Kenanga Research & Investment

Weekly Technical Highlights – FBM KLCI

kiasutrader

Publish date: Mon, 09 Sep 2024, 06:17 PM

FBM KLCI

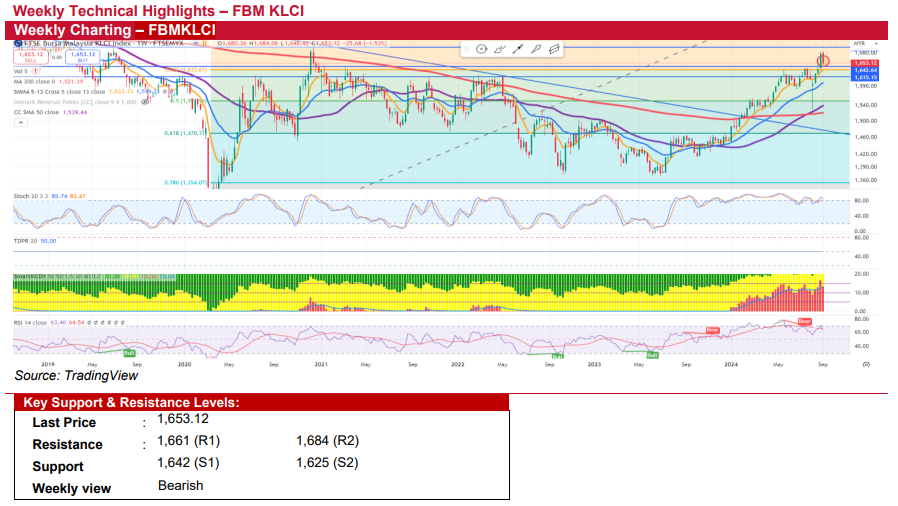

- The FBM KLCI ended the week on a weaker note, retreating 1.53% (or 25.68 points) to close at 1,653.12, as cautious sentiment persisted in global markets ahead of key US jobs data released last Friday night. Most subsectors closed lower, except for Health Care and REIT, with Technology, Energy, and Industrial Products leading the declines, each falling over 3%. Additionally, news of MACC raids on YTL Communications over a school internet project probe on Thursday weighed on YTL-related stocks. Weekly turnover dropped to 14.9b units valued at RM15.3b, down from 17.6b units worth RM20.7b the previous week.

- Moving ahead, we expect local market volatility to increase following the last Friday’s soft US employment data and renewed growth concerns in the US economy. Additionally, the yen has strengthened to YTD highs, surpassing the August 5th peak, raising concerns about whether there is still positioning in the yen “carry trade” that needs to be unwound. If a significant equity sell-off occurs on Monday, similar to early August's global market decline, the 50-week SMA level at 1,539 is expected to provide strong support once again.

- Technically, the FBM KLCI closed off its highs last week, with the weekly stochastic and RSI indicators continuing to show divergence, signalling that a near-term pullback is likely. Additionally, the break below the crucial 5-day SMA on the daily chart also suggests a dimmed short-term outlook.

- All in, we expect the market to maintain its risk-off sentiment this week, although the overall upward trend remains intact. Key support levels to monitor are 1,642, coinciding with the 5-week SMA, followed by 1,625. On the upside, key resistance levels are at 1,661, followed by 1,684.

Source: Kenanga Research - 9 Sept 2024

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments