Kenanga Research & Investment

WeeklyTechnical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Wed, 18 Sep 2024, 09:13 AM

Dow Jones Industrial Average (DJIA)

- US equity markets rebounded this week, with indexes rallying 3% to 6%, fuelled by favourable inflation data and renewed interest in tech stocks. The rally accelerated on news that the Federal Open Market Committee (FOMC) may consider a 50 basis points interest rate cut in its upcoming meeting. Meanwhile, US government bond yields continued their decline, with the 10-year Treasury yield falling to 3.66%, its lowest level since June 2023, down from a recent high of 4.70% in April, amid rising expectations of a rate cut.

- Looking ahead, the Fed is expected to announce its interest rate decision in the FOMC meeting on Wednesday, with investors closely watching for the extent of the pace of rate cut. The chances of a 50-basis point cut are now 50%, equal to a 25-basis point cut, compared to 30% and 70% a week ago. The push for a steeper cut has gained momentum, supported by former New York Fed President Bill Dudley's endorsement of a 50-basis point reduction, citing a "strong case" for a deeper cut to achieve a "soft landing" for the economy. There is a possibility that investors may “sell on the news”, as most expectations appear to be already priced in.

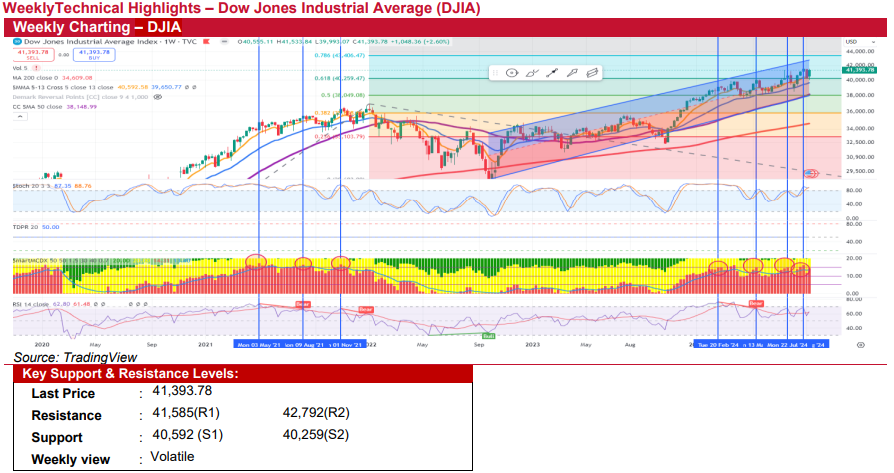

- Technically, the DJIA closed above its 5-week and 13-week SMAs, maintaining both short-term and medium-term uptrends. However, the weekly stochastic indicator remains in overbought territory, and ongoing RSI divergence signals that a potential trend reversal could still be looming.

- In short, we expect the benchmark index to trade range-bound with a downside bias in the first half of the week, with volatility likely to increase from Wednesday onwards, regardless of the Fed’s decision. Immediate resistance levels to watch are 41,585, followed by 42,792. Key support levels are identified at 40,592, aligning with the 5-week SMA, followed by 40,259.

Source: Kenanga Research - 18 Sept 2024

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments