Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Tue, 13 Aug 2024, 12:52 PM

Dow Jones Industrial Average (DJIA)

- The major indexes closed modestly lower for the week, with the DJIA down 0.6% WoW and the S&P 500 and NASDAQ falling by 0.04% and 0.18%, respectively. This followed a strong recovery from Monday's significant sell-off, triggered by recession fears, concerns over the Fed's interest rate policy, and the unwinding of the Yen carry trade. The rebound began on Tuesday, aided by comments from the BOJ Deputy Governor about maintaining rates, which stabilized the Yen. Positive economic signals, such as strong services data and lower-than-expected initial claims, also contributed to the recovery. The CBOE Volatility Index (VIX) spiked to 65.73, the highest levels since the pandemic, on Monday before ending the week at 20.69.

- Looking ahead, despite expected elevated volatility due to sensitivity to economic data, the outlook for the week seems favorable for bulls as the market remains in "recovery mode." Upcoming economic reports, such as Tuesday’s CPI, Wednesday’s PPI, and Thursday’s Initial/Continuing Claims, will be closely watched. On the corporate earnings front, Home Depot, Cisco, and JD.com are set to release their earnings on Tuesday and Wednesday, which could provide additional market direction.

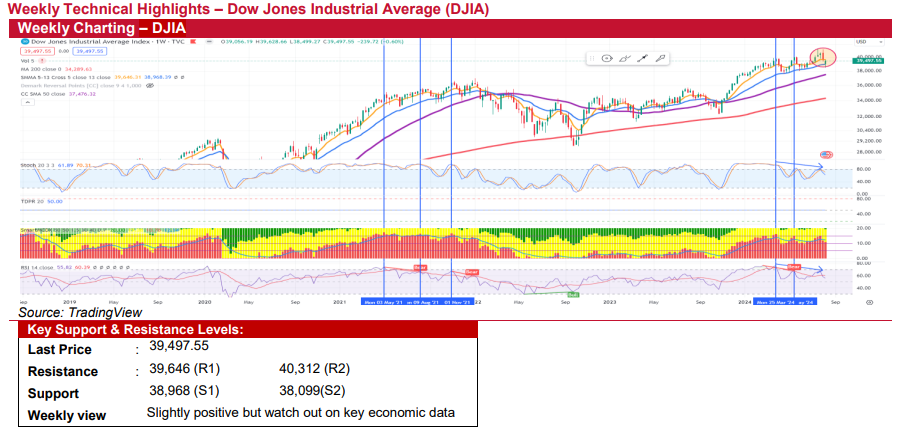

- Technically, the market's recovery and close above its 13-week SMA last Friday (despite dipping below it on Monday) suggest that the medium- and long-term uptrend remains intact. The weekly Stochastic and RSI indicators have dropped to more reasonable levels after last week's volatility spike. On the daily chart, the outlook appears promising as the daily Stochastic and RSI indicators have started to rebound from oversold territories, suggesting that the bulls could remain in control barring any negative economic data.

- Overall, we have a slightly positive outlook for the market this week, supported by the continued recovery mode. However, any negative economic data or continued unwinding of the Yen carry trade could shift momentum back to the bears. Immediate resistance levels are at 39,646 (coinciding with the 5-week SMA) followed by 40,312. Immediate support levels are at the crucial 13-week SMA at 38,968, followed by 38,099.

Source: Kenanga Research - 13 Aug 2024

More articles on Kenanga Research & Investment

Actionable Technical Highlights - HUP SENG INDUSTRIES BHD (HUPSENG)

Created by kiasutrader | Nov 20, 2024

Actionable Technical Highlights - FOCUS POINT HOLDINGS BHD (FOCUSP)

Created by kiasutrader | Nov 20, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments