Buying Good Companies when the price is cheap..... - Intelligent Investor

Tan KW

Publish date: Wed, 28 Jan 2015, 04:01 PM

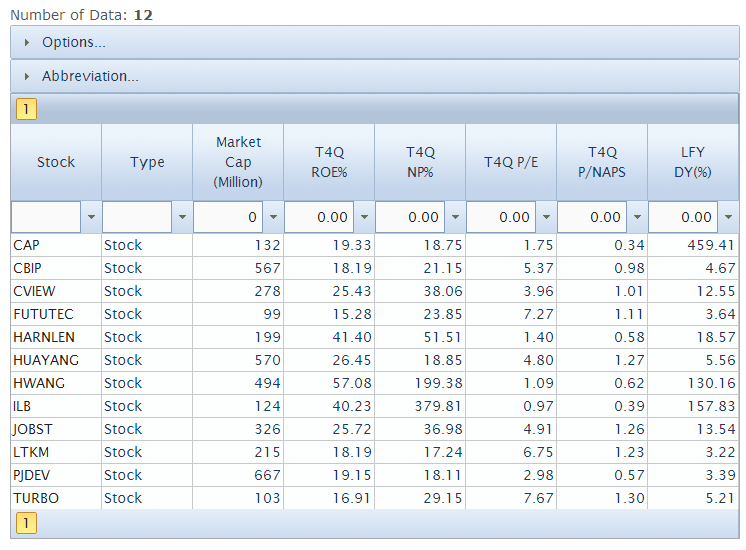

Below companies might be a good candidates..

- Good Companies - ROE >= 15, Net Profit Margin >= 15

- Cheap? P/E <=8, P/NAPS <= 1.5, DY >= 3%

http://www.klse.my/stock/screener.jsp?Type=S&T4QROE-1=15&T4QNPM-1=15&T4QPEPS-2=8&T4QPNAPS-2=1.5&LFYDY-1=3

Thanks for compiling my comments.

It is just a list of stock that deserve me to put in some efforts to understand more.

And, I am not yet perform analysis in most of the companies.

More articles on Good Articles to Share

Created by Tan KW | Jul 17, 2024

Created by Tan KW | Jul 17, 2024

Created by Tan KW | Jul 17, 2024

Created by Tan KW | Jul 17, 2024

Created by Tan KW | Jul 17, 2024

Created by Tan KW | Jul 17, 2024

Created by Tan KW | Jul 17, 2024

Discussions

Yea... oversold sentiment.... but they are not involved that much in upstream... mostly supplying to downstream and maintenance. Their pumps will still be in demand regardless of oil prices... this is market irrationality.. furthermore, they have big chunk of earnings in SGD which bode well in weak RM environment...

2015-01-28 16:18

Hi NOBY,

I came across TURBO when it was recommended by you last year. I didn't know the Oil and Gas industry well and it is definitely not in my circle of competence. And, I choose not to invest when I am not understand.

However, you seem did a very thorough analysis on TURBO. May I ask why you not include TURBO in your pick? http://klse.i3investor.com/servlets/pfs/41665.jsp

2015-01-28 16:25

Hi Mr. Tan,

Thanks for compiling my comments.

Please take note that the stock listed in http://www.klse.my/stock/screener.jsp?Type=S&T4QROE-1=15&T4QNPM-1=15&T4QPEPS-2=8&T4QPNAPS-2=1.5&LFYDY-1=3 is not a buy recommendation.

It is just a list of stock that deserve me to put in some efforts to understand more.

And, I am not yet perform analysis in most of the companies.

2015-01-28 16:27

Yea... I missed it out... There are a lot of other companies I own as well but did not include in the stock pick...

2015-01-28 16:35

Hi NOBY,

What is the max number of the companies in your portfolio \ watchlist?

2015-01-28 16:45

II, I have around 20 but my largest holdings are concentrated around 10 stocks. Watchlist I have a lot, but in general I dont commit >10% per stock. Although focus investing can be rewarding if you pick the winners, most of the time I dont know enough about the company to have a high conviction. Therefore, if I were to follow a purely quantitative approach with some qualitative judgement, diversification is my only protection.

2015-01-28 16:49

Hi NOBY,

I found that it is difficult to monitor too much stocks. I try to limit it to 10. But, most of the time I hold more than 10, but less than 15.

2015-01-28 16:53

@II, it is for my references... won't blame you if price go down.... don't worry.

2015-01-28 16:54

II, yea stick to what you are comfortable with. I can see that you are one of the top performers last year and this year.. well done...

2015-01-28 16:55

Yes. I am happy with my return. I wish I am able to maintain 15% CAGR for next 30 years.

2015-01-28 16:59

CVIEW landbank value in Kedah = RM357M, Selangor = RM253M. Current market cap of company is only RM279M.

2015-01-28 22:07

LAND value only can be realised if its actually sold, ie transacted. That is why in accounting, u will just place the original purchased value, not current market value.

LAND value also can goes down, not only UP, remember that mr. greddym3

2015-01-30 09:44

If you like to value the company based on the asset value instead of earning power. This is a list of companies trading under the net asset value.

http://www.klse.my/stock/screener.jsp?Type=S&T4QNPM-1=3&T4QPNAPS-2=1

You can perform study on the asset and make your own descision.

2015-01-30 10:08

Best is with High Asset Value Plus Strong Earning Power

1) AJIYA

2) SUPER

3) PRESTAR

2015-01-30 10:14

Hi Calvin,

Below stock is trading under the net asset value and able to earn more than 15% net profit margin and 15% ROE

http://www.klse.my/stock/screener.jsp?Type=S&T4QROE-1=15&T4QNPM-1=15&T4QPNAPS-2=1

Some candidate for High Asset Value Plus Strong Earning Power

2015-01-30 10:19

Thank you Intelligent Investor,

I am watching MUH. I had bought and sold Tn Logis, L&G and some others.

I think Assets are better than Earnings. Assets are more solid and stable while Earnings can evaporate due to changing winds. When earnings dropped for homeriz its shares weakened immediately.

2015-01-30 10:28

Hi Calvin,

I agree with you.

Asset play is safe and a well diversified net net portfolio can provide a CAGR around 15% - 20% ; Earning power candidate is definitely can provide more return if pick the right company.

So, it is depends on the individual earning target and risk appetite. Risk and return are inseparable.

2015-01-30 10:35

A list of growth stocks....

http://www.klse.my/stock/screener.jsp?Type=S&T4QROE-1=12&L10FYAvailableYears-1=10&T4Q_V_LFY_EPS-1=30&T4Q_V_AL10FY_EPS-1=50&

2015-01-30 10:37

I from oil and gas industry.. the industry is not good now and my company is currently undergoes retrenchment.. think twice when u pick oil and gas stock..

2015-01-30 13:55

NOBY

what a great chance to load up on some TURBO.... dont understand why market is prcing it so cheaply... furthermore 5 sen divvy is coming up in the coming quarter

2015-01-28 16:12