Kenanga Research & Investment

Highlights / Stock Picks of the Day - Hock Seng Lee Berhad (HSL) – Not Rated

kiasutrader

Publish date: Wed, 29 Oct 2014, 11:01 AM

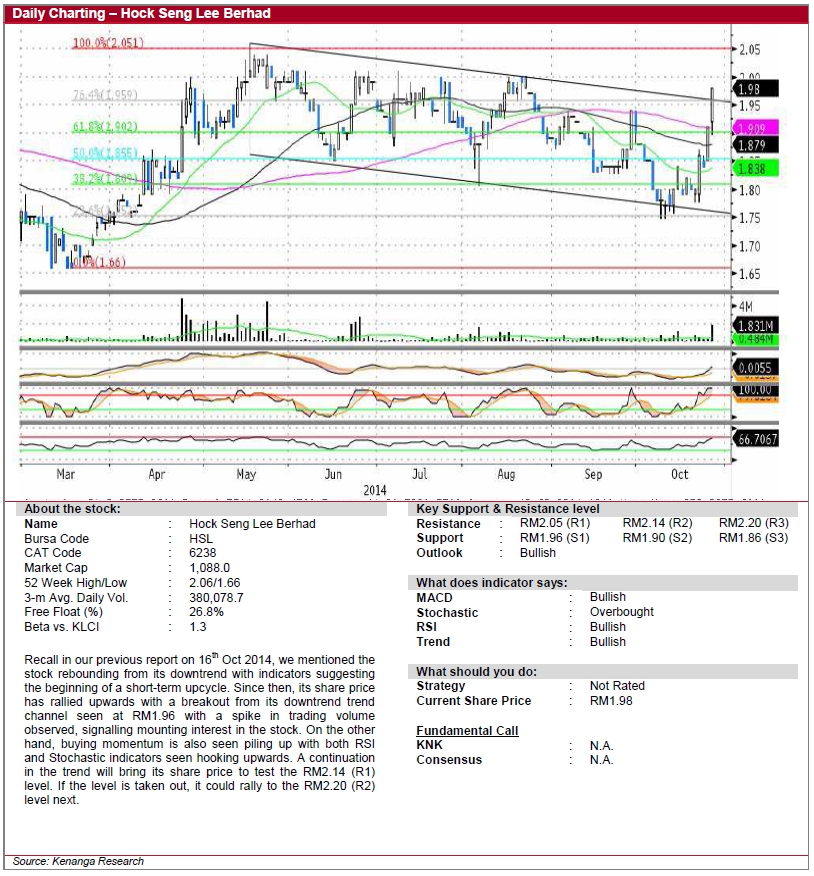

Recall in our previous report on 16th Oct 2014, we mentioned the stock rebounding from its downtrend with indicators suggesting the beginning of a short-term upcycle. Since then, its share price has rallied upwards with a breakout from its downtrend trend channel seen at RM1.96 with a spike in trading volume observed, signalling mounting interest in the stock. On the other hand, buying momentum is also seen piling up with both RSI and Stochastic indicators seen hooking upwards. A continuation in the trend will bring its share price to test the RM2.14 (R1) level. If the level is taken out, it could rally to the RM2.20 (R2) level next.

Source: Kenanga

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Actionable Technical Highlights - RANHILL UTILITIES BHD (RANHILL)

Created by kiasutrader | Dec 23, 2024

Actionable Technical Highlights - HUP SENG INDUSTRIES BHD (HUPSENG)

Created by kiasutrader | Dec 23, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments