AM

Dow Jones Industrial Average (DJIA)

- Weak labor market data and uneven earnings pressured the market, with the S&P 500 and NASDAQ declining for the third consecutive week, and the DJIA breaking a four-week winning streak, closing -2.1% WoW. Despite this, the S&P 500 rose 1.1% in July, while the DJIA gained 4.4%, and the NASDAQ fell 0.8%. Technology companies showed mixed earnings results so far. Analysts now expect an 11.5% earnings increase for S&P 500 companies in 2Q, up from an 8.9% forecast. The Federal Reserve held rates steady but suggested possible cuts if inflation eases, and noted concerns about the labor market.

- Looking ahead, investor confidence has been shaken, making markets more sensitive to economic weakness. A light economic calendar this week might benefit bulls, but recent weaker-than-expected data could heighten recession concerns. The market is vulnerable to headline risks, and any increase in global uncertainty could lead to selling pressure. Expectations for Fed rate cuts have increased, with an 89% chance of a 50 basis point cut in September and 100 basis points by December. There are concerns about whether the Fed can ease policy enough, both in terms of magnitude and time, for a soft landing. Key corporate earnings releases this week include CAT, SMCI, and UBER on Tuesday, and Walt Disney on Wednesday.

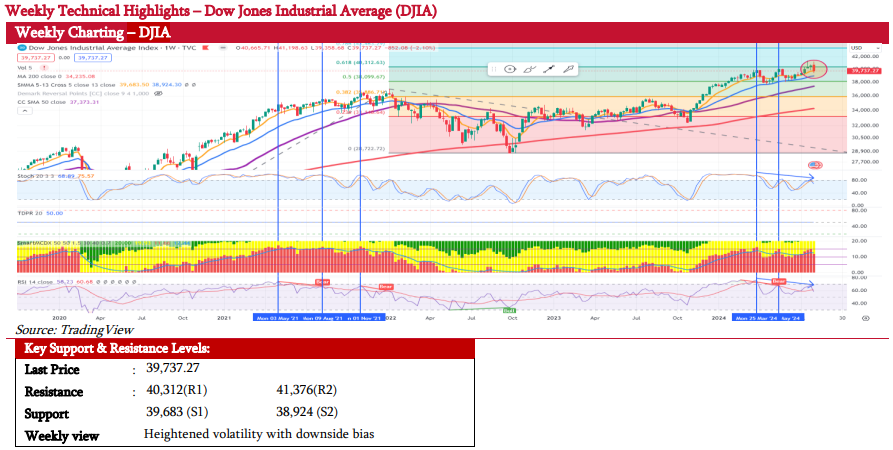

- Technically, last week's strong market sell-off caused the DJIA to break below its 5-week SMA but managed to close slightly above it on Friday. The weekly Stochastic Oscillator and RSI indicators have started to retreat from overbought territory, suggesting room for further mean reversion. We expect the DJIA to find strong support around the 38,924 level, which coincides with its 13-week SMA.

- In short, similar to last week’s view, we expect market volatility to remain high this week with downside bias due to renewed US recession concerns and escalating geopolitical tensions in the Middle East. Immediate support levels are at the 5-week SMA at 39,683, followed by the crucial 13-week SMA at 38,924. Key resistance levels are at 40,312, followed by the recent high of 41,376.

Source: Kenanga Research - 5 Aug 2024

More articles on Kenanga Research & Investment

Media - Grappling with Competition & Legacy Costs (UNDERWEIGHT)

Created by kiasutrader | Jan 15, 2025

Malaysia Labour Market - Steady unemployment rate of 3.2% in November; to further improve in 2025

Created by kiasutrader | Jan 13, 2025

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Jan 13, 2025

Discussions

Be the first to like this. Showing 0 of 0 comments