How Investors Lose Out To Emotion - TODD MAYFIELD

Tan KW

Publish date: Sun, 08 Jun 2014, 10:47 PM

BY

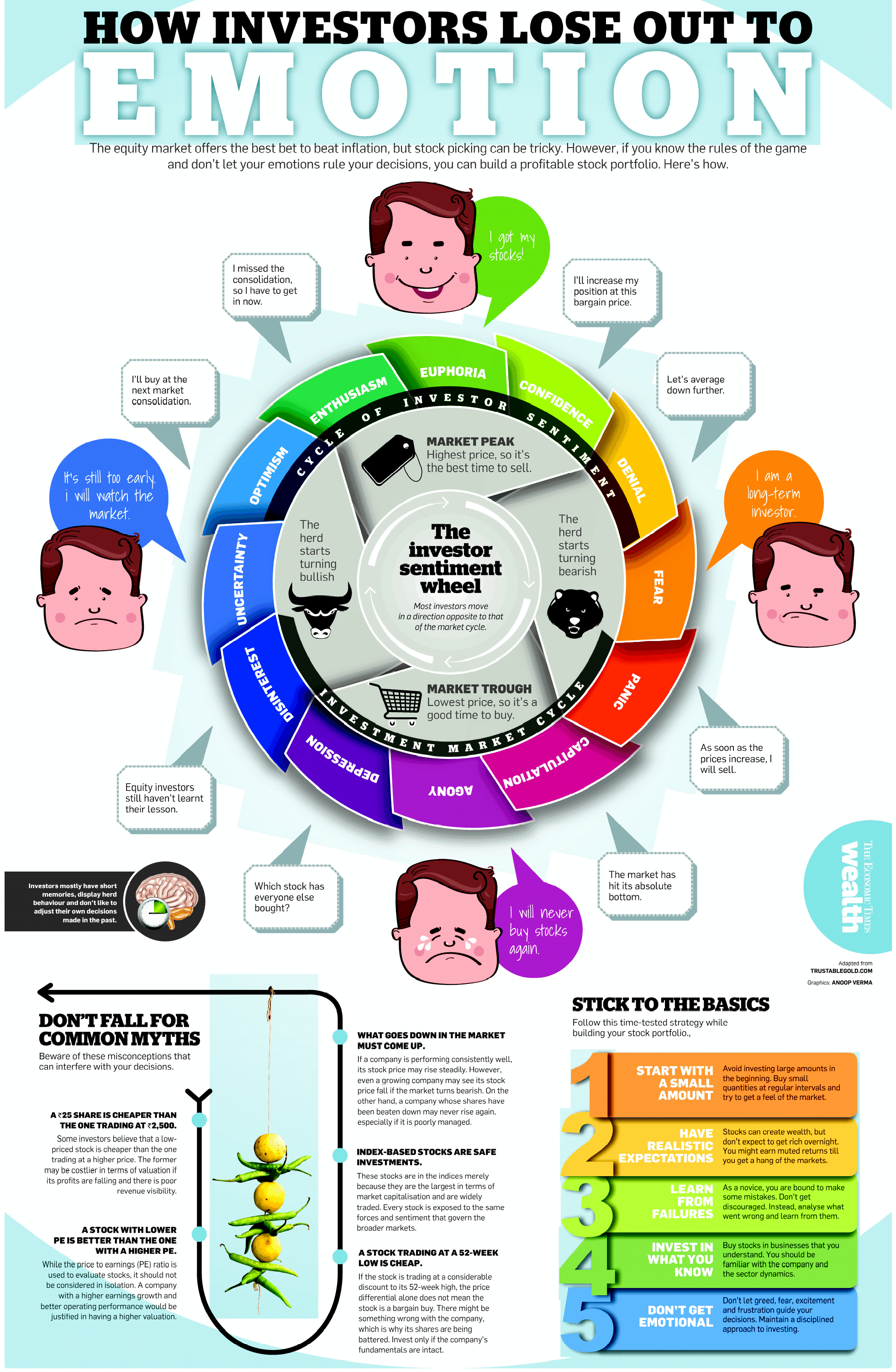

Euphoria leads to Confidence: A buyer jumps in and feels emotionally confident they’re going to experience a win.

Denial leads to Fear: If a stock price drops, investors lose out to emotion when they double-down and increase their position at a “bargain price.”

Panic leads to Capitulation: The investor has already held on too long and the agony becomes so great they may finally jump out at rock bottom.

Agony and Depression lead to Disinterest: The once euphoric investor has now been hurt by the experience badly enough they may not want to give it another shot. Giving up or giving in is the worst way an investor can lose out to emotion. We’ve all made investment mistakes–we would be wise to write them down and learn from them.

Here’s the best way to learn, respond to, and protect from emotional investing:

- Begin with a small amount

- Have realistic expectations

- Learn from failures

- Invest in what you know

- Try to not let emotions drive you

Don’t be discouraged if you’ve lost out to emotion while investing in the past. Learn from it! Be confident that you won’t make the same mistake again, and start out with a small amount if you’re jumping into new territory.

http://www.fearlessdollar.com/investors-lose-emotion-infographic/

More articles on Good Articles to Share

Created by Tan KW | Nov 29, 2024

Created by Tan KW | Nov 29, 2024

Created by Tan KW | Nov 29, 2024

Created by Tan KW | Nov 29, 2024

Created by Tan KW | Nov 29, 2024

Created by Tan KW | Nov 29, 2024

Created by Tan KW | Nov 29, 2024

Created by Tan KW | Nov 29, 2024

calvintaneng

Emotion is both an individual and a collective state of mind. It is very natural to be fearful when others are fearful and to be greedy when others are greedy.

When 2 planes crashed into New York Twin Towers during 911 CNN Flashed The News Over The TV 10,000 Times - creating Great Fear of Flying World Wide.

Singapore Airlines Shares Crashed From S$15.00 to S$7.00 - A Crash of Over 50%. I should buy some then. But fear was every where, then. May be SIA might drop to S$5.00 for me to buy cheaper?

It never did. Only 2 planes crashed - no more. So things return to normal & SIA rebounded to S$15.00

Now MH370 Disappeared & MAS Share Price Crashed. AAX Share Price Also Dragged Down. Why?

China Tourists will Shun Malaysia. I think it is the Best Time to Buy AAX if you can hold and average down.

Reasons:

1) Many China Nationals might switch from MAS to AAX due to MH370

2) In Future More Affluent Chinese Will Still Fly To Malaysia

3) AAX is ordering More Air Bus (Not Boeing)to cater for ex-MAS passengers

4) India is a growing market. As seen by the recent overwhelming response.

5) Malaysia is in Lonely Planet World Top 10 For Tourism

6) KL is World No. 4 for Shopping according to CNN

7) AAX is following the pattern of Air Asia's turnaround and growth.

Do your own due diligence.

2014-06-07 13:42